Senior Reporter

January Medium-Duty Sales Falter

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales of Classes 4-7 commercial vehicles in January fell 14.3% compared with a year earlier as all segments declined, Wards Intelligence reported.

Sales were 15,934 compared with 18,602 in the same 2021 period, according to Wards. In December, sales were 22,326.

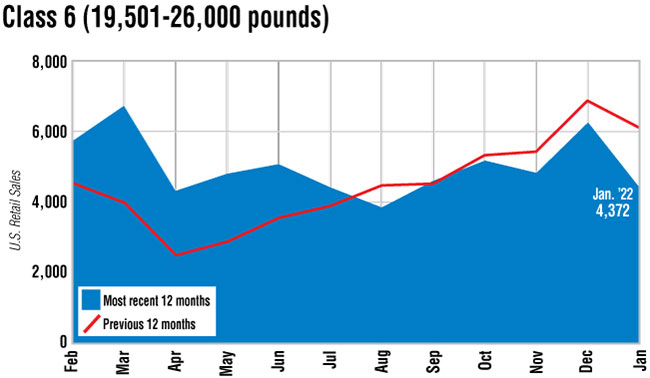

Class 6 posted the steepest decline, 28.9%, to 4,372 units.

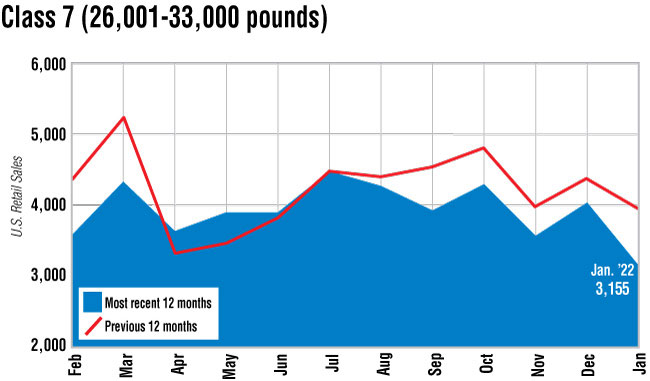

Class 7 was next, down 19.7% to 3,155.

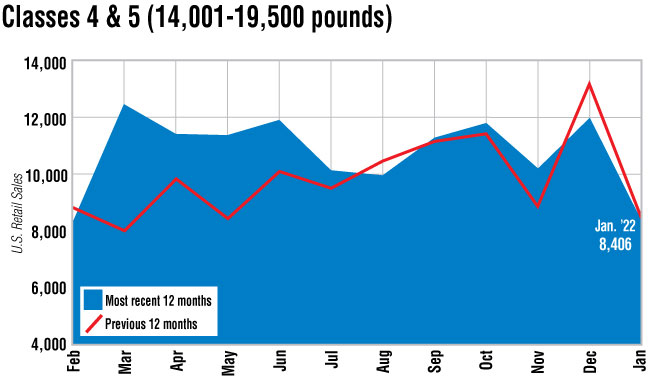

Classes 4-5 dipped 1.4% to 8,406.

READ MORE: NACFE Urges Medium-Duty Electrification

Steve Tam, vice president at ACT Research, told Transport Topics in the Classes 6-7 space the trend continues, whereby Class 8 manufacturers are “stealing from their Class 6-7 parts flow to push the bigger [higher margin] stuff out the door.”

ACT believes the robbing Peter to pay Paul phenomenon has been going on all year, “much to the consternation of the customers in that segment of the market,” Tam said, “but the other thing is that it is easier to extend the trade cycle on a Class 6-7 because they typically do not accumulate mileage at the same rate as the Class 8s.”

In Class 7, Freightliner, a brand of Daimler Truck North America, led with 1,573 sales. That was down from 1,675 a year earlier.

Paccar Inc.’s Class 7 sales dropped to 480 compared with 890 a year earlier. It is the parent of the Kenworth Truck Co. and Peterbilt Motors Co. brands, which split the sales nearly equally.

In Class 6, Ford Motor Co. led with 1,865. That was up from 1,675 a year earlier. Freightliner was next with 1,120 sales, down from 2,772 in the 2021 period.

Ford dominated in Class 5 with 3,931 sales out of 6,973, staying even with sales a year earlier. Ram, a brand of Stellantis, was next with 1,264 sales.

Class 4 saw Isuzu Commercial Truck of America once again in the lead with 535 sales out of a total of 1,433. That was down from 762 sales in the 2021 period.

In the segment, Ford had 461 sales and General Motors 388.

In related medium-duty news, Meritor Inc. noted half of the new wins for electric vehicles it reported for the recently ended fiscal first quarter were in the medium-duty segment for products in North America, South America and Europe.

“We only have 15% share there,” Meritor CEO Chris Villavarayan said during the earnings call. “The content is three to four times more content. So with that, I mean, if you think about our axle volume, and if you think about this transitioning, we’re getting so much more in revenue and content as we transition here.”

Tam noted the power needs of an electric medium-duty truck can be sized appropriately so as not to have as big of a purchase price differential when comparing a battery-electric to an internal combustion engine.

“That makes it easier to get the paybacks,” he said. “So even if the trucks don’t drive as many miles, the business case is definitely still there.”

Want more news? Listen to today's daily briefing below or go here for more info: