Managing Editor, Features and Multimedia

June Trailer Orders Jump

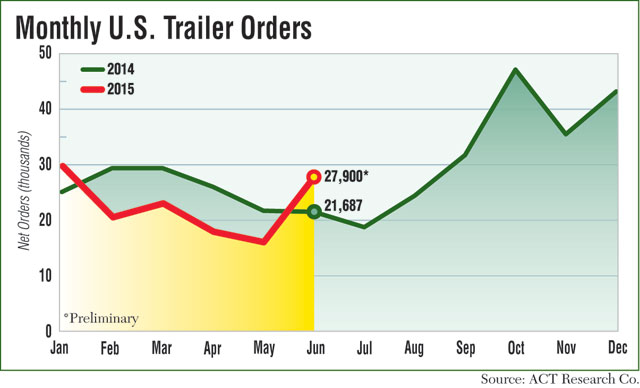

New trailer orders surged to nearly 27,900 units in June, defying normal seasonal patterns as fleets booked early commitments for 2016 production, ACT Research said.

Last month’s U.S. net orders total represented a 29% jump from 21,687 a year earlier and a 73% spike from 16,092 in May.

The June increase, driven by large orders for dry van and refrigerated trailers, snapped a streak of four year-over-year declines that began in February. It also was the biggest net orders total for June since 1994, the firm said.

ACT analyst Frank Maly said the June order surge was “exceptionally early” compared with years past.

June, July and August typically are the slowest months of the year for trailer orders, Maly said, adding that order levels usually begin to pick up in September, further accelerate in October and then remain strong through the fall and winter.

He said the unusually large June total reflected a significant increase in fleets placing orders for trailers to be built next year. This year’s build slots are full or nearly full for many product lines, so customers are acting early to get in line for 2016, Maly said.

“It’s a response to this year’s production slots being full,” he said. “In general, we’re now at the point where most [manufacturers], almost by default, are having volume commitments roll into early 2016.”

Despite the surge in activity last month, year-to-date orders continue to trail last year’s pace. In the first half of 2015, orders totaled 136,000 units, down from 154,000 in the first six months of 2014.

FTR reported a slightly lower tally for June trailer orders, pegging the total at 26,700 units, a 32% increase from a year ago and a 76% jump from May.

The research firm said several large dry van orders for delivery in 2016 boosted the June figure, while refrigerated trailers also exceeded expectations.

“The fact that some fleets are so confident about next year that they placed orders three months early is a great sign for the industry,” FTR Vice President Don Ake said.

However, he did cite softness in the flatbed, liquid and dry bulk trailer markets.

Wabash National Corp. said its backlog stood at $1.1 billion at midyear, up from $842 million a year earlier and representing about seven months of production.

“In response to increasing interest from customers, we opened the 2016 order book in late June and began accepting orders for 2016 build slots,” CEO Dick Giromini said on the company’s July 29 earnings call. “We’re presently experiencing a much stronger demand for these build slots than what is typical for this time of year and believe that this activity further supports our view that 2016 will be another strong year for the trailer industry.”

Wabash’s second-quarter profit climbed to $28.6 million, or 41 cents per share, from $16.2 million, or 23 cents, a year ago. Revenue rose 6% to $515 million.

The manufacturer said it shipped about 16,900 new trailers during the second quarter, up from 14,950 a year ago and at the high end of its guidance of 16,000 to 17,000 units.

Wabash boosted its full-year shipment guidance to a range of 63,000 to 66,000 trailers, up from its previous projection of 62,000 to 66,000 units. The company shipped 57,350 trailers in 2014.

Chris Hammond, executive vice president of sales at Great Dane Trailers, said the increase in order activity that usually occurs in the early fall seems to have shifted to the mid-to-late summer.

“It’s a structural change in when orders get placed due to the limited capacity in our industry,” he said. “I would expect it to stay this way through at least the next 12 months. When the market slows down it may move to a more normal pattern, I would suspect.”

Great Dane expects to sell all available manufacturing capacity this year and in 2016, he added.

Larry Roland, director of marketing at Utility Trailer Manufacturing Co., said demand for new equipment remains strong.

Utility’s June sales were in line with expectations for the time of the year, but order intake was “somewhat restrained,” he said, because the company hadn’t begun accepting 2016 orders until late July.

Hyundai Translead has been booking orders further into the future.

The trailer maker already has filled its production capacity for the first half of 2016, said Stuart James, Hyundai vice president of sales.

“Since our product slots for 2015 have been filled for some time now, all incoming orders are being placed in our 2016 production schedule,” James said. “We would normally not be seeing this type of order activity until October.”

Meanwhile, cancellations of trailer orders remain low, ACT’s Maly said.

“People who are placing those orders are steadfast in those commitments because they know it’s a long wait if they get out of line,” he said.