Senior Reporter

Class 8 Purchases Rise 4.5% in September as Buyers Invest in More Efficient Models

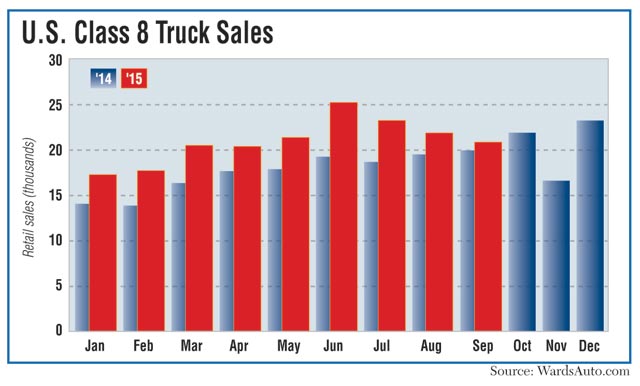

U.S. retail sales of Class 8 trucks totaled 20,972 in September, marking the seventh consecutive month when sales topped 20,000, WardsAuto.com reported.

Although last month’s 4.5% year-over-year gain was the only single-digit percentage increase so far in 2015, it was the strongest September since 2006, when trucks flew off the lots in record numbers ahead of new emissions regulations.

Year-to-date sales are up 19.7%, to 189,541 from 158,288, as fleets and other buyers continue to replace older models with new ones that would further enhance the profitability of their operations, truck makers and analysts said.

ACT Research President Kenny Vieth told Transport Topics he is still forecasting that 2015 will be the top of the current retail sales cycle with 269,000 truck sales.

He expects sales next year to be 240,000 to 250,000. Sales hit the all-time high in 2006 at 284,000 units.

Martin Daum, president of Daimler Trucks North America, the parent company of Freightliner Trucks and Western Star Trucks, said, “We are still seeing a strong desire by the fleets to replace old vehicles with more fuel-efficient vehicles that add to their bottom line, and the trend is going strongly towards vertical vehicle integration, safety features and increased driver comfort.”

Market leader Freightliner’s year-over-year sales rose 11.1% to 8,025 trucks for a 38.3% market share. Year-to-date, sales climbed 26.3% to 71,273 trucks and marked a 37.6% share.

At a Mack Trucks event in Hagerstown, Maryland, on Oct. 13, Mack President Stephen Roy said he is bullish about the year’s final quarter.

“We always start slow because of our vocational line,” he said, referring to cement mixers, dump trucks, refuse vehicles and other vocational trucks. “We’re strong at the end,” Roy said, adding that he has been pleased with the sale of the company’s Pinnacle highway tractors.

Mack’s year-over-year sales rose 9.3% to 1,810 trucks, or 154 more than the year-earlier period. Its year-to-date market share was 7.8%.

Kenworth Motor Co., a unit of Paccar Inc., enjoyed sharp gains in September, selling 3,384 heavy-duty trucks, up 21.7% from 2,780 a year earlier. Year-to-date it sold 28,558 Class 8 trucks, a 30.9% increase, compared with 21,824 sold in the year-earlier period.

“Industry retail sales are at historically high levels,” said Jason Skoog, assistant general manager for sales and marketing at Kenworth.

Kenworth captured “over 16% of the U.S. market for the second month in a row,” Skoog said.

Jeff Sass, Navistar International’s senior vice president of sales, said the continuing shortage of drivers and technicians means “the industry is demanding trucks that appeal to drivers, offer leading uptime and are supported by a large service network.”

He remained optimistic even though Navistar’s sales dropped 20.8% year-over-year to 2,290 from 2,892.

Navistar’s year-to-date sales were off 2% and stood at 23,099, for a 12.2% share.

“We continue to see strong truck demand and expect the industry to continue its healthy pace into 2016,” Sass said.

Magnus Koeck, vice president of marketing for Volvo Trucks, said the steady U.S. economy “continues to positively influence Class 8 sales” of more efficient models compared with older trucks. Volvo’s sales year-over-year slipped 8.3% to 2,272. But it had a 19% year-to-date gain, climbing to 23,027.

Peterbilt Truck Co., also a Paccar unit, did not respond when asked for comments. Its year-over-year sales last month were 2,812, up 0.7% from a year earlier. Its year-to-date sales rose 19.7% to 25,233.

DTNA’s niche Western Star brand climbed to 375 trucks year-over-year from 250. Year-to-date it has sold 3,504 trucks compared with 2,361.

Michael Baudendistel, an analyst with Stifel Transportation and Logistics Research Group, said the payback

on the cost of a new Class 8 truck is about 3.8 years and “still shorter than the average life cycle.”

But headwinds are gathering, according to an analyst.

Said John Larkin, also an analyst with Stifel: “[A] strong dollar, low energy prices, bloated inventories, mediocre consumer spending and weak capital investment weigh on overall freight markets.”

Associate News Editor Jonathan S. Reiskin contributed to this story from Hagerstown, Maryland.