Senior Reporter

May Truck Sales Fall 6%

This story appears in the June 19 print edition of Transport Topics.

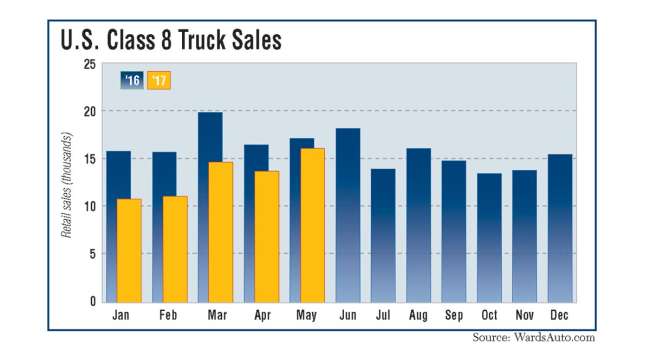

U.S. retail sales of Class 8 trucks fell 6.1% in May, but still topped 16,000 units for the highest volume of 2017 as sales started to align with the improvement that orders and production have shown this year, experts said.

Sales in May were 16,248 compared with 17,312 a year earlier, WardsAuto.com reported.

Year-to-date, sales were off 21.9%, falling to 67,021. That compares with 85,804 sales in the 2016 period, according to Ward’s.

May’s total also was the highest since August 2016, when sales were 16,262, Ward’s reported.

“We have seen the strength in the orders,” ACT Research Co. Vice President Steve Tam told Transport Topics. “We have seen the build rate starting to increase to come to up to speed with where the order demand is. The May sales number represents the first glimmer that we are trimming the expectations for the downside [compared with sales in 2016].”

ACT took its North American retail sales forecast up to about 236,000 trucks, which is down 7% from the 2016 total, Tam said, yet above replacement levels of about 225,000.

“This market is operating as normally as it has since 2013,” Don Ake, commercial sector vice president at research company FTR, told TT. “A year ago, we were still before problems. As soon as the freight took a rest, everything else took a rest.”

Sales dropped off sharply in 2016 beginning in April with 16,633 units, down 18.9% compared with the 2015 period. In January, sales sank to 10,944 trucks, according to Ward’s.

Peterbilt Motors Co., a unit of Paccar Inc., was the sole truck manufacturer to post a gain in May, rising 4.6% year-over-year to 2,454 units, earning it a 15.1% market share.

“The energy services and vocational segments, including refuse, have been strong performers so far this year, and we expect them to continue to perform solidly throughout 2017,” said Robert Woodall, assistant general manager of sales and marketing at Peterbilt.

“We maintain our forecast for the U.S. and Canadian Class 8 market of 190,000 to 220,000 units in 2017. We expect our strength to continue through the remainder of the year,” he said. “Our market-share gain relative to the same period last year demonstrates the fact that our customers recognize the premium value, high quality and advanced technology of our products.”

Peterbilt’s share of U.S. retail sales year-to-date is 15.8%, compared with 13.2% in the 2016 period.

Kenworth Truck Co., also a Paccar brand, fell 6.7% to 2,414, good for a 14.9% share.

International, a brand of Navistar International Corp., saw sales fall 11.8% to 1,537 and a 9.5% share.

Nonetheless, Navistar executives were upbeat about the prospect of future sales.

“The new LT Series Class 8 on-highway tractor powered by the Cummins X15 began shipping in January and is doing very well,” Navistar Chairman and CEO Troy Clarke said during an earnings conference call with analysts to discuss fiscal second-quarter results.

Bill Kozek, president of Navistar’s North America trucks and parts business, agreed that the Class 8 market was holding its own.

“And we’re seeing that in segments a little bit different than you might see in October, which is leasing, small to midsize over-the-road fleets and small to midsize private fleets,” among others, he said during the earnings call.

“But the other piece of that is customers are having pretty good years in general. And now, they’re looking at vehicles for now and then into 2018,” Kozek added.

Meanwhile, Volvo Trucks North America saw sales decline the most, plunging 23.9% to 1,351, good for an 8.3% share.

“Vocational and regional-haul applications showed the most strength, which has had a positive impact on our new Volvo VNR regional-haul model,” said Magnus Koeck, VTNA’s vice president of marketing.

Sales at Mack Trucks fell 14.5% to 1,176 for a 7.2% share.

John Walsh, Mack Trucks vice president of global marketing, pointed out the truck maker’s 1 percentage-point increase in market share year-to-date to 9.1%, compared with 8.1% in the 2016 period.

VTNA and Mack are units of Sweden-based Volvo Group.

DTNA niche brand Western Star sold 405 trucks, down 12.5%, earning it a 2.5% share.

In related news, Tesla said it will have a working prototype of its electric Class 8 “long-range” truck ready by September.

“The biggest customers of the heavy-duty Tesla semi are helping ensure that it is specified to their needs, so it’s not a mystery. … It’s going to really just be questions of scaling, of volume to make as many as we can,” Tesla CEO Elon Musk said during an annual shareholders meeting call June 6. He did not provide further details.

Jerome Guillen, formerly director of business innovation at Daimler AG, is in charge of Tesla’s truck program as the Palo Alto, Calif., company’s vice president of truck and programs.

“A lot of people don’t think you can do a heavy-duty long-range truck that’s electric, but we are confident that this can be done,” Musk said.