ATA Tonnage Index Continues Surge Into September

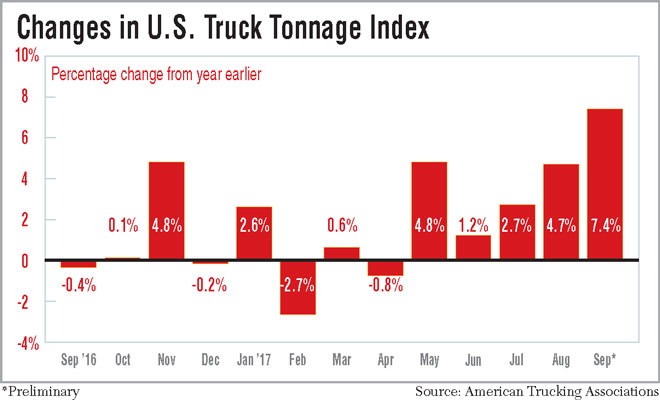

Recent growth in truck tonnage eased up a bit in September, but still advanced 7.4% year-over-year, American Trucking Associations reported Oct. 24.

“Tonnage gave back some of the solid gain in August, but remains at very high levels despite the weather-related issues during the month,” ATA Chief Economist Bob Costello said. “Going forward, rebuilding from those hurricanes and other natural disasters like the wildfires in California will add to freight demand.”

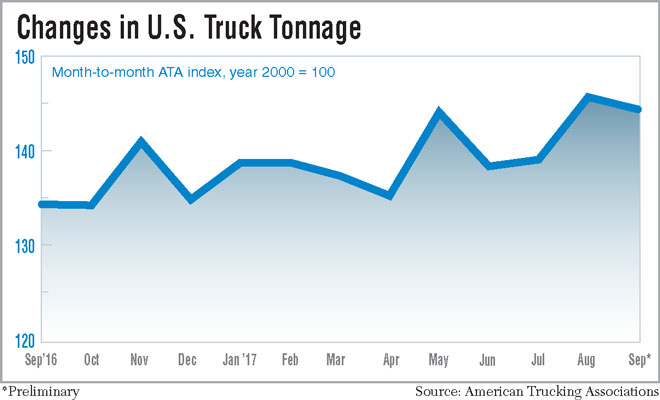

ATA’s seasonally adjusted index of for-hire truck tonnage was 144.4 in September, a slight dip from 145.7 in August, but well ahead of the comparable index in September 2016.

“September’s small setback doesn’t worry me,” Costello said. “Freight has been improving, and I would have thought tonnage last month would have been softer than it was.”

Other trucking economic indicators are also showing a strengthening marketplace for freight hauling.

ACT Research Co.’s for-hire trucking index, which tracks data on productivity, volume, price and fleet capacity, hit 63 in September, up from 43.4 in September a year ago.

A score above 50 signifies expansion and below 50 as contraction.

The volume index grew to 64.9 from 57.6, the price index jumped to 66.2 from 49.9 and the capacity index slightly improved to 54.6 from 51.8 year-over-year.

“Spot prices began to tick up in April or May, but it really tightened in July, August and September,” said Tim Denoyer, ACT Research’s senior analyst. “The last week in June is one of the strongest weeks of freight of the year and things got so tight at that point that the pendulum of pricing power really swung back to the truckers. Capacity usually loosens up in July and August, but freight volumes continued to remain strong in those months.”

When participants were asked about spot rates, 66% noted that they have sustained the post-hurricane increases. Another 56% reported that shipper’s interest in securing capacity under contracts increased due to the recent hurricanes.

“I think that it has been oncoming and that the hurricanes only sped up the process,” one truckload executive said in the survey. “People are scared of the upcoming winter and do not want a repeat of 2014.”

The DAT North American Freight Index achieved a record-high for any September at 597, with a 9% gain sequentially and 74% surge year-over-year. Demand for truckload capacity grew at the fastest rate since 2010, when the economy was emerging from a recession. The index, which uses a base of 100 to represent business conditions in the year 2000, reached its highest reading at 632 in June 2017.

Dry-van freight activity increased 80% versus last September and the average national price increased 35 cents to $1.97 per mile. There were 6.6 available van loads per available truck last month, the highest monthly ratio in at least eight years, DAT reported.

Tonnage gave back some of the solid gain in August, but remains at very high levels despite the weather-related issues during the month.

ATA Chief Economist Bob Costello

DAT industry analyst Mark Montague pegged this March as the inflection point on the spot market, benefiting from sustained growth in petrochemicals, plastic resins, residential and commercial construction and consumer spending.

“E-commerce has also moved some trucks from the contract side to the spot side when you have Christmas in July events and Amazon Prime Day,” he said. “In the past, we’ve had a September and October push to get items on the store shelves, but now it seems like we’re busy from July all the way through December and for returns in January.”

Refrigerated truckload activity rose 70% and rates were 32 cents higher to $2.23 per mile year-over-year. Montague credited the temperature-controlled strength on robust potato harvests in the Pacific Northwest (Idaho, Washington) and Upper Midwest (Minnesota, Wisconsin, North Dakota) along with a productive late fruit and vegetable harvest in California before the wildfires there.

“Based on patterns from the last three years, we expect higher demand for truckload capacity to continue at least through December, with the movement of holiday-related e-commerce freight and the onset of the federal electronic logging device mandate,” Montague said.

In other economic news, the Institute for Supply Management reported the Purchasing Managers Index rose to 60.8% from 58.8% in August and better than the 51.7% in September 2016. The index measures new orders, inventory levels, production, supplier deliveries and employment. A reading above 50% indicates economic expansion.

The Federal Reserve’s Industrial Production Index rose to 104.6, up from 104.3 in August and 103 in September 2016. The index uses 100 as a base representing production in 2012.

Housing starts fell slightly 0.8% sequentially but improved 1.4% year-over-year to a seasonally adjusted annual rate of 1.18 million units, according to the U.S. Census Bureau, a division of the Department of Commerce.

The Census Bureau also announced September retail sales improved 1.6% from the previous month and 4.4% year-over year to $483.9 billion, but the inventory-to-sales ratio was unchanged for the third-straight month at 1.38 in August, the latest month of available data.