E-Commerce Boom Offers Lifeline for Oil

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

Look across the street from your home-office window: chances are you will see a delivery van.

Trucks from Amazon.com Inc. and other e-commerce companies have become ubiquitous during the pandemic. In much of the industrialized world, an ever-growing number of vans, trucks, trains and ships are hauling everything from desks to smart phones as consumers turn to online shopping and companies re-stock their supply chains after months of disruption.

For the oil market, it is a potential fillip: in a world ravaged by the coronavirus, freight is again growing, in some areas rapidly. And that means diesel.

“Truck traffic is up substantially,” said Gary Ross, a veteran oil market watcher and CEO of Black Gold Investors. “People have money and they’re not spending it on going out to the theater, they’re buying goods.”

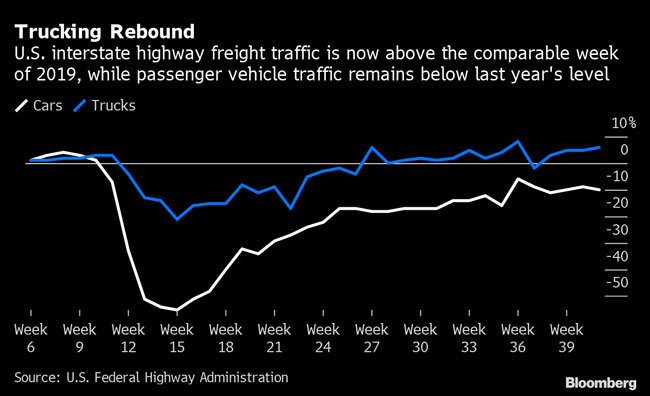

Official statistics reflect what many can see from their window. In the U.S., for example, large trucks have driven 5% more miles over the last four weeks than they did a year before, according to data from the U.S. Federal Highway Administration.

Freight companies also confirm the revival. James Foote, CEO of CSX Corp., one of the largest railway companies in the U.S., says volumes ended the third quarter above pre-COVID levels. U.S. trucking companies, facing a shortage of drivers and high demand, are rejecting a higher percentage of requests for their business than in 2019.

The trend matters for the oil market because trucking accounts for about 16% of global oil consumption and almost half of all diesel demand, according to 2019 data from the International Energy Agency.

Christmas Toys

The surge is expected to intensify in the shopping frenzy before Christmas. Delivery company DHL, owned by Germany’s Deutsche Post AG, expects its peak shipment quantities to be 50% higher than the same time last year.

There’s also a boost in freight from companies restoring inventories in supply chains that were disrupted by the pandemic — from car parts to children’s toys.

“As we talk to our customers, most specifically our overseas customers, they’re still seeing an opportunity for restocking,” said Keith Reardon, senior vice president of product and supply chain growth at Canadian National Railway Co.

RELATED: Amazon, FedEx, UPS Boost US Warehouse Jobs Amid Online Boom

The diesel market has struggled since the coronavirus pandemic began as the collapse in air travel forced refiners to push unwanted jet fuel into the production of diesel. That, in turn, swelled diesel inventories, sending prices down. As a result, profits from producing the fuel remain close to $3 a barrel, the lowest for this time of year in at least a decade.

While the freight rebound is helping oil prices, crude is still languishing at about $40 a barrel. Demand in the broader market is being crimped by the resurgence of the virus, and the outlook is fragile.

Over the past few episodes, we've had the chance to listen to the experiences of industry leaders and the strategies and planning that go into finding the right people for your workforce. Host Michael Freeze reviews the most important bullet points, from technician and driver training to incorporating diversity in recruitment and retention. Hear a snippet, above, and get the full program by going to RoadSigns.TTNews.com.

There’s also a risk the re-stocking surge could result in a vacuum of activity down the line, Drewry Shipping Consultants Ltd. wrote in a report. That would mean at least some of the additional demand tapers off by the start of next year.

But for now, thousands of miles of sprawling highways are full of trucks delivering goods. In the U.K., weekly figures show the use of heavy goods outpaces the recovery in any other vehicle type. It’s a similar picture on German roads, where large-truck miles have been at pre-pandemic levels since May.

Lithuania-based Girteka Logistics, one of Europe’s biggest truck owners, has added 500 trucks to the 7,000 it already had, as it rides the wave of housebound consumerism, according to Kristian Kaas Mortensen, director of strategic partnerships.

“People have to feel good, they have a need to spend.”

Alex Longley, Jeffrey Bair and Javier Blas were the primary contributors to this report.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More