Senior Reporter

Diesel Climbs to Highest Price in More Than Two Years

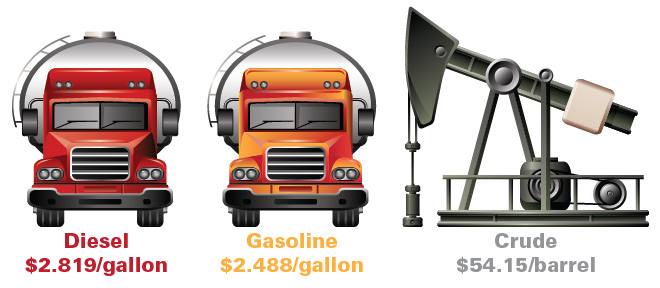

The U.S. average retail price of diesel increased 2.2 cents to $2.819 a gallon — the highest price in more than two years — as oil prices rallied on speculation production cuts will continue into 2018 after a meeting of the Organization of Petroleum Exporting Countries in November.

It was diesel’s highest price since July 6, 2015, when it was $2.832

Diesel now costs 34 cents more than it did a year ago, when the price was $2.479 gallon, the Department of Energy said Oct. 30.

Prices for trucking’s main fuel rose in all regions.

US avg #diesel price on 10/30 UP 2.2¢ to $2.819/gal over last week. Data: https://t.co/UGp7PfG9hB #Radio spots: https://t.co/fn9C1vDNVl pic.twitter.com/T7hgw1mzj7 — EIA (@EIAgov) October 31, 2017

In California, where retail diesel prices typically are highest in the nation, the tax on a gallon of diesel rose 20 cents Nov. 1.

Also, inventories of distillate fuel — primarily ultra-low-sulfur diesel used in transportation and to a lesser degree as heating oil — decreased by 300,00 barrels for the week ending Oct. 27 and are in the lower half of the average range for this time of year, according to DOE’s Energy Information Administration.

The U.S. average price for regular gasoline rose 0.9 cent to $2.488 a gallon. It costs 25.8 cents more than it did a year ago, EIA said. Gas prices fell in four regions and rose in five.

Meanwhile, West Texas Intermediate crude futures on the New York Mercantile Exchange closed at $54.15 per barrel Oct. 30 compared with $51.90 on Oct. 23.

The price of oil accounts for 42% of the cost of a gallon of diesel, and 45% of the cost of gasoline, according to EIA.

Also, restraints on overseas oil production are likely to continue, experts said.

Saudi Crown Prince Mohammed bin Salman said in published reports “of course” he wanted to prolong the OPEC output-reduction deal into 2018. That was after Russian President Vladimir Putin said an extension should run through at least the end of next year. With the leaders of the world’s two biggest oil-exporting countries on board, an agreement is seen as all but certain at a meeting in Vienna this month.

U.S. crude inventories are near the lowest levels since January 2016. Saudi Arabia’s minister of energy and industry, Khalid Al-Falih, said oil demand is more resilient than people think.

With higher prices, fleets are again probing alternatives. One is turning to battery-powered trailer refrigeration units, supported by solar panels, to eliminate the amount it spends running diesel-powered TRUs.

“As a leader in implementing environmentally friendly transport practices, Challenge Dairy was pleased to learn that a completely zero-emissions, lower-energy option was on the horizon,” said Tom Ditto, vice president of food service for Challenge Dairy Products Inc.

Dublin, Calif.-based Challenge is a wholly owned subsidiary of California Dairies Inc., the second-largest dairy cooperative in the United States. Challenge is responsible for the marketing and distribution of dairy products produced from 400 large family-owned dairies.

Challenge has been testing a battery-powered TRU made by eNow that draws energy from eNow’s solar photovoltaic panels mounted on the truck’s roof when the truck is making deliveries.

“A diesel TRU on the type of truck currently being tested typically uses between four and seven gallons of diesel a day, depending on a number of factors,” Ditto said.

The cost to fuel Challenge Dairy’s California delivery fleets refer units with diesel is about $100,000 a year, he said.

“These savings in combination with the estimated 90% reduction in maintenance costs and a 98% reduction in harmful emissions are more than enough evidence to make the switch,” he said.

Challenge Dairy plans to transition its entire fleet of distribution trucks to solar-powered TRUs, according to eNow.

Separately, Montreal-based PIT Group, which recently studied fuel efficiency, found that technology and driver behavior are key.

“While vehicle technology designed to improve fuel economy continues to advance, driver training is the element that shows the largest impact on fuel consumption,” said Yves Provencher, the company’s director of market and business development. “Our studies show that various ways to train drivers, including classroom, in-cab and simulator training, all have their advantages.”

However, if fleets want to maintain their drivers’ edge they need to offer on a regular basis refresher training and in-vehicle coaching technologies that address bad habits and reinforce effective skills, he said.