Senior Reporter

August Medium-Duty Sales Battle Excess Inventory, Drop 16.3%

[Stay on top of transportation news: Get TTNews in your inbox.]

Medium-duty truck sales in August fell 16.3% to just more than 19,000 compared with a year earlier, WardsAuto.com reported Sept. 11. Higher overall sales were held back by double-digit declines in the heaviest segments.

Classes 4-7 sales reached 19,386 compared with 23,154 a year earlier, according to Wards.

For the eight-month period, sales dropped 18.4% to 136,578 compared with 167,468 in the 2019 period.

Tam

“We are still beset with too much inventory,” ACT Research Vice President Steve Tam said.

Reflecting that, he said the market will see “meaningfully lower” build and sales in 2020 compared with a year ago, though not as low as the initial COVID-driven expectations. Improvements in build and sales volumes are not expected until late 2021.

This comes as service-related demand in the medium-duty market is suffering, though goods are faring better, he said. In the second quarter, consumer spending on services fell 46%, and goods dropped by 11% from the previous quarter.

Medium-duty trucks participate heavily in the service economy. “Fortunately for the medium-duty market, it is being subsidized by the goods movement,” Tam said.

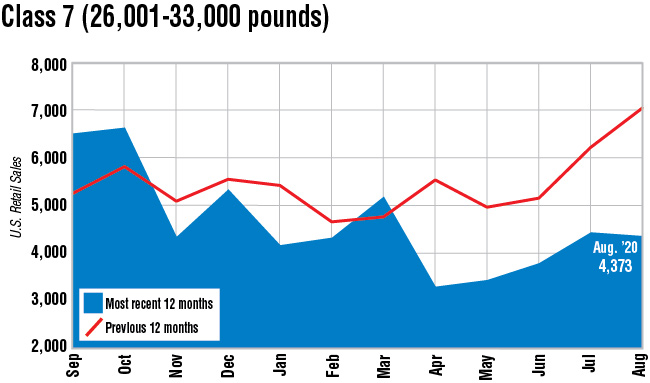

Class 7 sales in August fell 37.6% to 4,373 compared with 7,012 in the 2019 period.

International, a unit of Navistar International Corp., saw sales in that segment fall to 1,502 compared with 2,980 a year earlier.

“The [pandemic-driven] downturn is impacting certain key areas of operations where we are market leaders, particularly in the rental and leasing [markets],” Navistar Chief Financial Officer Walter Borst said during the company’s latest earnings call.

Other truck makers saw Class 7 sales slip, too.

Freightliner, a unit of Daimler Trucks North America, posted leading sales of 1,680 compared with 2,306 in the 2019 period.

Paccar Inc.’s brands, Kenworth Truck Co. and Peterbilt Motors Co., combined for 963 Class 7 sales, down from 1,165 a year earlier.

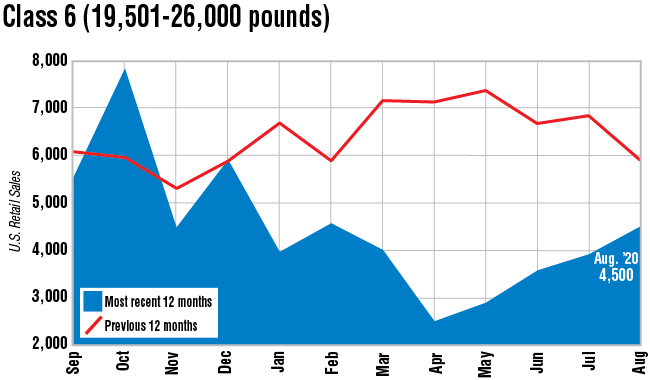

Total Class 6 sales dropped 24.1% to 4,500 compared with 5,931 a year earlier.

Ford Motor Co. led with Class 6 sales of 1,392. Freightliner was close behind with 1,229. International saw Class 6 sales drop to 884 from 1,571.

Tam also noted rental and leasing companies have begun to restore funds for purchases after earlier capital spending cuts.

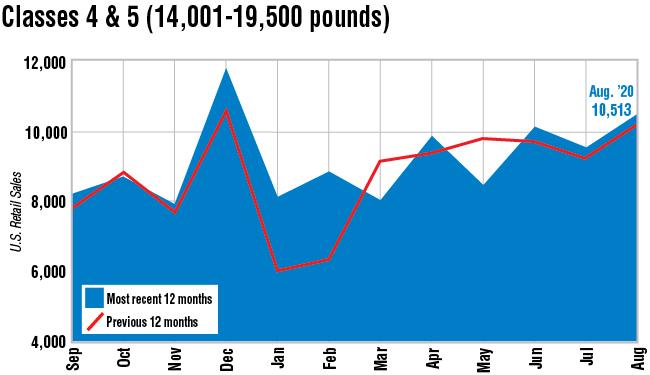

Buoyed by e-commerce shipments to homes and businesses, Classes 4-5 sales increased 3% to 10,513 compared with 10,211 a year earlier. Ford led in Class 5 sales with 4,707 trucks out of 7,798 sold in that segment. In Class 4, General Motors Co. led with 1,158 sales out of a total of 2,715.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More