Tesla Probably Can’t Make Money in China, Morgan Stanley Says

Investors should keep their expectations about Tesla Inc.’s ability to operate profitably in China “very low,” Morgan Stanley analyst Adam Jonas wrote in a note, adding that he’s cautious about the country’s role in the carmaker’s long-term strategy and fundamental value.

Jonas cited Chinese authorities suspending customs clearance for imported Model 3s — even though Tesla seems to have resolved that particular problem. The customs issue highlighted “the risks inherent in U.S. auto/tech firms conducting business in the PRC in high value imported products or technological areas that may become sensitive along the grounds of data privacy, cybersecurity, robotics, and AI.”

Jonas listed a host of concerns, including Tesla’s reliance on China having “constructive trade relations and economic policies with the U.S.” There are also American regulations that should be considered, such as the Treasury Department’s Committee on Foreign Investment in the United States, along with the “unquantifiable risks of technology transfer.”

Electronic and automated vehicle technology may be regarded “as having dual purpose,” he warned, which could limit the role of U.S. companies within China’s transportation industry, and vice versa. He added that Morgan Stanley’s China team is aware of dozens of domestic Chinese electric vehicle startups.

Further ahead, Jonas sees the auto industry “morphing into a public transport utility operated as a public good.” That might naturally limit the role of foreign entities, as national and economic concerns come into play.

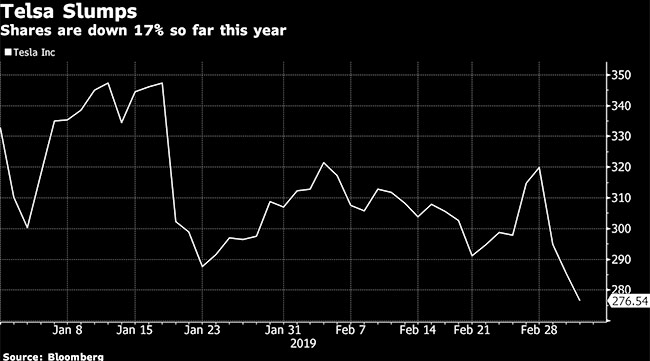

Morgan Stanley repeated its equal weight rating on Tesla shares, which are down 17% so far this year after closing March 5 at the lowest since Oct. 22.