Mileage Tax Builds Momentum as Alternative to Gas Tax

The switch from fuel to mileage taxes could take place in six years, two U.S. representatives told the annual meeting of the Mileage-Based User Fee Alliance.

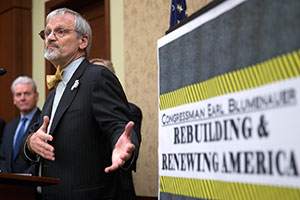

The nation’s infrastructure is falling apart at the same time “the Highway Trust Fund is in a death spiral,” which presents the opportunity to make transformative change in how the country funds transportation, said Rep. Earl Blumenauer (D-Ore.), a leading advocate of mileage taxes.

Blumenauer has introduced a measure to raise the federal gas and diesel tax 15 cents over three years until a mileage tax system is put in place.

“I think it could be the last time Congress ever has to act to raise the gas tax,” Blumenauer told the gathering of state and federal officials, technology providers and mileage tax advocates. “And then I want to get rid of the gas tax because it doesn’t work over the long haul.”

As more than a dozen speakers reiterated at the conference, dramatic advances in fuel efficiency for cars and trucks have eroded the revenue outlook for states and the federal government, both of which collect fuel taxes to pay for highways.

Rep. John Delaney (D-Md.) said of a mileage tax: “We need a little bit of time to think it through and to phase it in” to bring people around to the idea.

If the nation envisions a future in which it uses less gasoline, and that is a “a huge win for our environment and. . . for the citizens of this country . . . then the gas tax is a terrible source of funding for the Highway Trust Fund because it will keep dropping and dropping” at the same time transportation needs grow, Delaney said.

He has introduced a bill that would “repatriate” the tax money American corporations owe on their overseas profits and use the revenue to support the trust fund over the next six years.

At the same time, the bill would create a commission to come up with an alternative to the federal fuel tax. His preference is for a mileage tax, Delaney said.

Several states are considering mileage while others are actively exploring pilot programs. Oregon will begin testing its latest mileage-tax system — the state’s third experiment since 2006 — on April 1 and will “go live” July 1 with up to 5,000 residents participating in the pilot program.

The state, which has no diesel tax, already taxes trucks by weight and distance.

California passed legislation last fall to begin piloting a mileage-tax system, said state officials who attended the conference.

The state began exploring mileage taxes in 2007 when it realized that fuel tax revenues had begun declining along with gas consumption even though vehicle miles traveled were climbing, said Gary Gutierrez, project manager for the pilot program being created by the California Department of Transportation.

And since 1994, the last time the state raised its fuel taxes, the purchasing power of the fuel tax revenues has dropped 50%, Gutierrez said.

“So, truly, California is in a crisis mode in terms of trying to develop some kind of sustainable funding,” he said.

California and Oregon are part of an 11-state consortium in the West that is exploring mileage taxes.

Several speakers at the conference said they believe the states will be the laboratories for mileage taxes and that federal lawmakers will watch those programs closely before they adopt the idea.