Carriers, Shippers Working to Meet Demand for Freight Hauling

Carriers and shippers are adjusting to an environment where rising freight rates and a driver shortage are bumping up against an expected drop in capacity now that soft enforcement for truck drivers to record their on-duty status using electronic logging devices has ended, compelling the industry to work hard to prevent disruption in the movement of goods.

With demand for freight hauling already exceeding the supply of trucks, any loss of capacity could cause added delays and higher freight rates, said Mike Regan, an industry consultant who works with shippers and carriers to promote collaboration and who hosted a webinar with shipper and carrier executives on the topic in late March.

“What we’re seeing is entirely predictable,” he said.

Tracy Rosser, a top supply chain executive at Walmart, said his company is taking steps to make freight moves more efficient by increasing load volume and using drop and hook arrangements to keep drivers moving.

The company also relaxed deadlines for some supplier deliveries, letting shipments of food, household goods and health and beauty products arrive one day early, according to a memo from chief merchandising officer Steve Bratspies and reported by Bloomberg News. Under rules implemented last year, deliveries that came the day before they were due had been subject to fines.

Ryan Flynn, an executive with TCI Leasing & Transportation in Commerce, Calif., said he thinks ELD enforcement will exacerbate the capacity shortage and force more shippers to consider expanding use of dedicated equipment to meet their transportation needs.

“When prices go up on the spot market,” Flynn noted, “our phones start ringing.”

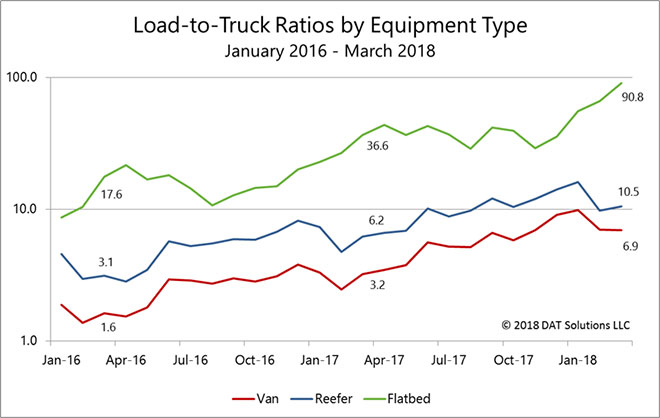

The ratio of loads to trucks on the spot market has been rising steadily for nearly two years, according to Eileen Hart, vice president of marketing and corporate communications for DAT Solutions, a load matching network based in Portland, Ore.

The number of dry van and refrigerated loads peaked at 9.9 and 16.1 for every truck, respectively, in January 2018 and the number of flatbed loads per truck reached an unheard-of level of 90.8 in March, nearly three times the level from a year ago.

The ELD mandate accounts for some portion of this trend, but other factors are also at play, Hart said, including an improving industrial economy, growth in the energy sector and increases in e-commerce shipments.

“The extraordinary increase in flatbed load availability is clearly influenced by this increase in energy and construction activity,” Hart noted.

“I have 10 flatbed loads for every driver I have,” said Jeff Rodgers of Universal Logistics Holdings.

The Cass Freight Index, which measures changes in shipments and expenditures based on freight payment data, shows that the U.S. economy is not only growing, but the rate of growth is accelerating.

Broughton

In March, the Cass Freight Index for shipments was 1.209, an increase of 11.9% compared to the same month a year ago. The index for expenditures was 2.723, a 15.6% jump year over year.

“We normally only see such high percentage increases in volume when related to easy comparisons,” such as when the economy is beginning to come out of a recession, said Donald Broughton, managing partner of Broughton Capital in St. Louis and author of the Cass Freight Index Report. “That these percentage increases are so strong and strong against tough comparisons explains why capacity is so constrained and why pricing is so strong.”

The FTR Trucking Conditions Index, which tracks a combination of freight volume and rates, fleet capacity, fuel prices and financing, rose to 15.41 in February and is at the highest level since the index was launched in 1992. Any score above zero is considered a bullish signal for trucking while a reading near zero is considered a neutral operating environment and double-digit readings, either up or down, are thought to be signs of significant operating changes in the market.

“The first quarter of the year is typically a soft period for freight growth, but not in 2018,” said Jonathan Starks, chief operating officer at FTR Intelligence in Bloomington, Ind. “The index jumped four points from the January reading and could improve still more through at least the second quarter, fueled by an even stronger economy.”

There are signs, however, that carrier capacity is beginning to catch up with demand.

ACT Research reported that its For-Hire Trucking Index fell to a seasonally adjusted 47.3 in March after averaging 63 over the past 12 months due to a combination of slower volume growth and faster capacity growth by freight carriers.

“The negative turn is partly because of seasonality issues,” said Tim Denoyer, vice president and senior analyst for ACT Research in Columbus, Ind., “but the March data represent the first question mark in some time on the direction of truckload rates in 2018.”