Fleet Failures Down in 1Q

By Jonathan S. Reiskin, Associate News Editor

This story appears in the June 1 print edition of Transport Topics.

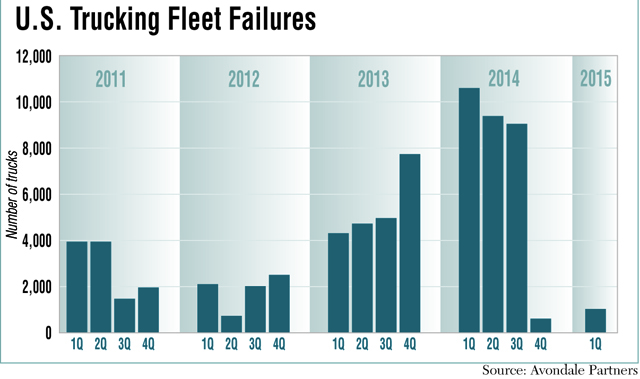

Just 85 motor carriers, with a total of 1,025 trucks, went out of business during the first quarter as fleets feasted on high demand for their services and low diesel prices that form an uncommonly strong business environment.

A report from Avondale Partners stock analyst Donald Broughton said this year’s first-quarter closings, with an average of 12 trucks per fleet, were a record low for January to March.

In contrast, during last year’s first quarter, 390 carriers controlling 10,630 power units went out of business — making for a 90% decrease when measured by truck count year-over-year.

The six months running through March were unified, though, as “conditions are so good it’s hard to go out of business even if you try,” Broughton said. “The demand is there, rates are good and capacity, while not as constrained as a year ago, is still tight.”

First quarters generally are challenging, Broughton said, because freight volumes drop, licensing fees and insurance premiums come due and bad weather can disrupt operations.

Closings took out at least 8,000 trucks in each of the first three quarters of 2014, but the final quarter saw just 45 carriers with a total of 605 trucks going under — the record low for a quarter since Broughton began tracking fleet failures in 1997.

Bob Costello, chief economist for American Trucking Associations, said the Avondale report is consistent with his observations. He said spot market rates are not surging as they were a year ago but are “still strong,” and while diesel prices have been rising in recent weeks, they still are low compared with the past several years.

“Small and medium-size carriers continue to benefit from these conditions,” Costello said.

With diesel down, so is the cost per mile of operating a truck, and that makes it easier for management to deal with operating capital. Fleets often have to wait 30 to 60 days to collect a freight bill. In the meantime, managers need to keep cash on hand to pay for expenses.

“When accounts receivable are high, it consumes cash,” Broughton said. “Working capital requirements have fallen because of diesel . . . and that fall improves profit margins.”

Looking at the need for trucking, Costello said, “The fundamentals for trucking services and volumes of freight remain good in the long-run outlook. A fair number of trucking companies have more freight than they know what to do with.”

Trucking companies are increasing fleet sizes cautiously and being more selective with whom they do business, said Keith Tuttle, president of Motor Carrier Service in Northwood, Ohio.

“Companies are more particular today about the freight they choose to haul,” said Tuttle, who is chairman of the Truckload Carriers Association.

Comparing current business with the 2008-2009 recession, when fleets were lucky to get any sort of business, Tuttle said: “It’s changed quite a bit.”

Shippers, brokers and other logistics companies now are trying to curry favor with companies in possession of trucking capacity.

“The very good brokers want long-term, lasting relationships with carriers. If you abuse carriers it’s not a sustainable business model in this market,” Tuttle said.

Fleets often are increasing capacity by operating more efficiently rather than buying a large number of new trucks. Tuttle said Motor Carrier Service now has a brokerage division, and many other truckload firms have done the same thing. That means carriers are trying to keep existing fleets fully utilized as compared with keeping a stable of new trucks at the ready in case a load pops up.

Tuttle also said he is optimistic about the rest of this year.

“Good, well-managed carriers are pushing through rate increases as shippers are trying to lock in capacity,” he said.

Scott Arves, president of Transport America, said Broughton’s analysis tracked with his own first-quarter experiences.

“It was hard not to have a good first quarter; it was pretty easy to stay busy,” said Arves, who is retiring June 1.

Spot market rates were good, he said, with loads available exceeding truck capacity.

Arves said smarter customers are accepting rate increases.

“A shipper who believes the driver shortage is just a temporary phenomenon won’t give a freight-rate increase based on fuel going down, but other customers are trying to get ahead of the issue,” Arves said. Getting increases for base rates when fuel surcharges are down “is a much easier sell.”