3Q Turnover Remains High Despite Gains in Driver Pay

This story appears in the Feb. 2 print edition of Transport Topics.

Truckload fleets were unable to gain ground in the long-running battle to control driver turnover during the third quarter, despite raising pay at a record pace, American Trucking Associations reported last week.

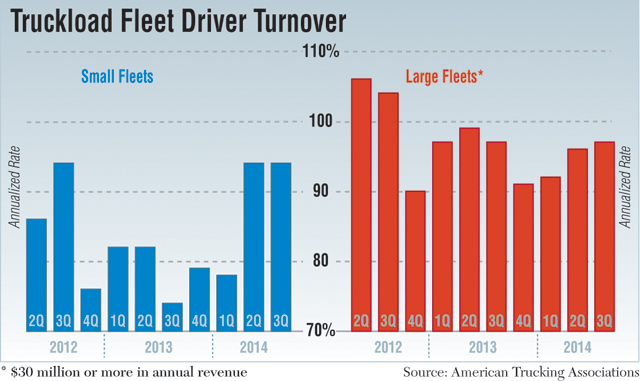

Turnover rose 1 percentage point to 97% from the second quarter at fleets with revenue above $30 million. It remained stuck at 94% at fleets with revenue below that amount, ATA announced Jan. 28.

“Driver turnover, which is a good barometer of the driver market, remains high,” ATA Chief Economist Bob Costello said.

Large-fleet turnover has averaged 95% for eight quarters.

Truckload fleets in the third quarter raised driver compensation at a record pace, according to the National Transportation Institute’s study of more than 300 carriers.

Increases were announced by 42% of fleets, compared with the prior record of 11%. Crete Carrier and U.S. Xpress Enterprises announced double-digit increases.

Costello linked pay and turnover trends as pressure rises to recruit and retain good drivers.

On a year-over-year basis, turnover matched the third quarter at larger fleets that carry about two-thirds of truckload freight. However, smaller fleets, whose year-over-year churn historically is lower, jumped from 74%.

“Significantly increased pay by some large fleets helped with turnover for the large carriers while potentially increasing it for the small carriers as drivers leave for carriers boosting pay,” he said.

Marten Transport referenced “a difficult driver recruiting and retention market” last week. Knight Transportation agreed, saying “attracting and retaining high-quality driving associates to the industry continues to be a challenge.”

Knight ranks No. 31 on the Transport Topics Top 100 list of U.S. and Canadian for-hire carriers, and Marten is No. 45.

“Turnover is a long-term trend, and there hasn’t been a lot of change recently,” said Steve Prelipp, a consultant and former Schneider National recruiting executive. “Fleets are trying to address that, but only some of them have been successful.”

Costello envisions no letup.

“While it is not approaching its historic highs of the early 2000s, continued economic growth and increased freight demand will continue to exacerbate the shortage of drivers many sectors of the industry are witnessing,” Costello said.

“I wouldn’t be surprised

if turnover rises some in the months ahead, as I expect

the driver market to stay very, very tight,” he told Transport Topics.

Turnover at less-than-truckload carriers was 13%, ATA said. That was 2 percentage points above the second quarter of last year and matched the third-quarter 2013 total.

Brian Johnston, director of business development for job posting board JiggyJobs.com, said turnover persists for another reason — a disconnect between drivers and fleets.

“Fleets are seeing drivers jumping around [from carrier to carrier] as they are trying to move freight in a very competitive market at the lowest possible cost,” Johnston told TT on Jan. 28. “A lot of drivers continue to be unhappy about pay, home time or both.”

Jiggy Jobs, which advertises positions at nearly all of the 15 largest truckload carriers, is part of Tennessee-based ACS Advertising, which was acquired last year by technology vendor Pegasus TransTech.

Though turnover isn’t changing much, Johnston said the number of drivers, particularly younger ones, that use mobile devices such as smart phones and tablets to look for jobs more than doubled in the past year, reaching 35%.

Prelipp also noted a generational factor.

“The younger drivers in Generation X and Generation Y are predisposed to not drive trucks, and they’re not as inclined to be loyal,” he said. “They’re just wired that way — to be more individualistic.”

“They tend to want instant gratification rather than working for the same company for 20 years,” which baby boomer drivers often do, he added.

Johnston also said turnover-prevention steps include more fleets allowing pets and increasing efforts to recruit husband-and-wife teams.

Prelipp illustrated chronic turnover troubles another way: by predicting the theme of a recruiting and retention conference this week.

“The theme is again going to be that the fleets don’t have as many trucks as they want. They are turning down good freight every day,” he said. “In those situations, the pressure comes crashing down to the recruiting office from the CEO’s office.”

ATA’s second-quarter large-truckload turnover number was revised down 7 percentage points from a preliminary 103% total that was announced in October.