Diesel Gains for 2nd Week

This story appears in the Feb. 23 print edition of Transport Topics.

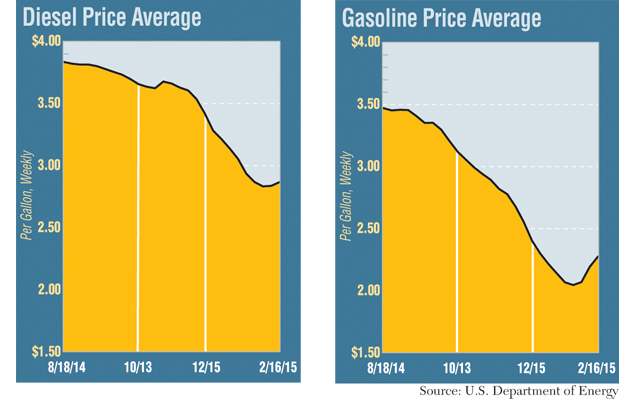

U.S. retail diesel prices rose last week, by 3 cents a gallon, the first back-to-back increase for the fuel average since June.

The Department of Energy said the diesel average was $2.865 a gallon. The gain during the week before was the first increase after 12 straight weekly declines.

DOE’s Energy Information Administration also said gasoline prices added 8.3 cents a gallon to $2.274 on Feb. 16, the third straight gain. The gas average has shot up 23 cents over three weeks.

Prices for both fuels were more than a dollar a gallon cheaper than a year ago, when the diesel average was $3.989 and gasoline was $3.38.

Both refined products have been on an extended price fall; U.S. diesel prices declined in 29 of the 31 weeks ended Feb. 2, when the average hit $2.831.

During that stretch, there was just one increase — in early November — and a no-change week in September.

Both fuels still are well below their peak prices over the past 12 months. Diesel hit $4.021 a gallon March 10, and gas reached a high of $3.713 on April 28.

It was unclear whether the price increases might be the start of a trend. Two analysts said diesel and gas are following crude prices, which generally rise in late winter.

The exception to that could be California fueling stations, where price hikes could remain longer because of a Feb. 18 explosion at the Exxon Mobil refinery in Torrance.

“Crude has not had its final capitulation on prices yet,” said Denton Cinquegrana, chief oil analyst for OPIS, the Oil Price Information Service.

“This is the time of year for rallies,” Cinquegrana said of the increase in crude oil prices.

Crude oil futures contracts on the New York Mercantile Exchange rose to about $50 a barrel in

February after hitting a low of $44.45 Jan. 28.

On Feb. 19, the closing price was $51.16 per barrel.

“There’s still plenty of oil,” Cinquegrana said, adding that Nymex prices are being kept low because of strong U.S. oil production.

“We’ve seen a turnaround in crude oil prices. They’ve come back strongly in February,” said Timothy Hess, an Energy Information Administration analyst.

The price increases for crude now have filtered through to refined products, he said.

The U.S. rig count, or hardware used in drilling new wells, has dropped significantly over the past month, Hess said, to 1,058 from 1,421 a month ago.

Even if the hunt for new oil is not as vigorous as it has been, Hess said U.S. crude inventories are still at relatively high levels. And OPIS’ Cinquegrana said there is room for Nymex crude to drop back below $50.

If oil prices do retreat, it could send diesel and gasoline prices back down. But this volatility in prices can be a worry for truck operators.

“It’s a world market,” said Lex Ludtke, vice president of Ludtke Pacific Trucking in Bellingham, Washington, which makes it difficult to plan on fuel prices for his 28 tractors that haul refrigerated loads longhaul and intermodal containers locally. But he is leery that prices will remain low in the long term.

“It will go back up,” Ludtke said. “Maybe the scary wolf isn’t as scary anymore, but we still look at fuel because you know it’ll go back up eventually,” he said.

Regardless of what happens to oil and fuel prices, Ludtke said his company will keep in place the fuel-saving techniques, which were adopted when prices were high.

And for the near future, he is grateful for the comfort that high demand for trucking services is providing.

“There’s enough freight out there for everybody now,” he said.

Bloomberg News reported Feb. 18 that an electrostatic precipitator exploded in a fluid catalytic cracker at Exxon Mobil’s 149,500-barrel-a-day Torrance refinery.

Fluid crackers convert heavy petroleum products such as vacuum gasoil into lighter fuels, including gasoline and diesel. The blast threatens to shrink fuel supplies in California, where they’re already at a six-year seasonal low, the wire service said.

Production from California refineries cannot be replaced easily because the state mandates that vehicles use special fuel blends of diesel or gasoline to help preserve air quality.

Bloomberg said wholesale gasoline prices in Los Angeles quickly surged to the highest level in more than a year shortly after the explosion.