Bloomberg News

Oil Climbs on Biggest Jump in US Gasoline Demand in 11 Months

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

Oil rallied on optimism that consumption could gradually return as major producers continue to cut output to counter a global glut.

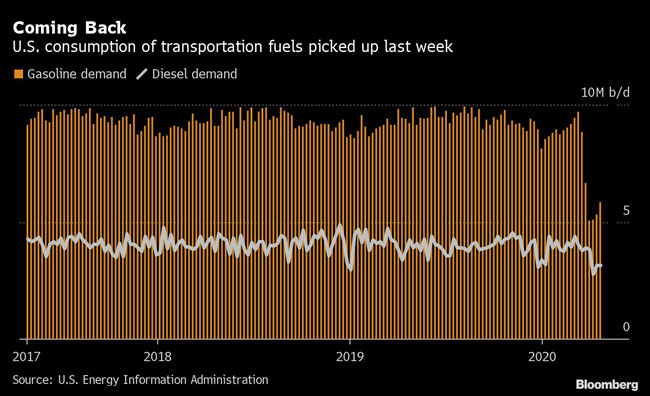

West Texas Intermediate futures surged 22% April 29. U.S. gasoline stocks fell by 3.67 million barrels compared to an estimated build of 2.49 million, according to the U.S. Energy Information Administration. Weekly gasoline supplied, an indicator of demand, rose by 549,000 barrels a day, the most since May.

“That was a nice surprise to the market,” Nick Holmes, portfolio manager at Tortoise, said regarding better-than-expected results for crude inventory and gasoline supply in the EIA report.

The discount on crude for June delivery relative to July, a structure known as contango, tightened to as little as $3.28 a barrel after blowing out to as wide as $7.69 April 28.

Coming Back

The narrowing gap in the front-month spread suggests that the concern about storage may be easing, according to Michael Lynch, president of Strategic Energy & Economic Research Inc. “People are starting to think storage isn’t going to get quite so overstuffed after the EIA report,” Lynch said.

The agency reported a smaller-than-expected 8.99 million-barrel increase in national crude stockpiles and a 3.64 million-barrel build at Cushing, Okla., the delivery point for futures.

Producers in the shale-rich Permian Basin, and elsewhere in the U.S., will cut about 2 million barrels a day of output in May compared to March, said Mercuria CEO Marco Dunand in an interview.

Russian oil companies will cut output by about 19% from February levels, the nation’s Energy Minister, Alexander Novak told the Interfax news agency. Nigeria, which has been struggling to sell its oil even at $10 a barrel, will ship the lowest volume of its key Qua Iboe crude grade since 2016 in May and June.

Want more news? Listen to today's daily briefing: