Truck Tonnage Down in December, Up for 2017

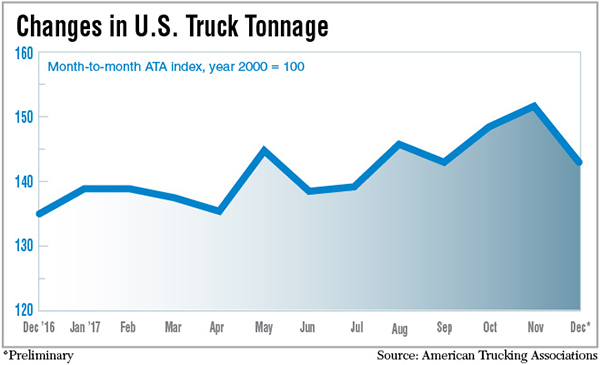

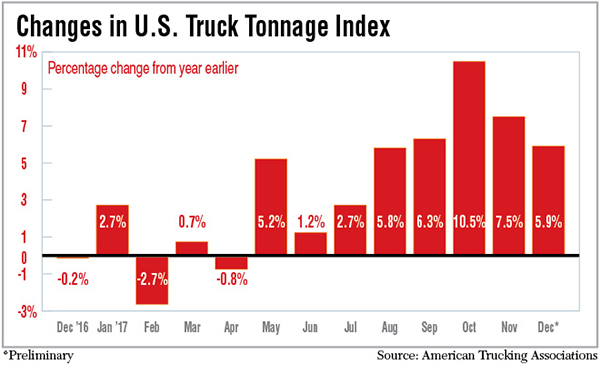

Truck tonnage rose 3.7% in 2017, the largest annual increase since a 6.1% gain in 2013, according to American Trucking Associations’ Truck Tonnage Index. The annual increase came despite a 5.7% year-end drop in tonnage from November to December.

“Despite the decline in December, last year was a solid year for truck tonnage, especially during the second half of 2017,” ATA Chief Economist Bob Costello said. “I remain optimistic for 2018 for a host of reasons, including a pick-up in factory activity, better housing construction, solid retail sales and an expected shot in the arm from the new tax law.”

The seasonally adjusted index in December equaled 142.9, down from 151.6 in November, but up 5.9% from December 2016. The index uses a base level of 100 for freight activity in the year 2000. The not seasonally adjusted index, which represents the change in tonnage actually hauled by fleets, equaled 141.9 in December, 3.4% below that of November.

The Weekly Market Demand Index from Truckstop.com jumped as high as 50 in December before finishing the year at 49. The MDI measures the ratio between trucks and freight on the spot market, serving as a proxy for capacity utilization. A number less than 15 denotes a market that favors shippers while a value greater than 20 favors truckers.

“Unequivocally the [capacity] market is very tight. Part of the reason is the electronic logging device (ELD) mandate that took effect in December,” said Noel Perry, Truckstop.com senior economist. “Shippers are spending a lot of extra time looking for [trucks],” notes Perry.

Truckstop.com is a load board and financial services provider based in New Plymouth, Idaho.

The FTR Trucking Conditions Index was 9.2 in December, a significant jump from 2.9 in December 2016. The index takes into account fuel prices, rates, demand and truck utilization.

Anything above zero is a positive environment and, once the index is in double digits, “the market is undergoing a significant change in operations,” FTR Chief Operating Officer Jonathan Starks said. “We are basically in range of that.”

Starks

He added, “For 2018, rates for moving freight will stay high, demand for loads will stay strong, and utilization is at record levels and expected to stay there for at least half the year.”

The Cass Freight Index rose 7.2% in shipments and jumped 16% in expenditures in December 2017 versus December 2016. The closing value for December 2017 shipments was the best for that month going back to 2013. Cass uses information from freight bill payments through a St. Louis bank to calculate both indexes.

“The overall freight recession, which began in March 2015, appears to be over and, more importantly, freight seems to be gaining momentum in most segments,” said Donald Broughton, founder of Broughton Capital and author of an analysis that accompanied the Cass report.

Broughton

“In more recent months, as oil climbed above $55 and then above $60, industrial activity has returned to boom levels. Simply put, industrial activity is alive and well — and accelerating strongly. The recent changes to the tax law and the ability to accelerate depreciation should only serve to further strengthen the capital‐intensive industrial economy,” he said.

Also, the maturing of the millennial generation is driving growth, Broughton noted. “Millennials have started to form households, and thus have started the goods accumulation phase of their lives, as well. Consumer spending is poised to be strong for the foreseeable future. … Bottom line, both the industrial and consumer economies are shifting into high gear. 2018 should be very interesting,” he said.

Other December economic statistics pertinent to the freight industry were generally positive.

The Institute for Supply Management reported its manufacturing index at 59.7% in December, up 1.5 percentage points from November, as 16 out of 18 manufacturing industries reported growth. A total greater than 50% shows expansion. It was the 103rd consecutive month of growth for the overall economy, according to the institute.

The Federal Reserve Industrial Production Index moved slightly higher in December to 107.5. The index rose 3.6% from December 2016 to December 2017, its largest calendar-year gain since 2010.

One slow area was housing starts, a gauge of the construction industry. The December number from the Census Bureau showed about 1.19 million starts on an annualized basis, down 8.2% from a revised November estimate, and 6% lower than the 1,268,000 reported for December 2016. In 2017, there were an estimated 1,202,100 housing starts, up 2.4% from 2016.

Retail sales reached $495.4 billion in December, a 0.4% rise from November and a 5.4% jump from December 2016. Total sales for the fourth quarter rose 5.5% from the same period a year ago.