OPEC Gambles on Move to Force Russia Into Oil Production Cut

[Stay on top of transportation news: Get TTNews in your inbox.]

OPEC ministers took a high-stakes gamble, recommending a large production cut to offset the hit on demand from the coronavirus, without overcoming Russian opposition first.

The cartel members tried to paint Moscow into a corner, warning that if Russia doesn’t join them in reducing production by 1.5 million barrels a day, OPEC wouldn’t act at all — an outcome that would almost guarantee an oil price crash. If Russian oil minister Alexander Novak doesn’t accept the proposal March 6 “there will be no deal,” his Iranian counterpart Bijan Namdar Zanganeh told reporters after the meeting on the morning of March 5.

The cartel raised the stakes further that evening, agreeing at informal talks at the Saudi delegation’s hotel in Vienna that the cut should last until the end of 2020, six months longer than the proposal earlier in the day.

The ultimatum is unprecedented since Saudi Arabia, Russia and nearly two dozen other nations created the OPEC+ alliance in 2016 to collectively manage oil supply. The risk for the Saudis is that if the gamble backfires, Riyadh has more to lose — it needs higher oil prices to fund its budget than Russia does.

“OPEC is making the cuts conditional on Russia joining,” said Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd. “Saudi Arabia may be ready to walk away if it doesn’t get a positive answer.”

Secretary-General Mohammad Barkindo was clear that he would make every effort to prevent such a thing, telling reporters he was “fully determined to maintain the unity of the group” and continue talks with its dependable partner Russia.

Only in July, Russia and Saudi Arabia touted their alliance as a marriage to “eternity.” Fast forward less than a year, and the view among traders is that the couple may be on the verge of divorce. Still, it’s not the first fight between Moscow and Riyadh, and both sides have been able to find a satisfactory solution in the past.

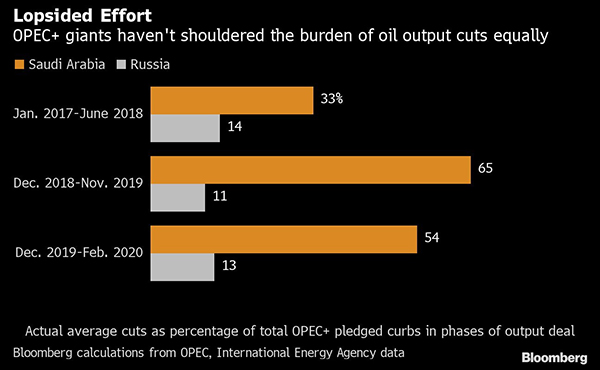

The Kremlin has gained a lot from its cooperation with OPEC. The country has been the biggest financial beneficiary of the cuts, largely because it’s borne a lesser share than Saudi Arabia. The alliance has also significantly enhanced President Vladimir Putin’s presence on the world stage and his political clout in the Middle East.

Diplomatic Poker

With oil prices down 20% since the start of the year as the economic impact of the coronavirus saps oil demand, the stakes for the March 6 meeting between OPEC and Russia are high. Not just for the OPEC+ alliance, but for the entire energy industry, from ExxonMobil Corp. to smaller shale drillers in Texas, and oil-rich nations in Africa and Latin America.

The stakes in this game of diplomatic poker are huge — 1.5 million barrels a day of fresh oil cuts, plus 2.1 million of existing curbs that OPEC+ agreed on last year, which expire at the end of this month. That’s equivalent to the consumption of Germany and France combined.

So far, Russia has indicated it’s only prepared to roll over the current cuts for another three months, and doesn’t want to go deeper. Moscow appears to be betting that the oil market would rebalance by itself over the next few months as low prices take their toll. In particular, Russia believes that the U.S. shale industry is about to go in reverse. Exxon on March 5 announced it was slowing the pace of its flagship shale project in the Permian Basin.

“OPEC’s move today shifted the blame on Moscow for any epic policy failure while offering glory if minister Novak swoops into Vienna tomorrow to seal the deal,” said Bob McNally, founder of consultant Rapidan Energy Advisers.

The oil market took the OPEC proposal with extreme caution. Brent crude, the global benchmark, was down 1.9% at $50.15 a barrel at 7:02 p.m. in London on March 5.

With flights canceled in Europe, schools closed in Japan, towns quarantined in Italy and a rising death toll in Iran, the coronavirus crisis has gone global, and with it, its impact on energy demand. Goldman Sachs Group Inc. earlier this week became the first major Wall Street Bank to forecast a contraction in consumption this year, suggesting that an even larger cut may not arrest the drop in oil prices.

“Cutting production 1.5 million barrels a day in April or May is not really going to save you in the current environment,” said Jeffrey Currie, global head of commodities research at Goldman. “The demand damage is happening today, right now.”

OPEC itself cut its forecast for demand growth in 2020 to 480,000 barrels a day, down from a pre-crisis forecast of 1.2 million barrels a day. “We now convene at a time when the outbreak of COVID-19 has had a pronounced adverse impact on economic and oil demand forecasts,” said Algeria Energy Minister Mohamed Arkab.

Saudi Arabia’s push for a big cut reflects its mounting concern about demand and prices. Oil is now trading far too low to balance the budgets of most OPEC members. Riyadh needs more than $80 a barrel, according to the International Monetary Fund. Russia only requires a price of about $40 a barrel to balance its budget.

Saudi Arabia has always shouldered a larger share of the cuts than Russia, but the split has become more inequitable with each iteration of the deal. Last year, the kingdom implemented 65% of the group’s total supply reduction on average, compared with just 11% for Russia, according to data compiled by Bloomberg.

Want more news? Listen to today's daily briefing: