3Q Fleet Failures Remain Low, Aided by Fuel, Rates, Capacity

This story appears in the Nov. 9 print edition of Transport Topics.

Fleet failures remained at historically low levels in the third quarter as fuel, rate and capacity conditions remained favorable enough to keep marginal fleets afloat, according to a new report.

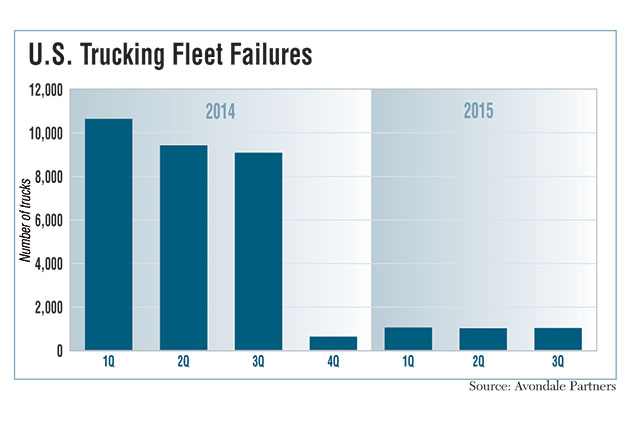

A total of 1,005 trucks were pulled off the road in the July-September period. That’s about 90% fewer than the 9,090 in last year’s third quarter. The second quarter had 995.

“Conditions are good enough that we are not seeing an increase in failures,” Avondale Partners analyst Donald Broughton told Transport Topics last week. “There hasn’t been enough change yet to move the needle.”

He said, “Capacity is not as tight as it was a year ago. But there are still more loads than trucks.”

Failures reached a low of 605 trucks in the fourth quarter of 2014 and have remained around 1,000 throughout 2015, according to Avondale’s report. That trend reflects the simultaneous slide in diesel prices as measured by the Department of Energy and truckload rate increases based on Cass Information Systems’ freight bill processing.

In last year’s fourth quarter, diesel prices still topped $3 per gallon, but rate increases on a year-over-year basis peaked at 7.4%. In this year’s first quarter, rates rose 6.5% as the diesel average dropped to $2.92 per gallon. By the third quarter, diesel averaged $2.63 and rates rose 3.5%, the slowest in nearly two years.

Truck tonnage, American Trucking Associations’ closely watched freight indicator, has followed. Tonnage growth has eased down from the 4.7% increase in last year’s fourth quarter to 3% in this year’s third quarter, though the month-to-month trend in 2015 is a see-saw pattern.

As a result of the fuel price decline this year, fleets are enjoying an environment where it costs 6% to 7% less to run their trucks, Broughton said, giving them an ample cushion to stay out of financial difficulty.

The new report was issued at a time when freight markets appear to be changing in line with stagnant industrial production and the 1.5% third-quarter GDP growth, which trailed the strong 3.9% second-quarter pace.

In addition to the weaker economy, a further slowdown in the pace of freight rate increases could put additional pressure on fleets’ finances.

“I have a strong suspicion 2016 failures will be higher, if only because 2015 has been so low,” Broughton said.

“If the economy continues to be softer due to demographics, rates ebb and the used truck market deteriorates further, it wouldn’t take more than a small factor here or there to push more carriers into liquidation.”

Economic trends, the underpinning for truck demand, are shifting for two reasons, he said. U.S. consumers overall aren’t spending the “dividend” — or the increase in disposable income resulting from lower energy costs that reduce the cost of commuting to work and heating their homes, Broughton said. Also, the employment rate among Americans isn’t rising significantly, limiting income growth at a time when retirements are increasing.

At the same time, he said, younger Americans are spending more on communications devices, apps and other media that don’t generate truck tonnage. They also remain reluctant to buy homes, limiting tonnage growth from furniture, appliances and other purchases linked to home ownership.

The slower pace of rate increases also could continue into next year, Broughton said, a view shared by other analysts such as Thom Albrecht of BB&T Capital Markets.

“Are we on the way to 2% or 3% [increases], or 1 or 2%?” Broughton asked. “If so, we could see some sizable jump in failures in the first quarter.”

Recent weakness in used truck prices also could lead to an increase in failures. He said that decline will make it “ever more difficult” for carriers to renew their fleets by lowering trade-in values. That in turn makes it harder to remain competitive with carriers that can afford more fuel-efficient trucks.

Another looming issue is electronic logging devices, Broughton said.

“ELDs will make it more difficult for fleets that don’t have the equipment to give drivers the miles they were getting before,” he said. A mileage reduction will hurt revenue and raise the risk of failures, he added.

One contributor to the bottom line that should remain stable — and favorable for fleets — is fuel prices, based on Avondale’s forecast, which says that crude will remain in the $40 to $60 a barrel range next year, barring a shock to global markets.