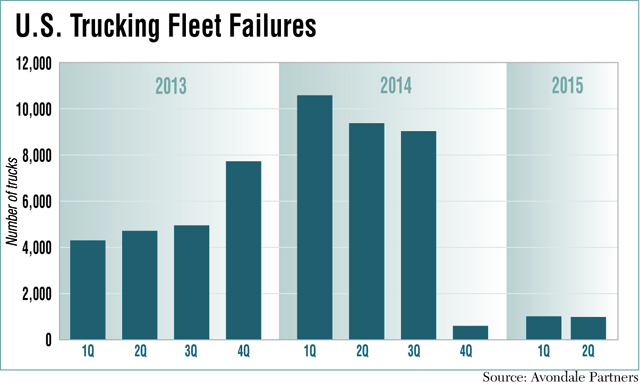

Fleet Failures Plunge 90%

This story appears in the Sept. 7 print edition of Transport Topics.

This story appears in the Sept. 7 print edition of Transport Topics. Trucking failures fell by nearly 90% in the second quarter compared with a year earlier and also dipped slightly from the first quarter of 2015 as favorable rates and fuel prices as well as other trends buoyed fleets’ financial results, a new report finds.

A total of 995 trucks were pulled off the road between April and June by fleets that failed, Donald Broughton, an Avondale Partners analyst, said in a report made available to Transport Topics last week. That total compares with 9,435 trucks in the 2014 quarter, and 1,025 in the first quarter of this year.

Broughton has tracked nearly two decades of fleet failures, which topped 10,000 trucks early last year, when diesel prices were about 40% higher than current levels.

“The truckload environment re-mains too strong for truckers to fail,” Broughton’s report said. “Pricing continues to tick up by mid-single digits, hours-of-service regulations have been relaxed and demand continues to surpass supply.”

The Cass transportation index of truckload rates this year has hovered about 7% above 2014. At the same time, Broughton estimated that the 2014 revision of parts of the hours-of-service rules boosted trucking capacity by up to 2%.

“These factors have kept marginal truckers afloat and could continue to prevent capacity from exiting in coming quarters,” Broughton said.

Bob Costello, chief economist at American Trucking Associations, agreed with Broughton’s assessment.

“We clearly went from an environment of talking about how we could have high failures to the complete opposite situation because rates increased, fuel prices fell, and small and medium carriers have been able to reinvest in their fleet as a result,” Costello told TT.

“Those that had old equipment and were getting nickled and dimed to death [by maintenance costs] have been saved by buying new equipment,” he said.

Broughton highlighted another advantage for fleets.

As fuel prices have sunk to the lowest level in six years, the decline allows fleets to bill customers forfuel surcharges that are higher than the price actually paid later for diesel.

“Paying for fuel at today’s price creates a cash flow windfall and requires an ever-lower amount of working capital,” he wrote. “This creates financial flexibility.”

“I expect a low level of failures in the third quarter,” Broughton said, because of those favorable fundamentals as well as stronger used-truck sale prices and low borrowing costs.

The U.S. economy also is not a negative factor because there continues to be enough demand to generate more loads than trucks, even though capacity is not as tight as last year at this time, he said.

Increased driver pay, responding to a driver shortage and increased demand, also is having a positive effect on capacity, Broughton said.

As carriers boost pay, often twice in one year, they can attract enough drivers for trucks that otherwise would have been unseated.

As a result, he said the percentage of fleets’ unseated trucks typically has been cut by more than half to no more than 3%.

“Taking those trucks and putting them to productive use is a powerful financial incentive,” he said.

That increased capacity is being counterbalanced by other factors, the report noted.

Some trucks are exiting the market when fleets that make acquisitions retire older equipment.

“Less well-capitalized fleets are trading more trucks in than they are purchasing,” he added.

A few uncertainties remain, the report said.

Despite the recent increases, a pay differential between the truckload industry and construction/manufacturing jobs persists.

Drivers still make about 10% less than manufacturing workers and 15% less than construction workers, according to Labor Department statistics.

That higher pay, along with more home time, and the prospect of a better lifestyle will continue to put pressure on the driver pool, Broughton believes.

One negative force that “can kill a trucker” in today’s markets are pressure on insurance and safety costs, he said.

Future period failures are uncertain, the analyst said, because of the unclear effects of regulatory changes such as electronic logging devices, which could curtail capacity.

Still other changes are creating a positive impetus.

Last year’s spot market price spike, when prices rose 15% or more due to a lack of capacity, isn’t being repeated this year because shippers offered to pay higher rates to guarantee a secure stream of trucks, Broughton said.

Today’s lower failure rate is reflected in less spot market activity, he added, as fewer shippers have to turn to load boards to find trucks that replace bankrupt fleets’ equipment.

Broughton also noted the steep decline in trucking stock prices at a time of favorable conditions in the truckload sector is creating an opportunity to buy shares at depressed prices that should appreciate.