Managing Editor, Features and Multimedia

‘Coopetition’ Continues in Truck Tech Sector

This story appears in the November 14 print edition of iTECH, a supplement to Transport Topics.

Seth Clevenger

Seth ClevengerThe trucking industry’s technology sector has long been characterized by a galaxy of partnerships and integrations connecting various vendors’ systems. Through these integrations, fleets have been able to assemble the technology components of their choice to build an enterprise system tailored to their operations.

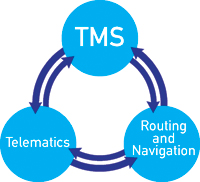

Vendor partnerships have tied together different types of complementary systems, including transportation-management software, telematics and mobile communications platforms, routing and navigation, and business-process automation.

However, consolidation in the technology arena in recent years has raised questions about whether this approach will continue.

BEST OF NOVEMBER iTECH: More stories, columns

The most prominent example is Trimble Navigation Ltd., which acquired PeopleNet in 2011 and then purchased TMW Systems and ALK Technologies in 2012, bringing three of the trucking industry’s largest technology suppliers under common ownership.

That has created a situation where these Trimble companies offer integrations with outside firms that compete directly with a sister company. TMW, for example, integrates its TMS software with telematics technology from Omnitracs, a PeopleNet competitor. At the same time, PeopleNet integrates with McLeod Software, a rival to TMW.

Nevertheless, executives at these Trimble companies have shared a consistent message over the past four years: Integrations with outside partners will continue, because joint customers demand it.

But that doesn’t mean Trimble is ignoring the obvious opportunities to more closely unite the capabilities of its own properties.

Those joint development efforts came to the forefront in September, when TMW and PeopleNet hosted their first combined user conference in Nashville, Tennessee.

There, the companies previewed TripInsight, a “comprehensive journey management application” that incorporates ALK’s CoPilot Truck navigation, PeopleNet’s mobile technology and TMW’s back-office software.

That was perhaps the clearest indication yet of Trimble’s work to build something greater than the sum of its parts. After all, why acquire these different technology suppliers if there’s nothing to be gained by putting them all together?

In some ways, this mirrors the trend toward vertical integration at the truck manufacturers.

Original equipment manufacturers have been pursuing greater efficiency and performance through proprietary, integrated powertrains. But even with all of that emphasis on in-house integration, engines from independent supplier Cummins Inc. remain a prominent third-party option.

That example could provide a blueprint for how the technology space may evolve in the years ahead.

Large technology firms such as Trimble likely will emphasize the added value of combining their own systems, while still offering integration options with outside companies rather than severing those relationships.

In an interview with Transport Topics at September’s user conference, Trimble executives again endorsed that approach and reiterated the company’s commitment to partnering with outside suppliers.

That’s obviously good news for fleets with TMW-Omnitracs or McLeod-PeopleNet integrations, but it’s also the right path for the industry as a whole.

Today’s “coopetition” model, where firms can be both partners and competitors, allows fleets to benefit from the strengths and innovations of multiple suppliers.

The industry is best served by an open technology ecosystem where vendors are willing to connect their capabilities.

Seth Clevenger, technology editor, can be reached at 703-838-1795 or sclevenger@ttnews.com. Follow him on Twitter @SethClevenger.