Senior Reporter

November Trailer Orders Climb 10%, Driven by Big-Fleet Demand

This story appears in the Jan. 4 print edition of Transport Topics.

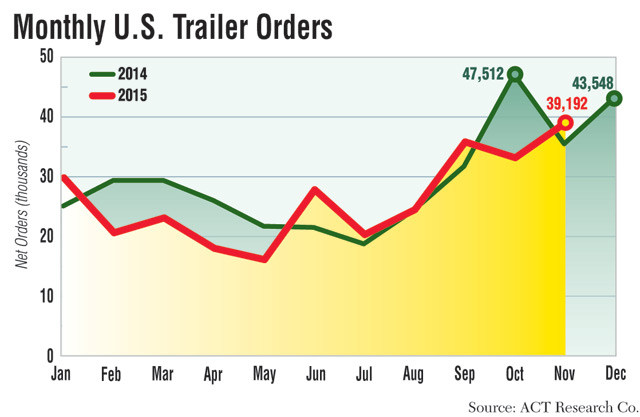

Net orders in November for new truck trailers were the third-highest of all time as large fleets sought replacement units and continued a solid order season, ACT Research Co. reported.

The monthly total of 39,192 was also the highest this year, ACT said, and up 10% year-over-year.

The top two months came in 2014, with October’s 47,512 orders, and December‘s 43,548.

“It can be difficult to fully appreciate the strength of trailer orders in the past two years, with six of the industry’s top 10 strongest order months having occurred since October 2014,” Frank Maly, an ACT analyst, said in a statement.

Trailer manufacturers said the need for trailers spotted with shippers because of the driver shortage, plus emerging regulations, factored into the strong demand.

“We are set up for a real good start to 2016. The first half looks pretty darn solid. We will see how orders slow and backlog builds to support the rest of the year. . . . Large fleets continue to drive the market,” Maly told Transport Topics.

He said small fleets are not buying trucks. “And they are not adding trailers either. So the two points go hand in hand.”

David Gilliland, vice president of national accounts at Great Dane Trailers, said, “We are seeing replacement [orders] not new [for growth]. Volumes are extremely high. That is due to several reasons: Interest rates are low, trucking is profitable and used trailer values are extremely high. So those are a good recipe for the fleets to upgrade their trailers.”

Part of the reason used-trailer sales are so strong is because the lead times for new trailers are stretched. “People need trailers now, and [go to] the secondary market,” Gilliland said.

ACT said the lion’s share of growth came from dry vans, up 33%, year-over-year, and it is a segment now with an eight-month backlog.

Maly also said refrigerated trailer orders in November reached almost 6,000 units “which is phenomenal on its own.” The reefer trailer backlog is stretched out to 9.5 months.

“The trailer market continues to show remarkable resilience entering 2016,” Don Ake, an analyst with the research firm FTR Associates, said in a release. “This is the third-highest order month ever, and some segments aren’t even doing very well. It is particularly impressive considering Class 8 [tractor] demand is faltering and freight growth is slowing somewhat due to the manufacturing slump.”

Both ACT and FTR reported Class 8 orders plunged in November. FTR put the total at 16,475 orders, while ACT said it was 16,600. In either case it was about a 60% year-over-year decline.

“The trailer side of the equation [compared with Class 8 orders] has experienced a smoother, more gradual growth trend over that last six years than our power counterparts,” said Larry Roland, director of marketing, Utility Trailer Manufacturing Co. “This has kept the backlogs from becoming overinflated and panic buying at a minimum.”

Glenn Harney, chief sales officer for Hyundai Translead, said he believes the industry is still replacing trailers that were taken out of the pool in 2008-2011.

“We are probably close to filling that shortage but growth has yet to be addressed,” Harney said.

At the same time, there are other factors emerging that drive orders, he said.

“Hours of service [for drivers] and more stringent inspection regulations both play a role. Rather than leave freight on the dock, some of it is getting loaded into trailers and then it sits until a truck can be found,” Harney said. “Also, the California Air Resources Board and pending Environmental Protection Agency regulations require aerodynamic devices be put on dry freight and reefer trailers. It might make more sense to put them on new trailers rather than retrofit.”

FTR’s Ake also said, “Fleets are being encouraged to place their entire 2016 requirement orders now, due to continuing capacity constraints [at the trailer makers].”

David Giesen, vice president of sales for Stoughton Trailers, said the trailer market will eventually settle down to more historical volumes for new purchases. “I cannot tell you when that will happen but speculate it will be in the near term.”

Charles Willmott, chief sales officer at the Strick Group, said the average peak-to-peak cycle for trailer building over the last 50 years has been six years.

“Since the last peak in 2006, we are almost at the 10-year mark,” Willmott said. “Am I surprised? Very pleasantly, but at this point I do not see a major change in trailer demand through 2016.”