Senior Reporter

Medium-Duty Sales Notch Year-Over-Year Increase in November

[Stay on top of transportation news: Get TTNews in your inbox.]

Classes 4-7 U.S. retail sales in November surpassed 18,000 and jumped nearly 10% compared with a year earlier as only Class 7 failed to post a year-over-year gain, WardsAuto.com reported.

Sales reached 18,318, up 9.3% compared with 16,753 a year earlier.

But year-to-date sales dropped 15.1% to 193,246 compared with 227,683 a year earlier.

Meanwhile, Ford Motor Co. emphasized it is giving its commercial vehicle business an expanded role.

Ford CEO Jim Farley said the company is allocating more capital, resources and talent to its strongest businesses and vehicle franchises.

“[That includes] expanding our leading commercial vehicle business with great margins, but now with the suite of software services that drive loyalty and generate reoccurring annuity-like revenue streams, and being a leader in the electric vehicle revolution around the world, where we have strength and scale,” he said.

“We’re developing all-new electric versions of the F-150 and the Transit, the two most important, highest-volume commercial vehicles in our industry. These leading vehicles really drive the commercial vehicle business at Ford, and we’re electrifying them,” Farley added.

Ford also consistently dominates in Class 5 sales and sometimes leads in Class 6. Trucks in those categories are the largest that do not require a commercial driver license to operate.

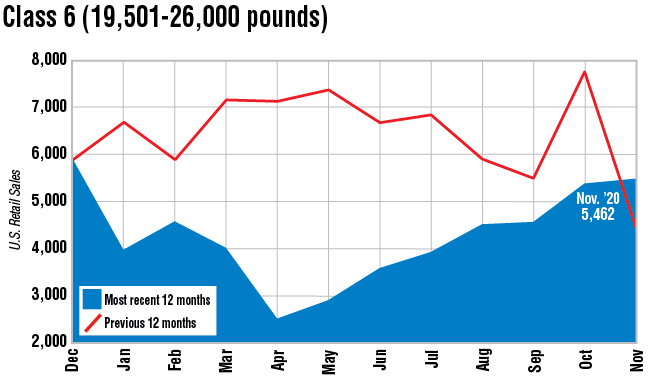

Class 6 sales rose the most, 22.1%, in November to 5,462 compared with 4,474 a year earlier — carried higher by large gains at Ford.

Ford supplied a leading 2,144 units in Class 6, for a 39% share, up from 1,285, or a 29% share in the 2019 period.

Its F-650 trucks come with either a V8 gasoline or V8 turbo diesel engine, a unique choice in the segment. Sales incentives are underway.

Freightliner, a brand of Daimler Trucks North America, sold the second-most, 1,689 compared with a leading 1,402 a year earlier in the Class 6 segment.

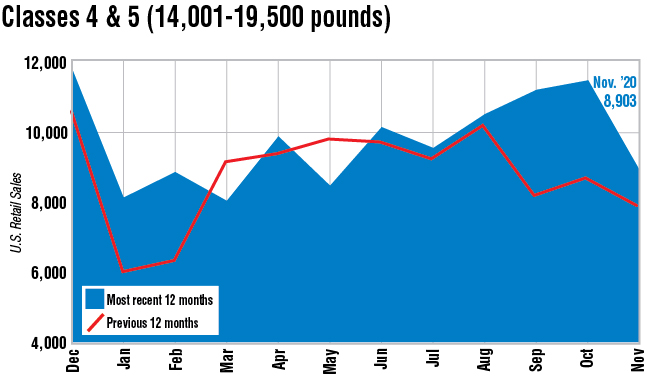

Classes 4-5 sales combined were 8,903, an increase of 12.4% compared with the 2019 period.

In Class 5, sales hit 7,261. Ford sold 4,641 for a 64% market share.

Class 4 sales were 1,642. Isuzu Commercial Truck of America Inc. notched a leading 903 — for a 55% share.

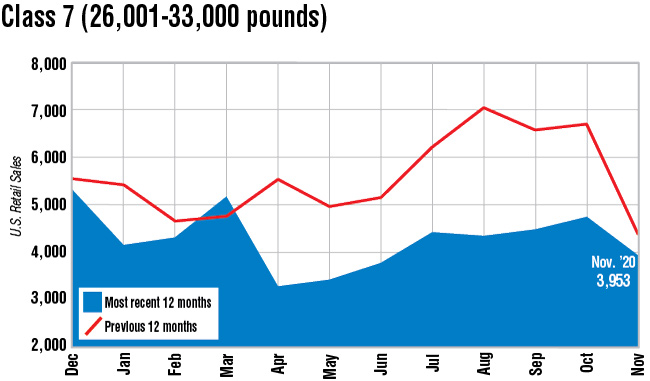

Class 7 sales fell 9.2% to 3,953 compared with 4,355 a year earlier.

Freightliner notched the most, 1,678 — for a 42% share. That was down from 1,780 a year earlier. International was next with 1,067, earning a 27% share. That was up from 929 a year earlier.

Paccar Inc., the parent of the Kenworth Truck Co. and Peterbilt Motors Co. brands, saw its combined Class 7 sales reach 1,032 — for a 26% share. That was down from its sales of 1,303 in the 2019 period.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More