Senior Reporter

New Era in Aftermarket Under Way

This story appears in the Jan. 23 print edition of Equipment & Maintenance Update, a supplement to Transport Topics.

Outside of brakes and oil changes, service in the aftermarket has largely operated as “fix as fail,” but that era is fading. Instead, more trucks have connected components and telematics, which means preventive maintenance is becoming the new norm. That is pushing the aftermarket to know when a truck is coming in, what part it needs and to get it to the service provider at the right time and right price, industry experts said.

In addition, there are more brands of parts from which to choose, plus more sophisticated “mission critical” components, parts manufacturers said. That makes it a priority for them to continue to educate and train customers’ service personnel.

“It’s a vast array of things that are changing, probably at a pace more rapid than has been for quite some time,” said Jerry Conroy, North America regional vice president of aftermarket sales at Bendix Commercial Vehicle Systems, a unit of the Knorr-Bremse Group.

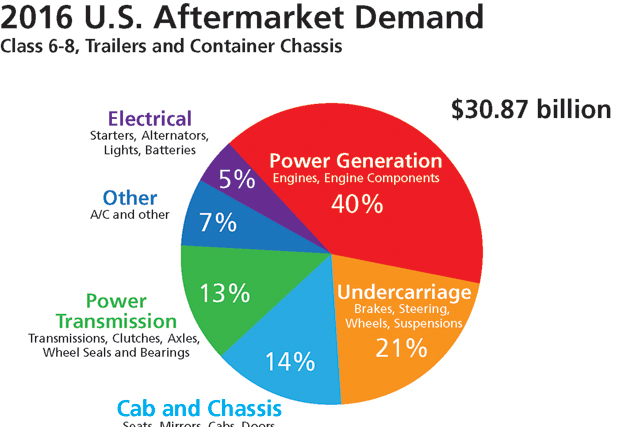

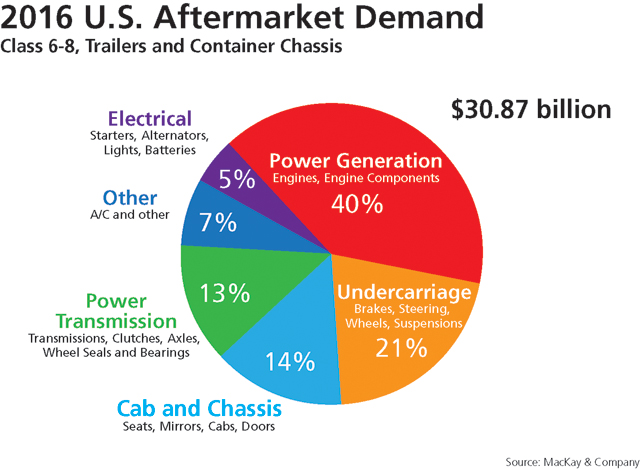

At the same time, the aftermarket was a smaller pie in 2016 compared with 2015, and the outlook is for a flat 2017, according to suppliers’ anecdotal reports. Sales of both new and used trucks remain in a prolonged slump. Carriers searching for loads park excess trucks against the fences, where they can be cannibalized for spare parts, if needed. The economy wobbles forward.

But a key way to prosper amid the changes is to offer service, said Doug Wolma, general manager of aftermarket at Dana Inc. Truck dealerships do and so are experiencing steady growth in the aftermarket, he said.

“They are knocking on the door of 50% of the overall business in North America where traditionally they have been short of that,” he said, noting the independent channel had been a bigger piece of that business but dealers have both the telematics technology and service offering.

The North American commercial vehicle aftermarket is about a $115 billion a year business, Wolma said. About $63 billion of that, or 55%, is service. “Those that don’t participate on the service are going to be on the outside looking in at some point.”

Also, suppliers for the passenger car aftermarket are starting to exert significant influence on the commercial vehicle aftermarket, Wolma said. Some of the largest are even eyeing the opportunity of expanding into commercial vehicle parts sales. And they bring deeper experience with e-commerce, such as with e-catalogs and related business-to-business skills.

“There is a lot of hunger out there on the commercial vehicle side to have that same information available,” he said.

What one regional fleet wants from the aftermarket, though, are prices that are locked-in companywide, say, for a quarter. “That way, I know I’ll get the same price in Dallas as in Birmingham, Alabama,” said Billy Lollar, vice president of maintenance at J&M Tank Lines Inc., which is based in Birmingham.

The J&M fleet is largely made up of trucks from Kenworth Truck Co., a unit of Paccar Inc., Lollar said. It buys 80% of its parts from two suppliers — including 100% of its OEM parts from Paccar Parts, and routine items such as brakes, wheel seals and lights mostly from FleetPride, an independent distributor carrying more than 400 brands with 250 locations in 45 states.

J&M is negotiating with both suppliers and the Kenworth dealers it uses. Lollar was optimistic the carrier would prevail. “At the end of the day, we buy a lot of parts through these guys. So all that has to be factored in when we sit down to negotiate to buy new trucks, too.”

Several suppliers said they sell parts through different proprietary brands to create a range of pricing options. SAF-Holland is among them, and it launched its supplemental, cost- conscious Gold Line Quality Parts brand in 2015.

The average age of a Class 8 truck is nine years and a trailer is just under 10 years, said Juan Hernandez, SAF- Holland’s international marketing and sourcing manager. “The owners of those aged vehicles are not willing to spend as much money on repairing them,” he said. “So that has put great pressure on pricing of parts, which has created the need for this cost- conscious brand. It’s an evident trend happening right now in the aftermarket.”

Troy, Michigan-based Meritor Inc. has 240,000 active part numbers it sells as either Meritor, Euclid or Meritor Wabco branded products, supported by its large field support team. ”We do spend a significant portion of our time focusing on the fleet customers to continue creating the ‘pull’ demand,” for parts, said Meritor Inc.’s Brett Penzkofer, vice president for North American aftermarket.

Sometimes remanufactured parts are available.

Remanufactured parts are those where individual components are repaired or replaced in a factory to original specifications.

“We have our remanufactured option that allows us to be priced more competitively ... but we are still delivering the genuine Bendix product and promise,” Conroy said.

For Bendix, these include brake shoes, valves, air dryers, compressors and electronics.

Another fleet is focused on greater connectivity between the truck and the shop technician.

“These trucks talk to us today. They send us e-mails. They are going to be virtually connected to some technician and tell him what to replace. That’s where it is going to go,” said Gerry Mead, senior vice president of maintenance at truckload carrier U.S. Xpress Inc.

The key is for fleets to continue “adapting and embracing the technology,” he said. U.S. Xpress Enterprises ranks No. 19 on the Transport Topics Top 100 list of the largest for-hire carriers in the United States and Canada.

Meanwhile, tougher federal regulations create opportunities in the aftermarket, said Tina Alread, director of sales for HDA Truck Pride, an independent provider of parts and service with 700 distribution locations and more than 400 service facilities.

Regulatory compliance helps sustain both the original equipment and aftermarket side, she said. “If we didn’t have government constantly pushing all these issues, whether you support it or not, our industry would have been stagnant a long time ago,” Alread said.

Take, for example, diesel emissions regulations and the aftertreatment systems they spawned in model years 2007 and 2010. “These were probably one of the most painful things instilled upon our industry, or forced on our industry,” she said. “But we haven’t been able to master how to make it work right, unfortunately,” she said, but noted the aftermarket is benefitting. “It’s not like they made a million-mile emissions [reduction] system.”

Clutch assemblies, transmission units and parts to rebuild transmissions are Eaton Corp.’s main aftermarket items, said Amy Kartch, director of vehicle group North America aftermarket.

“We constantly strive to ensure the message is getting out there on our product offerings, training, technical information [and] where to find it. It is very important, especially in this age of a lot of messaging and noise, potentially. How do we make our communication, regardless of the medium, the most relevant and accessible for our different customers?” she said.

The process can be online tools plus printed messaging available, for instance, to the service bay where they have less access to a computer, or if it’s something “we just want to stay very visible versus them having to go online and look for it,” Kartch said.

Bendix also spends a lot of time educating suppliers, fleets, drivers, technicians and counter people, too, Conroy said.

“The worst thing you can do is introduce technology that is met with resistance,” he said. “When people understand what the benefits are and how to service it, what they need to stock, you can avoid a lot of those hesitations the next time they go to spec a vehicle or sell a part.”

Finally, aftermarket service helps drive brand loyalty and new truck sales, said David Danforth, general manager of Paccar Parts.

The amount of time spent waiting to diagnose a situation, getting the correct part and putting the truck back on the road “has really become the benchmark for fleets for repeat purchases of vehicles,” Danforth said.

Parent company Paccar also offers the truck brand Peterbilt Motors Co. and MX engines.

The higher quality of new trucks means demand for aftermarket parts is going to slow down a little bit in the first four years of ownership, he said.

“But then as those trucks run longer, and if the quality of the truck is better, people are going to expect to keep it longer,” Danforth said. “As long as we do a great job on our end with the dealers keeping good care of the customer, then in years 4 to 10, we will get more revenue in the second half of that 10-year cycle than we typically have,” Danforth said. “That’s our model.” ³