Senior Reporter

Diesel, Gasoline Averages Both Increase

The U.S. retail average price for diesel and gasoline each had the biggest spike in six weeks amid volatility in oil prices, analysts said.

Diesel jumped 3.7 cents a gallon to $2.165, the Department of Energy said. It was the biggest increase since March 14, when it leaped 7.8 cents.

All regions posted higher prices, DOE said after its April 18 survey of fueling stations.

Diesel, however, remained 61.5 cents cheaper than a year ago, when the price was $2.780.

It rose the most in the Gulf Coast region, up 5.4 cents to $2.046, which notwithstanding was the lowest price of any region.

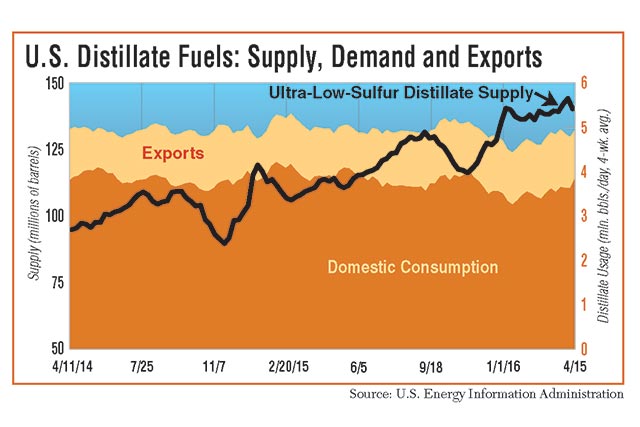

Against the backdrop of rising prices, stockpiles of ultra-low-sulfur distillates, including diesel, fell 2% to 140.9 million barrels — compared with the record level of 144.9 million barrels set April 8 — and were 23.5% higher than a year earlier, DOE’s Energy Information Administration said.

Demand for distillate fuels, which include ULSD and heating oil, increased 11% to 4.2 million barrels per day compared with 3.8 million the previous week, EIA said.

Also, the national average price for regular gasoline jumped 6.8 cents to $2.137 a gallon.

That was its biggest weekly gain also since March 14 when it jumped by 12 cents.

Gasoline rose in all regions, too, but it was 34.8 cents a gallon cheaper than a year earlier.

Sean Hill, an EIA analyst, said the higher prices for gasoline and diesel stem from the recent increases in the cost of crude working its way into the retail fuel markets, a process that can take about 10 days.

“I don’t expect any major drop in gasoline or diesel prices from where they’re at right now from crude prices,” Hill said, adding that, for the most part, they are back where they were before all of the OPEC talk about freezing production.

Crude oil fell after the world’s biggest producers, including OPEC’s 13 member countries and nonmember countries, failed to reach an agreement April 17 to hold production levels where they are — amounting to what Bloomberg News called “a diplomatic failure that threatens to renew the rout in prices.” The deal’s demise left a coordinated response to the slump in ruins, Bloomberg reported, “and that will send an important message to the market: It’s every country for itself again.”

On April 18, crude oil futures fell below $40 and closed on the New York Mercantile Exchange at $39.78, then climbed over that threshold to close at $40.99 the next day.

Hill said the current low price of crude adds to its volatility. “A dollar or two swing is a big percentage. . . . [Prices] look super volatile, and they are.”

Meanwhile, one option fleets have to improve fuel mileage, which reduces fuel costs, is to switch to low-viscosity engine oils already on the market, moving to 5W/10W-30 or an xW-30 series instead of staying with the more traditional 15W-40, Mike Roeth, executive director of the North American Council for Freight Efficiency, told Transport Topics.

Roeth said about 15 fleets, as well as a “critical mass” of lubricants manufacturers and engine makers, were involved in NACFE and the Carbon War Room’s pending confidence report on low-viscosity oil.

“They tell us there are some pretty good fuel-economy savings in the lower-viscosity oils, around 1%. The only issue is the cost, but we believe it is a really good technology to pursue for fuel savings,” Roeth said, citing the study’s preliminary results.

He said a valuable feature of a low-viscosity oil on the market now is that it can be “retrofitted” to older trucks. “That’s a big deal because it gives fleets a chance to gain 1% on all their trucks.”

On an over-the-road tractor, a 1% savings with fuel at today’s prices is an annual savings of about $350 per truck, he said.

“At $4 diesel, or 2014 levels, it’s twice that, or $700. Those are pretty big numbers,” Roeth said.

The detailed report is expected to come out early this summer.

Roeth added the new FA-4 low-viscosity oil coming in December is designed for model year 2017 engines and focuses on adding another 1% in fuel savings. A companion oil, CK-4, is intended to replace CJ-4 and work with existing engines. Both will be ready by Dec. 1, lubricant manufacturers have said.