Senior Reporter

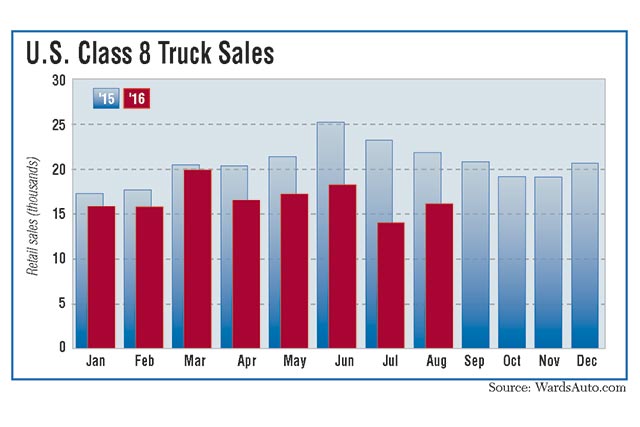

August Class 8 Sales Drop 26.1% in 9th Straight Monthly Decline

This story appears in the Sept. 19 print edition of Transport Topics.

U.S. retail sales of Class 8 trucks dropped 26.1% in August from a year earlier, WardsAuto.com reported, the ninth straight monthly decline, as industry conditions continue to show little improvement.

Sales totaled 16,262 units, down from 21,988 a year earlier, with all truck makers showing declines. Year-to-date sales were 134,505, off 20.2% from 168,569 in the 2015 period.

“We continue to hear about dribs and drabs, or bright spots, but nothing has moved the needle in any meaningful way,” Steve Tam, ACT Research Co.’s vice president for the commercial sector, told Transport Topics.

He noted that the Institute for Supply Management’s report for August found that only six of 18 manufacturing sectors reported growth.

“Unfortunately, transportation equipment was not one of them. There really is nothing that has changed our viewpoint,” he said.

Tam said ACT expects Class 8 truck production to be 229,800 units in 2016 — down 19.5% from 2015 — then falling to 203,100 in 2017.

He called the current environment a “multiyear catch-up before we get things back into balance.”

High dealer inventories are placing a damper on new production, said Magnus Koeck, Volvo Trucks North America’s marketing vice president.

“Dealers are working hard to get rid of the inventory, but it’s not going as fast as we’d hoped,” Koeck said during a VTNA event in Washington. (see story, p. 5).

VTNA sold 1,696 trucks, down 32.2% year-over-year, and secured a 10.4% share.

Sleeper trucks still are the majority of what Volvo sells, but day cabs are gaining and the sleepers that do sell are the smaller sizes rather than the largest. Koeck said that fleets are trying to offer drivers more routes where they can get home nightly, or close to it, thereby slicing into the demand for the largest sleepers.

Sales at Mack Trucks were 1,292, down 26.8% for a 7.9% share. Mack and VTNA are units of Volvo Group.

“While there are still relatively positive signs in the construction segment, August’s overall Class 8 retail sales continued to be weighed down by lower freight volumes, resulting from weak manufacturing in the face of high inventory levels across the overall economy,” said John Walsh, Mack’s vice president of global marketing.

International Trucks, a brand of Navistar Inc., posted sales of 1,967, down 18.3% for a 12.1% share.

“Everybody’s getting a little bit more aggressive [with pricing], but it’s nothing out of the ordinary and we’re not seeing anybody, any of our competitors, do anything that makes, that hurts, the entire industry. I guess I’d say it that way,” Bill Kozek, president of North American trucks and parts at Navistar, said during the company’s third-quarter earnings call Sept. 8.

Freightliner Trucks remained the market leader with 6,127 sales, down 25.9% year-over-year, and good for a 37.7% market share. Western Star’s sales fell 4.9% to 386, for a 2.4% share. Both are brands of parent company Daimler Trucks North America.

Ward’s August report “suggests some of the softness we saw in July was a lull at Freightliner and International,” said Molly Zacker MacKay, vice president of operations at research firm MacKay & Co., “but the market dynamic remains unsettled as crosscurrents continue to buffet both the supply of and the demand for Class 8 trucks.”

Freightliner and International posted the strongest gains in August compared with the previous month, Ward’s said.

Kenworth Truck Co. sales fell 30.1% to 2,516, good for a 15.5% share. Peterbilt Motors Co. posted sales of 2,260, down 25.6%, and secured a 13.9% share. Both brands are units of Paccar Inc.

Overall, the industrywide backlog is supporting sales, ACT’s Tam said.

In July 2015, the backlog of unbuilt orders was about 150,000 Class 8 trucks.

As that year and then 2016 progressed, customers placed orders for about 240,000 units.

“But the industry has built almost 300,000 trucks, leaving the backlog at about 94,000 at the end of this July,” Tam said.

ACT’s forecast of a little more than 200,000 units next year means “we only have to take in 100,000 orders, in essence, to be able to survive,” he said.

“That’s only about 8,000 orders a month, the absolute subsistence level of orders. Anything above that helps to preserve the backlog,” Tam said.

He added that demand for trucks is expected to increase in the second half of 2017 as the freight environment improves.

Associate News Editor Jonathan S. Reiskin contributed to this story from Washington.