Air Disc Brakes for Trailers Slowly Gaining Momentum in Market

Adoption of air disc brakes for trailers is slowly trending upward as some fleets look beyond the tractor to improve stopping power and enhance safety, industry experts said.

Meanwhile, manufacturers are making them lighter, and they require less maintenance than drum brakes. Air disc brakes also are key to the performance of collision mitigation systems.

In addition, the upcharge for air disc brakes represents a smaller portion of a trailer’s total purchase price on more expensive specialized equipment, such as tankers and refrigerated trailers.

Nevertheless, drums still dominate the market. They’re cheaper because they’ve been around for so long, they’re lighter than disc brakes and technicians know their way around them.

But fleets that have made the switch to trailer air disc brakes said they love them.

Steve Sturgess for Transport Topics

For Ploger Transportation, it’s safety that drives the decision to spec air disc brakes for all wheel positions — tractor and trailer.

“We’re a small company running a small fleet and safety is our absolute priority,” said Joel Morrow, Ploger’s vice president of equipment procurement. “That’s why we spec disc brakes.”

He specs SAF-Holland suspensions, axles and disc brakes.

“You can run long downgrades like Fancy Gap with no fear of the brakes fading,” said Morrow, referring to the famous, long downgrade in Virginia. “It gives an extra safety advantage if someone cuts you off.”

In addition, there are service benefits on top of the easy-to-change brake pads, Morrow said. “For instance, there’s no lubrication required, so that removes 12 greasing points on the truck.”

“We don’t see the added weight as near a negative to offset the positive of what the disc brakes deliver on our day-to-day operations,” said David Stevenson, president of Custom Commodities Transport, based in Gilmer, Texas.

As for cost, the lifetime savings argue strongly in favor of the adoption of trailer air disc brakes, he said. “We’re looking at return-on-investment long term.”

For savings on maintenance and savings on cost per mile alone, they’re “just a no brainer,” said Stevenson, who specs brakes from Bendix Commercial Vehicle Systems.

The big difference between air disc and drum brakes is the heat dissipation of air disc brakes, said Simon Dean, director of engineering for the Americas at Wabco Holdings Inc., a major disc brake supplier. The drum brake gets overheated more quickly, and as a result, brake-to-brake and side-to-side variation in stopping capability occurs, he said.

“That variation in drum brakes is what drives people to ADB as well,” Dean said.

Air disc brakes in production by Bendix

Bendix and Wabco also have touted the importance of air disc brakes in supporting the trucking industry’s move toward more advanced automated driving and driver-assist systems, including truck platooning.

Chris Villavarayan, president for the Americas at Meritor Inc., said demand for air disc brake systems is rising.

“We’re developing and improving products and technologies such as the EX+ [air disc brake]. By updating and optimizing the EX+, our engineers reduced weight by 10 pounds per brake to offer the lightest-weight trailer ADB on the market while also maintaining reliability,” he said.

Walt Frankiewicz, senior vice president of North American sales at Haldex AB, said the company’s new ModulT air disc brake is ideal “for fleets looking for high efficiency and greater control and stability with a longer service life and lower total cost of ownership.”

Introduced in early 2016, the ModulT weighs 70.5 pounds, including pads.

Despite offering more consistent stopping power and maintenance advantages, the take rate for trailer air disc brakes overall remains fairly low.

Industrywide, trailer air disc brakes account for about 12% to 15% across the North American Free Trade Agreement region, said Jeff Wittlinger, business unit director for wheel-end and braking systems at Hendrickson Trailer Commercial Vehicle Systems. Wabco’s Dean added that the penetration for trailer ADBs is about 15%, “but we’re seeing it increase and expect 25% over the next two or three years.”

At Utility Trailer Manufacturing Co., where air disc brakes have been available since 2008, the penetration is about 21% and varies by region and vocation, said Stephen Bennett, vice president at the trailer manufacturer.

“We’re something of an anomaly as we’ve been at it a long time. Any salesman can tell you about ADBs,” he said, adding that Utility invested in dealer training early on.

SAF-Holland supplies integrated axles and brakes.

“The systems approach is important,” said Roger Jansen, product manager for SAF-Holland trailer axles and suspensions for the Americas.

Supplying the hubs, rotors and axles ensures quality and reliability, Jansen said.

One of the earliest adopters of trailer air disc brakes was Contract Freighters Inc., when then-maintenance director Bruce Stockton spec’d them on 50 trailers. He is now a maintenance consultant at his limited time maintenance business.

“At CFI, we had trailers with air disc brakes, then at Con-way, which purchased CFI, we had 10 years experience on Vantraax suspensions,” Stockton said, adding that he encountered “zero problems” on his trailers.

The air disc brakes weighed more but they stopped better and worked out cheaper because they were easy to maintain, Stockton said.

Stockton said CFI wanted the trailer manufacturers to make ADBs standard, as the upcharge added $300 to $400 to each trailer.

“You have to weigh this against how many new trucks can you buy instead,” he said.

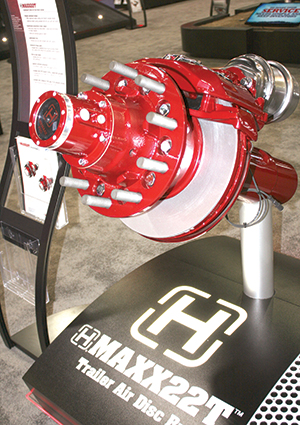

Hendrickson Maxx22T air disc brake

by Steve Sturgess for Transport Topics

Wittlinger, of Hendrickson, said the upcharge for trailer air disc brakes has been coming down as customer interest and adoption rates rise.

“The tank and refrigerated trailer segments have been early adopters; however, we are seeing increased interest from other on-highway segments,” he said.

Stevenson, of Custom Commodities Transport, said the company’s focus on safety outweighs the added cost of air disc brakes.

“I shouldn’t say we’re not concerned with the initial price. We are. But here’s the big part of it: how do you put a number on an accident?” he said. “And once you incorporate roll stability and some of the other features, it helps you tremendously in what you’re trying to do out there each day.”

Wittlinger added that maintenance savings depend on many factors, including application, maintenance practices, trade cycles and operating conditions.

Meanwhile, the take rate for air disc brakes at Manac Inc., a Canadian trailer manufacturer, is only about 5%, said Tom Ramsden, vice president of sales and marketing.

Some large Canadian fleets specify air disc brakes because they like the safety factor, he said, “but it’s still hard to justify the cost for longhaul operations.”

SAF-Holland’s Jansen said there were many “early adopters” of trailer air disc brakes in Canada because of heavier loads, particularly in the bulk sector.