Senior Reporter

Daimler Truck Poised to Become Public Company

[Stay on top of transportation news: Get TTNews in your inbox.]

Daimler Truck, the global leader in truck and bus production, is poised to transition into a stand-alone, publicly traded company upon completion of a major reorganization, parent company Daimler AG announced Feb. 3.

Under the plan, Daimler AG would rename itself Mercedes-Benz, and the truck and bus unit would become Daimler Truck AG. Like the truck unit, the car business would be individually traded.

The transaction and the listing of Daimler Truck AG on the Frankfurt Stock Exchange is expected to be complete before year-end 2021, according to Stuttgart, Germany-based Daimler.

The parent company noted the steps are needed to unlock the full potential of its businesses in a zero-emission, software-driven future.

“This is a historic moment for Daimler,” said company Chairman Ola Källenius. “It represents the start of a profound reshaping of the company. Mercedes-Benz Cars & Vans and Daimler Trucks & Buses are different businesses with specific customer groups, technology paths and capital needs.”

Yet he noted that both companies operate in industries that are “facing major technological and structural changes.” He added, “Given this context, we believe they will be able to operate most effectively as independent entities, equipped with strong net liquidity and free from the constraints of a conglomerate structure.”

Under the revamped structure, the company said it expects its Portland, Ore.-based Daimler Trucks North America division to expand its leading market position, boost profitability and benefit from “increased scale and strong partners” to amortize investments in technology. DTNA is the leader in U.S. retail sales of Class 8 trucks — a key segment of the North American market, the world’s most profitable for commercial vehicles. DTNA makes the Freightliner and Western Star truck brands.

“This is a pivotal moment for Daimler Truck,” said Martin Daum, chairman of Daimler’s global truck business. “With independence comes greater opportunity, greater visibility and transparency. We will grow further and continue our leadership in alternative powertrains and automation. We have already defined the future of our business with battery-electric and fuel-cell trucks, as well as strong positions in autonomous driving. With targeted partnerships we will accelerate the development of key technologies to bring best-in-class products to our customers rapidly.”

Daimler’s truck unit could be worth about $35 billion if valued at multiples similar to Volvo, although it would need to substantially improve returns to justify that valuation, Deutsche Bank analysts wrote in a January report.

“Daimler Truck already has a solid financial basis, and our business model is robust,” Daum said. “We will continue to work on our cash flow management and we know how to deal with industry market cycles — we have proven that again in the significant COVID-related global market reduction.”

He added, “We have clear strategies to raise our financial performance and accelerate our execution. We will use our strong and well-known global brands, our scale and our exceptional technology to deliver industry-leading returns.”

Our plans for a fundamental change in our structure: We intend to separate our businesses into two pure-play companies and plan a majority listing of #Daimler Truck to accelerate into zero emissions and software-driven future. — Daimler AG (@Daimler) February 3, 2021

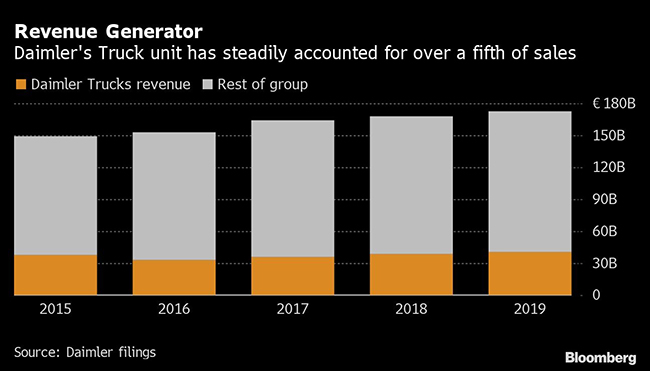

Daimler’s truck division, which reports in euros, posted the approximate equivalent of $48 billion of revenue in 2019, according to the company’s annual report. It sold 488,521 vehicles worldwide and earned $2.9 billion before interest and taxes that year.

On the same day the Daimler announcement was made, rival Volvo AB issued a bullish outlook for the global truck market earlier within its report of better-than-expected quarterly earnings. Transport and construction activity has fully recovered in most markets and improved customer confidence, according to the company. Volvo raised its forecast for heavy-duty vehicle sales in Europe and North America this year by a combined 90,000 units.

The results raise the bar for Daimler Truck, which has long trailed its Swedish rival in terms of profitability. Volvo’s operating margin of almost 13% is “the highest the company has ever reached in recent memory,” RBC analyst Tom Narayan said in a note.

Want more news? Listen to today's daily briefing below or go here for more info: