Senior Reporter

Diesel Drops 16.4¢ in Latest Double-Digit Decline

[Stay on top of transportation news: Get TTNews in your inbox.]

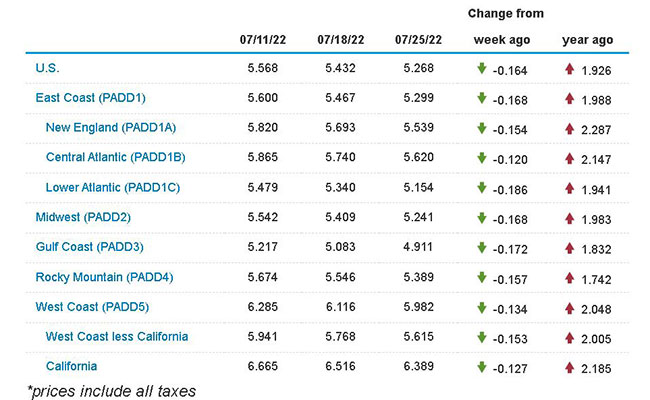

Diesel’s national average price continued its downward path, shedding 16.4 cents to $5.268, according to Energy Information Administration data released July 25.

Trucking’s main fuel has fallen in price the past five weeks, including double-digit drops in the past four.

Since reaching a record high of $5.810 on June 20, the average price for a gallon of diesel has decreased by 54.2 cents.

Diesel still costs $1.926 more per gallon than it did at this time in 2021.

All 10 regions surveyed by EIA showed significant declines, ranging from a high of 17.2 cents in the Gulf Coast region to a low of 12 cents in the Central Atlantic.

Gasoline dropped by a similar amount, an even 16 cents, to reach $4.33 a gallon.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

According to the Energy Information Administration, one factor likely contributing to the downward trend of both diesel and gasoline prices is the slight uptick in domestic refining activity. In its latest U.S. Utilization of Refinery Capacity report, dated July 22, EIA said refineries were running at 92.2%. That figure is down slightly from the previous week’s 93.7% but up slightly from a year-ago rate of 91.4%. One month ago the refineries were running at 95% and much of that refined gasoline and diesel has made its way to storage facilities and gas/diesel stations across the country. By comparison, in early September 2021 refineries were running at 81.9%.

In Chicago, oil industry analyst Phil Flynn told Transport Topics refineries running above 90% are putting more product into the market at the same time that consumers are curtailing travel due to high fuel prices, which hit record levels earlier this summer.

“Refineries were recently running at a 30-year high relative to capacity and producing a lot of product,” Flynn said. “It’s probably not going to stay there for too long. We saw refineries really kick it into high gear and there’s concern about demand destruction and people pulling back. There are signs people are doing that, but the question is how much of this demand destruction is going to be permanent. We just don’t know.”

Longer-term, however, Flynn is concerned about refining capacity, citing reports that at least five refineries shut down in 2021. Plus, a major Houston refinery is up for sale and its owners are promising to close it in late 2023 unless a buyer is found. Flynn also noted while hurricane season has so far been quiet, one major tropical disturbance that interrupts drilling and refining capacity could cause a spike in prices.

“I keep looking at the Atlantic because this year it could be more critical than other years,” Flynn said. “We know it could all change, but it’s been pretty quiet.”

Flynn

Meanwhile, Sen. Marco Rubio (R-Fla.) wants the U.S. to sanction China’s purchases of oil and other energy supplies from Russia in an effort to cut off funding for that country’s war against Ukraine. Rubio introduced a bill July 25 along with Rick Scott (R-Fla.) and Kevin Cramer (R-N.D.) that would impose penalties on any entity insuring or registering tankers shipping oil or liquefied natural gas to China from Russia, according to Bloomberg.

China’s imports of Russian crude have surged this year as the world’s biggest energy consumer picked up discounted barrels that European buyers had shunned. Cutting off the flow of Russian crude to China could leave Beijing competing more fiercely with other large buyers, like India, for oil from the Middle East and Africa, potentially raising prices.

By buying Russian energy, China is supporting that country’s war in Ukraine, according to Rubio. “Any entity, including Chinese state-run companies, helping them in that effort should face serious consequences,” he said.

The proposal would face long odds of getting a vote in the Democratic-controlled Senate, and runs counter to Biden administration policy, which aims to keep oil supplies flowing while at the same time limiting Russia’s energy revenue.

Russia’s invasion of Ukraine roiled oil markets, pushing crude up by about 30% so far this year, on concern that Russian oil would be cut out of global trade and drive up an already tight market. European countries are already considering rationing consumption of natural gas, much of which it buys from Russia, to help conserve supplies for winter.

Want more news? Listen to today's daily briefing below or go here for more info: