Senior Reporter

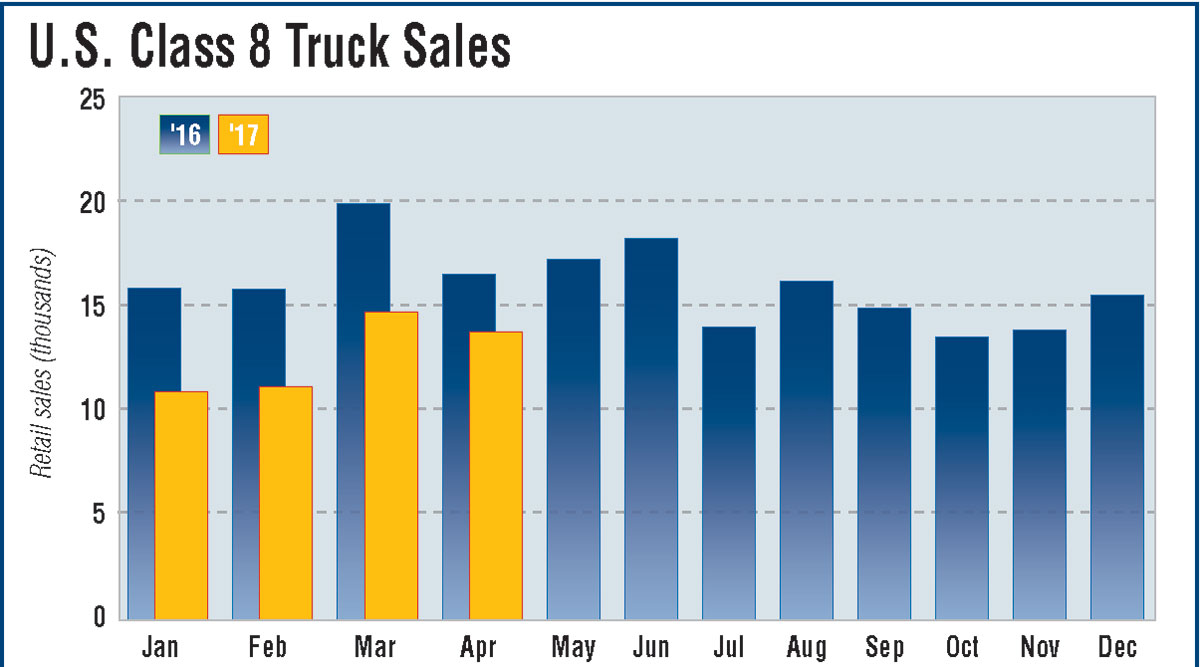

Class 8 Truck Sales Fall 16.8%; Smallest Drop in 13 Months

This story appears in the May 22 print edition of Transport Topics.

U.S. retail sales of Class 8 trucks in April fell 16.8% to about 14,000 as soft freight rates and plentiful used trucks with weak valuations held demand in check, experts said.

Sales reached 13,836 compared with 16,633 a year earlier, Wards- Auto.com reported.

That was the smallest year-over-year decline in 13 months, or since a drop of 2.9% in March 2016, according to Ward’s. Other experts expected improved sales later this year.

Year-to-date, sales were down 25.9% to 50,773.

“We hear stories about what’s happening in the freight market. I hate to use the word languish, like it’s really bad. It’s not. It’s just really mediocre. It’s just not going anywhere,” ACT Research Co. Vice President Steve Tam told Transport Topics.

That economic drag is reflected in the weaker year-over-year and year-to-date truck sales ratios and “is what has caused us to be more bearish in our outlook,” Tam said.

It is a very nuanced truck-manufacturing environment, Tam added, “Sales and production are clearly lagging behind orders.”

All truck makers posted year-over-year sales declines in April.

Freightliner, a unit of Daimler Trucks North America, remained the market leader with a 35.9% share after selling 4,965 trucks but experienced a year-over-year decline of 21.9%.

Niche truck maker Western Star, also a DTNA brand, sold 432 trucks, down 10.6% and good for a 3.1% share.

Peterbilt Motors Co., a unit of Paccar Inc., fell the least. It slipped 2% to 2,285 trucks, good for a 16.5% market share.

Kenworth Truck Co., also a Paccar brand, fell 8.5% to 2,323 trucks and a 16.8% share.

“Paccar has been gaining market share the last year and a half, and I expect them to continue to gain some more market share,” Rush Enterprises Inc. Chairman and CEO W.M. “Rusty” Rush said in a conference call to discuss first-quarter earnings with analysts April 25.

Peterbilt’s year-to-date market is 16.1%, compared with 13.1% the 2016 period, Ward’s said.

The Rush dealership network sells Peterbilts and International Trucks, among other brands, and operates more than 100 locations in 21 states.

International, a brand of Navistar Corp., sold 1,535 trucks, down 18.9%, earning it an 11.1% share.

Rush said Navistar was on the right track in recently launching two new heavy-duty models and a new 12.4-liter engine.

“They’ve got refocused because they went so many years when everything was focused on engines [whose exhaust gas recirculation systems caused trouble for trucks sold in 2011-12] instead of products. So that only bodes well for us in the future,” Rush said.

Sales at Volvo Trucks North America declined the most, falling 32.9% to 1,226 for an 8.9% share.

Mack Trucks sold 1,061 units, down 11.1% for a 7.7% share.

VTNA and Mack are units of Volvo Group.

Truck makers either declined to speak or did not respond to requests for comments. However, two large fleets commented on the truck market during recent conference calls.

Schneider’s truck purchases have declined in 2017 after it accelerated purchases of tractors in 2016 because of “continued weakening of the used-equipment market,” it reported in its 2017 first-quarter earnings statement. Schneider has 13,000 trucks and ranks No. 7 on the Transport Topics Top 100 list of the largest U.S. and Canadian for-hire carriers.

The used-truck market also has been soft and is expected to remain so, Knight Transportation Inc. CEO Dave Jackson said on a first-quarter earnings conference call with analysts April 26. The average age of Knight’s trucks has grown to 2.4 years from 1.8, he said. The company operates about 4,700 tractors and ranks No. 29 on the for-hire TT100.

Tam said the ongoing decline in used-truck prices was moderating. Also, ACT’s latest For-Hire Trucking Index indicated elevated purchase expectations, with 65% of a mix of small to large fleets planning to buy in the next three months.

Don Ake, vice president of commercial vehicles at research company FTR, suggested dealers would begin restocking Class 8s heading into the second half of the year “in anticipation of higher sales volumes.”