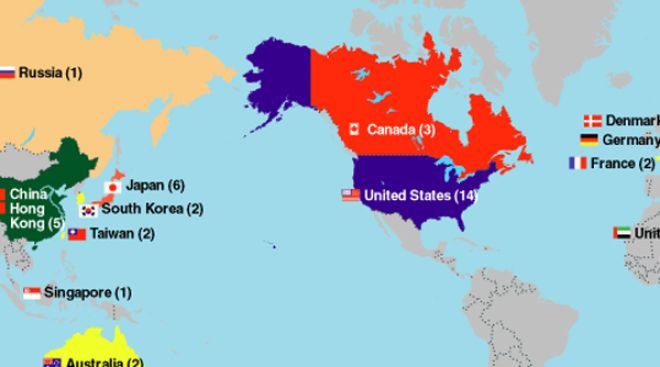

| Rank This Year | Rank Last Year | Company | Headquarters | Freight Revenue (Millions) | Total Revenue (Millions) | Freight Revenue Share |

|---|---|---|---|---|---|---|

| 1 | 1 | FedEx Logistics | United States | $57,198 | $62,335 | 91.8% |

| 2 | 2 | UPS Inc. | United States | $57,100 | $65,872 | 86.7% |

| 3 | 3 | China Railway Corp. | China | $39,395 | $150,274 | 26.2% |

| 4 | 4 | Maersk | Denmark | $29,096 | $30,945 | 94% |

| 5 | 5 | Russian Railways | Russia | $26,285 | $38,594 | 68.1% |

| 6 | 6 | Deutsche Post DHL Group | Germany | $21,915 | $68,271 | 32.1% |

| 7 | 9 | Mediterranean Shipping Co. | Switzerland | $21,428 | $21,428 | 100% |

| 8 | 7 | Union Pacific Corp. | United States | $21,240 | $21,240 | 100% |

| 9 | 10 | CMA CGM Group | France | $21,116 | $21,116 | 100% |

| 10 | 8 | BNSF Railway | United States | $20,406 | $21,387 | 95.4% |

| 11 | 11 | Indian Railways | India | $17,948 | $25,311 | 64.8% |

| 12 | 13 | Mitsui O.S.K. Lines | Japan | $13,958 | $14,830 | 94.1% |

| 13 | 12 | NYK Group | Japan | $13,869 | $19,903 | 69.7% |

| 14 | 18 | COSCO Shipping Holdings Co. | China | $13,378 | $13,378 | 100% |

| 15 | 14 | Deutsche Bahn AG | Germany | $12,578 | $48,234 | 26.1% |

| 16 | 17 | CSX Corp. | United States | $11,408 | $11,408 | 100% |

| 17 | 15 | Hapag-Lloyd AG | Germany | $11,264 | $11,264 | 100% |

| 18 | 16 | Yamato Holdings | Japan | $11,190 | $15,459 | 72% |

| 19 | 19 | Norfolk Southern Corp. | United States | $10,551 | $10,551 | 100% |

| 20 | 22 | SF Express | China | $10,522 | $10,522 | 100% |

| 21 | 20 | Kawasaki Kisen Kaisha Ltd. (K Line) | Japan | $10,166 | $10,166 | 100% |

| 22 | 21 | Canadian National Railway | Canada | $9,766 | $10,054 | 97% |

| 23 | 23 | XPO | United States | $7,516 | $15,381 | 48.9% |

| 24 | 25 | GeoPost Group | France | $7,350 | $7,699 | 95.5% |

| 25 | 24 | SG Holdings | Japan | $7,302 | $9,003 | 81.1% |

| 26 | 27 | J.B. Hunt Transport Services | United States | $6,181 | $7,190 | 86% |

| 27 | 28 | Orient Overseas (International) Ltd. | Hong Kong | $6,108 | $6,108 | 100% |

| 28 | 30 | Canadian Pacific Railway | Canada | $4,915 | $5,053 | 97.3% |

| 29 | 29 | Yellow Corp. | United States | $4,891 | $4,891 | 100% |

| 30 | 32 | Knight-Swift Transportation | United States | $4,634 | $5,186 | 89.4% |

| 31 | 35 | Evergreen Marine Corp. | Taiwan | $4,444 | $4,947 | 88.9% |

| 32 | 31 | Hyundai Merchant Marine Co. | South Korea | $4,438 | $4,438 | 100% |

| 33 | 33 | Yang Ming Marine Transport Corp. | Taiwan | $4,303 | $4,303 | 100% |

| 34 | 34 | Transnet Group | South Africa | $3,775 | $4,918 | 76.8% |

| 35 | 36 | Schneider | United States | $3,647 | $4,384 | 83.2% |

| 36 | 40 | TFI International | Canada | $3,460 | $3,655 | 94.7% |

| 37 | 39 | Emirates Group | United Arab Emirates | $3,386 | $24,831 | 13.6% |

| 38 | 38 | Old Dominion Freight Line | United States | $3,358 | $3,358 | 100% |

| 39 | 37 | Nippon Express | Japan | $3,117 | $17,798 | 17.5% |

| 40 | 43 | Cathay Pacific Airways | Hong Kong | $3,067 | $12,483 | 24.6% |

| 41 | 41 | Toll Group | Australia | $3,023 | $6,282 | 48.1% |

| 42 | 44 | ZIM Integrated Shipping Services | Israel | $2,978 | $2,978 | 100% |

| 43 | 46 | Lufthansa Group | Germany | $2,851 | $40,186 | 7.1% |

| 44 | 38 | Pacific International Lines | Singapore | $2,616 | $3,798 | 68.9% |

| 45 | 45 | Kansas City Southern | United States | $2,583 | $2,583 | 100% |

| 46 | 48 | Estes Express Lines | United States | $2,476 | $2,746 | 90.2% |

| 47 | 50 | Korean Air | South Korea | $2,473 | $10,387 | 23.8% |

| 48 | 42 | Aurizon | Australia | $2,409 | $2,409 | 100% |

| 49 | - | Wallenius Wilhelmsen Group | Norway | $2,404 | $3,024 | 79.5% |

| 50 | - | Kazakhstan Temir Zholy | Kazakhstan | $2,349 | $2,785 | 84.3% |

Top 50 Global Freight Companies

Revenue from acquired companies only included for period after close of acquisition. All revenue figures have been converted to U.S. dollars based on the average exchange rate in the appropriate calendar year.

Sources: Company reports and SJ Consulting Group Inc. estimates

To be included in the Top 50 list, please send contact information to tteditor@ttnews.com. We will contact you via phone or e-mail to get information about your company prior to publication of the next Top 50 list.

Amazon Prime Memberships in US Gain 8% to New High

Amazon.com Inc.’s Prime subscription service hit a new high of 180 million U.S. shoppers in March, up 8% from a year earlier, according to Consumer Intelligence Research Partners.

Amazon Becomes the Largest US Private EV Charging Operator

Amazon has installed more than 17,000 chargers at about 120 warehouses around the U.S., making the retail giant the largest operator of private EV charging infrastructure in the country.

Shipping Giant MSC Vows to Fight ‘Excessive’ $63M FMC Fine

The world’s largest container carrier will push back against a proposed U.S. government fine that would rank among the stiffest penalties handed down by the Washington regulator.

Amazon Eyes Record High

Wall Street investors are finally doing what analysts have been recommending all along: buying Amazon.com Inc.

Baltimore Bridge Collapses After Cargo Ship Rams Into It

BALTIMORE — A containership lost power and rammed into a major bridge in Baltimore early March 26, causing the span to buckle into the river below. Six people were missing.

Amazon Reports ‘Measurable Progress’ on Worker Safety

Amazon’s safety data shows a decline in its warehouse injury rate in 2023, marking an improvement for the second consecutive year, but critics disagree with how the company measures safety.

Hapag-Lloyd Warns of Further Earnings Decline in 2024

Following a slump in profits in 2023, German container shipping company Hapag-Lloyd expects earnings to decline again in 2024.

Houthi Missile Damages MSC Containership in Gulf of Aden

Houthi militants attacked and damaged a Swiss-owned container vessel on March 4 in the Gulf of Aden, as the Iran-backed group continues to roil shipping in the region.

March 5, 2024Norfolk Southern Urges Shareholders to Reject Takeover Plan

OMAHA, Neb. — Norfolk Southern wants its shareholders to back its current management team and strategy and reject a bid from a group of investors seeking to take control of the railroad.

Port of Baltimore Hit Cargo Record Last Year

The Port of Baltimore hit records for handling cargo last year, state officials said, showing a rebound from global supply chain difficulties and disruptions during the pandemic.