Intermodal Resurgence Chugging Along in Third Quarter

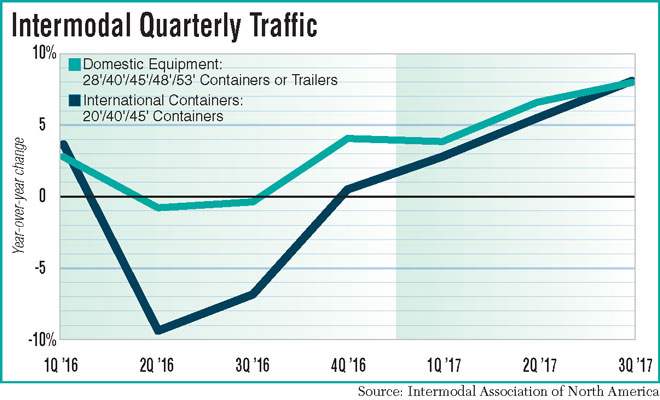

The bounce back in the intermodal sector continues as volume jumped 6.3% in the third quarter — the highest growth rate in more than three years, according to the Intermodal Association of North America.

During the third quarter a year ago, as the industry struggled against an ample supply of cheap trucks, intermodal volumes were down 4.6%, but conditions are much better 12 months later.

This year, intermodal loads rose 4.3% to 13.3 million units through the first nine months, according to IANA’s Intermodal Market Trends & Statistics report.

“Intermodal is up double digits on CSX, Norfolk Southern and Union Pacific and boxes continue to be ‘constrained’ on the West Coast,” SunTeck TTS Senior Vice President Jeffrey Brashares told Transport Topics.

For Legacy Supply Chain Services, a Fernandina Beach, Fla.-based intermodal marketing company and third-party logistics provider, volume surged 20% in the third quarter. For the first nine months, it’s up 8% compared with last year.

“Capacity has grown increasingly tight in the second half of the year, especially on movement of goods West to East. In October, we found the market with no excess capacity in California and loads are flowing over to truck,” Russ Romine, vice president of transportation, said, adding that prices are going up because of the demand. “Some large retailers, such as Wal-Mart and Target, are offering $2,500 for empty boxes to ensure capacity. Since the past four or five peak seasons have been somewhat light and sporadically busy, almost all carriers have not added capacity and in fact have allowed it to wane.”

International intermodal loads jumped 8.2% to 2.3 million in the third quarter. International loads are projected to increase 4% to 5% in the fourth quarter with most of the top U.S. ports seeing heavier traffic than 2016. On the East Coast, Neopanamax vessels started traveling through the Panama Canal and unloading more containers in one fell swoop, placing additional strain on truck, chassis and container supplies.

Many trucking executives told Transport Topics that the only inhibitor to fully capitalizing on surging demand is the inability to find the owner-operators.

“We’re short drivers, without a doubt, and rates are still a little low. I’m not sure when the rates will go up, but in order to attract more drivers into the market, their earnings have to be increased,” said Charles Connors, president of H&M International Transportation, which operates in New Jersey, Philadelphia, Jacksonville, Fla., Savannah, Ga., Norfolk, Va., and Memphis, Tenn.

Tracy Davis, president of Bedford Park, Ill.-based Acme Transportation, agreed that while his drayage revenue and loads were up 5% to 6% in the third quarter, there were situations when he had to say “no” to a beneficial cargo owner although he wanted to say “yes”.

“We are turning away a lot of business and I would argue that I could probably double the size of our company right now, if I could find the drivers,” he said.

Industry experts speculate that some drivers left to chase lucrative markets in Texas and Florida stemming from hurricane relief and reconstruction freight, while others quit the industry in response to the electronic logging mandate. And still others have joined the construction industry while there is low unemployment and an economy that grew 3% over the last two quarters, experts said.

The domestic intermodal container market grew by 3.8% to 1.9 million loads — strongest in the central and eastern portions of the country where truck capacity is tightening and pushing more freight to rail, according to IANA. The Northeast region grew 8.6% in the quarter.

Trailer loads, a smaller market overall, rose 8.4% to 320,930 units. However, trailer loads had dropped 26.9% last year, setting a very low bar to leap in 2017.

Adding trailers and containers together, domestic equipment was up 4.4% overall in the third quarter.

“I was expecting domestic to really gather momentum because of the ELD situation, the hurricanes and the 3% growth in the economy (gross domestic product). But when I look at the September numbers, I see a lag in domestic container growth, which was only 0.7% year-over-year,” said Larry Gross of Gross Transportation Consulting.

Nevertheless, intermodal volume should expand in the foreseeable future, barring an economic downturn or significant change in trade policy, IANA noted.

By corridor, transportation between Eastern and Western Canada jumped 12% year-over-year, the largest gain in North America. In the United States, the top lanes were from the South Central region to the Southwest, a region connecting markets such as Los Angeles to Dallas and Houston. Traffic rose 7.7% between the Southeast and Southwest and 5.9% between the Midwest and the Northeast. Traffic for intermodal marketing companies grew 4.1%, recording gains in both highway and intermodal loads. Total IMC revenue soared 11.2% versus last year, almost twice the 6.6% year-over-year gain in the second quarter.