US Gasoline Traders Would Rather Export Than Ship to New York

The busiest U.S. fuel pipeline is running below capacity, as Gulf Coast refiners get fatter margins exporting to Latin America than shipping to New York.

Colonial Pipeline Co.’s Line 1, which carries as much as 1.37 million barrels of gasoline a day from the Houston area to North Carolina, has been full less than half the time this year, and not since March, according to shipper notices. The line, which feeds into another pipe running to New York Harbor, has been overfilled in April and May the past three years, Colonial data show.

Demand from Latin American countries whose refineries aren’t able to meet domestic fuel demand, such as Mexico, has pulled supply from the Gulf Coast that would otherwise end up in Colonial. At the same time, readily available cargoes from eastern Canada and Europe have kept New York prices in check, even with stockpiles below normal.

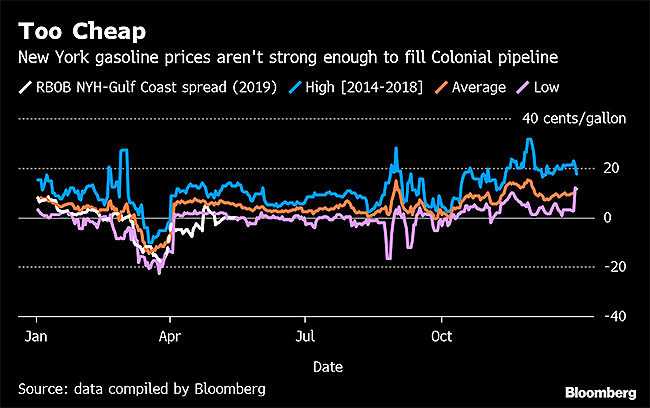

The arbitrage — or profitability of buying fuel in the Gulf Coast and selling it in New York — has been closed for most grades for long enough that less fuel is being shipped on the line, according to traders. Reformulated gasoline, or RBOB, in New York on May 16 was the weakest seasonally relative to the Gulf Coast in six years, data compiled by Bloomberg show.

East Coast gasoline markets have been adequately served by refineries from Philadelphia north that were running near full capacity before the last few weeks, said Andy Lipow, president of Lipow Oil Associates in Houston. More Gulf Coast and Midwest barrels are finding a path onto ships, he said.

“The arbitrage is closed because New York Harbor has a more-than-adequate supply of gasoline,” Lipow said. “There is really no need to pull any of it off the Gulf.”

Twelve of 25 five-day cycles so far this year were allocated, which occurs when shippers want to move more fuel on the line than it can hold. When space is rationed, shippers can only move a percentage of what they want to. From 2013 to 2018, space on Colonial was rationed across several months, with traders paying hefty premiums to buy space from other shippers.

“The volumes shipped on Colonial Pipeline are a result of customer demand and can fluctuate for many reasons,” spokeswoman Kelsey Tweed said via e-mail. “Because we don’t own the product, we do not provide comment on market changes or the future of the market.”

Shippers are paying their counterparts as much as 1.5 cents a gallon to take over their line space, according to a broker. That allows sellers to maintain their shipper histories with Colonial, which factors into how much they can transport when the line is overfilled and space is rationed.

#GasPrices are always changing, so here’s the latest data for the Summer Fuels Outlook! Be sure to follow us for updates in the Short Term Energy Outlook! https://t.co/Nna42BhRqg #SummerFuels #SummerRoadTrip pic.twitter.com/EBScjUKJsx — EIA (@EIAgov) May 10, 2019

U.S. government data suggests East Coast gasoline prices should be higher. Stocks of RBOB were at an eight-month low last week, Energy Information Administration data showed. They would be lower, except that the region has been importing at least 12 cargoes a week. Ship-tracking and fixture data show interest remains high in cross-Atlantic shipments.

The situation isn’t likely to last too long as refiners ramp up production and domestic demand peaks as summer driving season approaches.