Bloomberg News

Shipping Costs Are Soaring as LNG Vessels Drop Out of Service

[Stay on top of transportation news: Get TTNews in your inbox.]

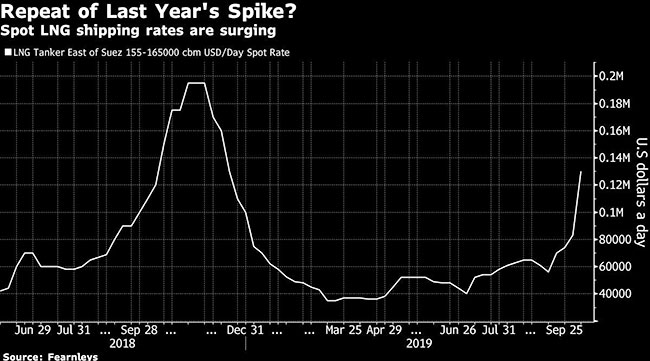

The cost of chartering a liquefied natural gas vessel on the short-term market has jumped the most since at least 2013.

The day rate for a standard tanker east of the Suez Canal jumped 57% in the week to Oct. 9, as issues related to U.S. sanctions on units of China’s COSCO Shipping Corp. start to hit just as the heating season begins to boost demand. That comes on top of other factors limiting the number of ships available, including Typhoon Hagibis in Japan, the biggest buyer of the fuel, and the stockpiling of fuel on tankers.

The skyrocketing rates, which have more than doubled in less than a month, show how U.S. sanctions on units of China’s largest shipper are affecting global trade flows, having already fueled steep increases in oil tanker rates. China plans to ask the U.S. to lift sanctions on the shipper at high-level trade negotiations in Washington.

“It is a super tight market at the moment,” a spokesman at LNG tanker owner GasLog Ltd. said by phone. “We don’t know whether the COSCO sanctions will have a meaningful impact on the LNG shipping market, but it is influencing sentiment.”

Benchmark LNG spot shipping rates east of the Suez Canal jumped to $130,000 a day on Oct. 9, according to Fearnleys in London. Spark Commodities Pte Ltd., a venture between commodity tracking company Kpler SAS and the European Energy Exchange, puts the rate at $133,200.

China National Offshore Oil Corp. is seeking two cargoes for prompt delivery to its Dapeng terminal because of the sanctions, according to traders with knowledge of the matter. The company didn’t immediately respond to a request for comment.

Woodside Petroleum Ltd.’s North West Shelf LNG venture in Australia wouldn’t load two tankers that were meant to deliver cargoes for CNOOC because the vessels are owned by a unit of COSCO, according to the traders. The Dapeng Moon, Dapeng Sun and Dapeng Star are anchored near the terminal or off the coasts of China, according to ship-tracking data compiled by Bloomberg.

A Woodside spokesman declined to comment on specific loadings, and said the company is aware of the sanctions and will comply with all legal obligations. COSCO Shipping didn’t respond to an email seeking comment and didn’t answer calls from Bloomberg.

Five specialized ice-class vessels for Russia’s Yamal LNG project in the Arctic, chartered from a joint venture between COSCO unit China LNG Shipping (Holdings) Ltd. and Teekay Corp., are still on routes serving the project normally, according to ship-tracking data. Novatek PJSC, the majority shareholder of Yamal LNG, has said it has tanker capability via transshipments to fully meet its obligations should the sanctions drag on, and that it hopes the issue around sanctions will get resolved quickly.

Want more news? Listen to today's daily briefing: