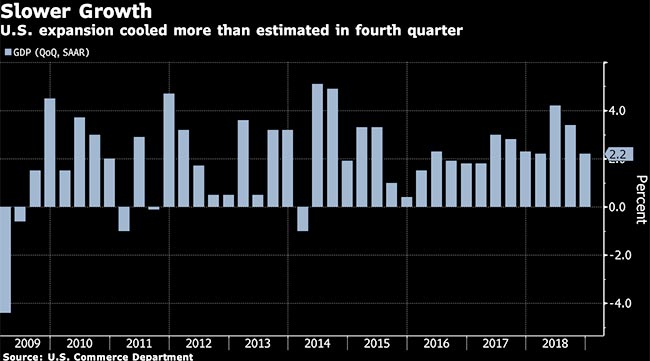

GDP Declines in 4Q, Reflecting Consumer, Government Spending

U.S. economic growth cooled by more than initially reported last quarter on revisions to consumer and government spending, signaling mounting challenges to the expansion as it nears a record duration.

Gross domestic product grew at a 2.2% annualized rate, Commerce Department data showed March 28, less than the initial 2.6% reading and projections for a revision of 2.3%. Consumer spending, the biggest part of the economy, grew at a downwardly revised 2.5% pace that also missed projections.

The final reading on a turbulent quarter that included U.S. stocks tumbling to the cusp of a bear market adds to concerns for the world’s biggest economy as global headwinds gather from Europe to China. While Federal Reserve Chairman Jerome Powell said this month that underlying economic fundamentals remain strong, policymakers have cut their outlook for growth this year and next, and forecast no interest-rate hikes for 2019.

While the expansion is poised to become the nation’s longest on record at midyear, the downward revision indicates that the economy had weaker momentum heading into 2019, when various indicators in housing and manufacturing have been showing signs of cooling.

Economists surveyed by Bloomberg News project that growth in GDP, which measures the value of all goods and services produced in the country, will slow to 1.5% in the first quarter, the slowest pace in two years.

“We’re settling into a more sustainable pace of growth,” as the impact of fiscal stimulus fades, said Ryan Sweet, head of monetary policy research at Moody’s Analytics Inc. “I’m not overly concerned yet. It was a pretty strong 2018. Underlying fundamentals are still solid,” he said, citing the labor market and household finances.

The less-robust reading — which followed 3.4% growth in the third quarter — reflected broad revisions to spending on consumer goods, including recreational goods and vehicles. State and local government spending was downwardly revised on investment in structures, while business fixed investment was reduced on software spending.

The report kept intact an economic milestone that President Donald Trump has boasted about, as the Republican-backed tax cuts helped bring full-year growth to 3%, as measured on a fourth-quarter-over-fourth-quarter basis. That was the fastest since 2005 and compares with the initial reading of 3.1%. The White House has set a 3% goal for expansion.

Meanwhile, there is some risk that Trump’s tariffs could weigh on future growth. Net exports remained a drag on the expansion.

Excluding the volatile trade and inventories components of GDP, final sales to domestic purchasers increased at a downwardly revised 2.1%pace after 2.9% in the third quarter. Economists monitor this measure for a better sense of underlying demand.

The report also gave the first read on business earnings in the fourth quarter. Pretax corporate profits fell 0.4% from the prior quarter for the first decline since early 2017, though profits still rose 7.4% from a year earlier.

While the expansion has moderated, the labor market has remained in generally solid shape despite some recent gyrations. Payrolls grew by an average of 186,000 over the past three months as the unemployment held around the lowest levels in a half century.

A separate report from the Labor Department on March 28 showed filings for unemployment benefits fell to a two-month low. Jobless claims decreased to 211,000 in the week ended March 23, below what economists had forecast.