August Tonnage Gains 2.1%

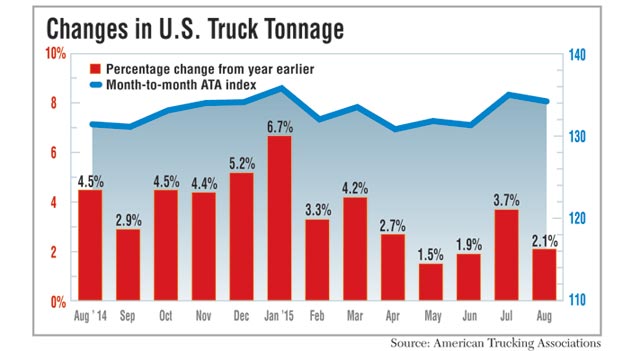

Truck tonnage hauled by for-hire carriers in the United States increased 2.1% in August compared with the same month in 2014, American Trucking Associations reported Sept. 22.

ATA Chief Economist Bob Costello said July’s activity was “robust” and revised upward from the initial report. In contrast, August represents “a breather.”

The seasonally adjusted index checked in at 134.2, down from 135.3 in July. However, August was the 30th consecutive month of year-over-year expansion in the tonnage index.

Year-to-date, 3.3% more truck tonnage has been moved compared with the first eight months of 2014. The record high for the index was 135.8 in January.

Costello cited several examples of softness in the economy, including weak housing starts, falling factory output and high inventory levels. He warned they could combine for “a negative impact on freight volumes over the next few months.”

Transportation executives and analysts said the economy is showing some mixed signals on strength, but no one suggested expansion is over.

“We’re seeing a level stretch. We continue to do well, but there’s not a big uptick,” said Kevin Burch, president of truckload carrier Jet Express, based in Dayton, Ohio.

The core of Jet’s business is the automotive industry. Burch said relatively low gasoline prices make SUVs more popular, and production of them requires more truckloads of inputs.

Tempering that increase in tonnage, though, is inventory control. Burch said automakers now are more sophisticated in their management of inventory, so stockpiles of inputs and finished vehicles are never allowed to bloat.

ACT Research Co. economist Jim Meil said economic problems overseas are showing domestic ripple effects. Canada, for example, is either in recession or without growth and its currency has fallen versus the U.S. dollar.

“It’s hard if you’re a U.S. producer trying to sell to Canada now,” he said of commerce with the United States’ largest single trading partner.

He cautioned against worrying about a one-month dip in truck tonnage, saying that a steady five-month streak would be more noteworthy.

The ATA tonnage index has mimicked the Federal Reserve’s industrial production index. July output jumped to 107.5 from 106.6 in June and then dipped to 107.1 in August.

Management at load-board operator DAT Solutions slices the truck market into dry van, refrigerated and flatbed sectors. The company examines spot-market demand for trucks and the prices generated from the load-board transactions.

The flatbed sector stood out for its August decline in loads posted relative to trucks available, down 16% from July to a ratio of 11.3 loads per truck. In August 2014, the ratio was 36.7 loads.

DAT analyst Mark Montague said there is a lot of variation within the sector.

“Nationwide, they’re not doing as well due to the oil and gas slump; however, Alabama, Mississippi, Louisiana and Arkansas are strong, and so is the Pacific Northwest,” Montague said.

Steel made in Alabama gets shipped north to automakers or their suppliers. ACT’s Meil also listed the automotive sector as one of the stronger parts of the economy.

Montague said the activity in the Northwest is related to a prosperous forest products industry.

The refrigerated and dry van sectors saw improvements in demand in August. The ratio for reefer trucks moved up 4.7% from July, and the dry van ratio increased by 2.7%. Compared with a year ago, though, there is much less activity.

“California produce volumes are way down because of the drought,” Montague said. “But overall, the U.S. reefer market has not shrunk since last year.”

In other parts of the country, there still is good business in loads being offered, particularly for crops of fresh apples, onions and potatoes. Montague said shipping of frozen foods remains stable and that California is shipping nuts such as almonds, if not green vegetables.

On the dry van side, Montague said the East Coast is doing particularly well. Container shipping into ports such as New York-New Jersey and Virginia is solid, providing loads to intermodal carriers.

While Canada’s problems are bad for U.S. exporters, imports from the North are strong and flowing into the Buffalo area, he said.

As for spot-market truck rates, they have dipped since July and fallen from a year ago, but not as much as fuel prices have declined.

“Shippers are happy [with rates] and carriers are doing OK, but you’re not happy if you’re making petroleum,” Montague said of current pricing.