Senior Reporter

December Class 8 Sales Cap Fourth-Best Year All-Time

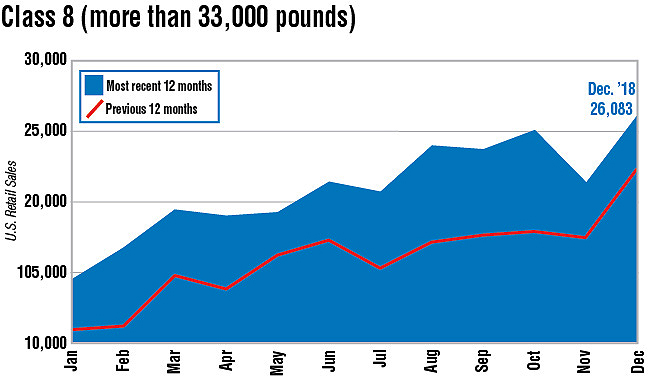

U.S. Class 8 retail sales rose 16.7% to 26,083 in December to cap the fourth-highest sales year ever as fleets replaced older trucks and expanded amid tight capacity, strong freight demand and high rates.

Sales were the highest for that month since 2006, when they were 26,462, WardsAuto.com reported.

For the full year, sales jumped 30.3% to 250,545, trailing only the all-time high of 284,008 units in 2006 — the pre-buy ahead of tighter federal emissions standards — and strong sales in 2005 and 1999.

“Full-year totals met our high expectations, and included a nice finish to the year,” ACT Research Co. Vice President Steve Tam said.

About 20% of the sales supported fleet expansion.

“U.S. Class 8 replacement is in the 190,000 to 200,000 range,” Tam said.

Sales intensified in the second half of the year.

“Things started to hop during the summer and finished very strong,” said Don Ake, vice president of commercial vehicles at FTR.

“The strong freight demand in 2018 kind of outran the system, and the market is still catching up,” Ake said.

Meanwhile, Tam said the indications are conditions may get a little bit softer sooner as strong freight growth and freight-rate growth slow.

And while truck production is likely to stay high to clear a large backlog, he expects to see “an early indication in the pace of that softening.”

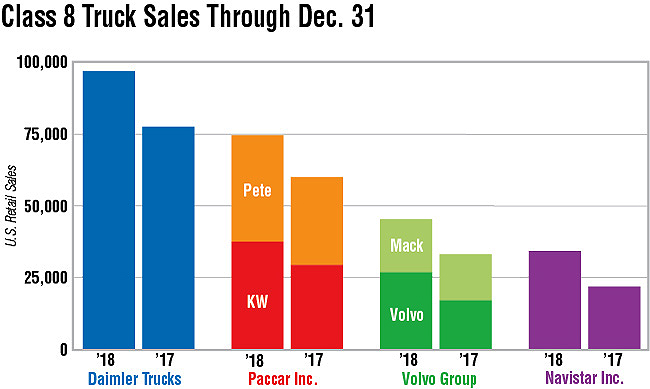

All truck makers posted higher total sales in 2018 compared with a year earlier — pointing to new features in their latest trucks as factors — but only two increased annual market share.

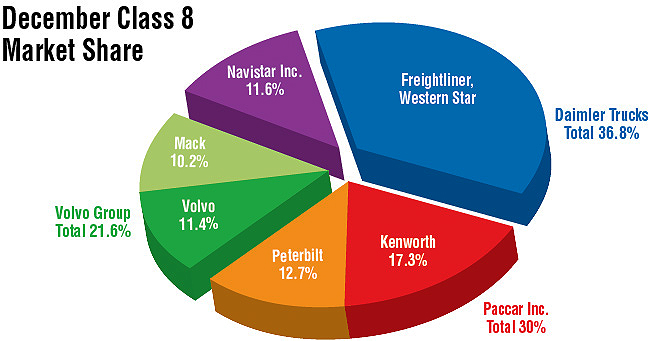

Freightliner, a unit of Daimler Trucks North America, was the market leader throughout the year. It sold 90,864 trucks, earning a 36.3% share, down from a 37.5% share with 72,168 sales a year earlier. “We had a great year,” said Roger Nielsen, CEO of DTNA.

Nielsen pointed to “high take rates for our engines, axles, transmissions and Detroit Assurance advanced safety systems” as sales drivers.

Western Star, also a DTNA brand, sold 5,758 trucks for a 2.3% share, slipping from 2.7% with 2017 sales of 5,137.

The only increases in market share came at International, a unit of Navistar Inc. and Volvo Trucks North America, a unit of Volvo Group.

International earned a 13.7% share on 34,326 sales, up from 11.4% and 21,895 a year earlier.

“If everybody is producing trucks as fast as they can, growing share is an indicator that demand is skewing in our favor,” said Steve Gilligan, vice president of product marketing at Navistar.

Gilligan said sales of International’s A26 engine are up year-over-year “and that’s encouraging. Also, the A26 is now available in all our vocational models.” The company launched the 12.4-liter engine in February 2017, aimed initially at regional and longhaul trucking.

VTNA notched a 10.7% share with 26,794 sales compared with 8.9% and 17,098 a year earlier.

Its VNR, VNL and VNX models “propelled our market share growth in a growing market,” said Magnus Koeck, vice president of marketing at VTNA.

“Motor carriers invested in new equipment that brings a greater return through enhanced safety, greater uptime, and premium comfort and productivity features to help attract and retain top professional drivers,” Koeck said.

Mack Trucks, also a unit of Volvo Group, earned a 7.4% share on sales of 18,448, compared with 8.3% and 16,013 a year earlier.

“The overall economy remains stable, with continued year-over-year growth in manufacturing and construction spending, said Jonathan Randall, Mack Trucks’ senior vice president of North American sales. “Mack Trucks ended 2018 on a high note, with continued strong demand for our new products like the Mack Anthem.”

Mack’s December share was 10.2%.

Peterbilt Motors Co. sold 36,970 trucks for a 14.8% share, down from 15.9% on 30,474 sales in 2017.

Kenworth Truck Co. sold 37,376 trucks for a 14.9% share compared with a 15.3% share and 29,336 in the 2017 period.

Peterbilt and Kenworth are units of Paccar Inc.

Looking at the near-term outlook, Tam said, “A lot of it hinges on what happens with the trade negotiations that will take place in February and, of course, who knows what is going to happen there. But I think they have broad implications not only from a domestic economic standpoint but also from an international economic standpoint.”

In the meantime, Tam said the per-day build rates in November were the highest of the year, “right at 1,400 units, a stiff rate. And that is where Q1 is picking up at, and then we will probably start seeing some increases for Q2.”

A per-day build of 1,400 equals — based on about 127 work days in the first half — 178,000 trucks.

Other truck makers did not respond to a request for comment.