Truck Turn Times Deteriorate at Ports of Los Angeles, Long Beach

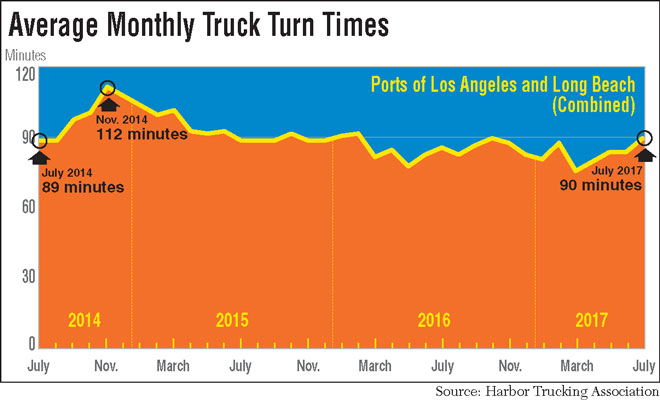

The average time it took a truck driver to enter and exit the two largest ports in North America increased four minutes in July, the third consecutive month of year-over-year increases in what has become a record-setting peak shipping season.

The combined turn time at the Southern California ports of Los Angeles and Long Beach was 90 minutes in July, according to monthly data from the Harbor Trucking Association.

At the Port of Los Angeles, the largest in North America based on annual cargo volumes, the turn time was 93 minutes. At No. 2 Port of Long Beach, it was 87 minutes.

About 24% of the total truck trips took more than two hours to complete, the highest percentage since last October.

HTA accumulates the data via GPS-enabled devices on its members’ trucks, using geofencing to calculate the time a driver enters the line near the entrance gate until exiting the complex.

“We’re right in the middle of peak season, and so you’ll always see an increase harborwide in turn times,” HTA Executive Director Weston LaBar told Transport Topics. “The fallout of the new shipping alliances is now something we’re really seeing, and throughout the harbor we’re seeing the haves and have nots in terms of cargo volume, which is represented in our data. The terminals that got a lot of new cargo are having longer turn times, and those that lost market share have quicker times.”

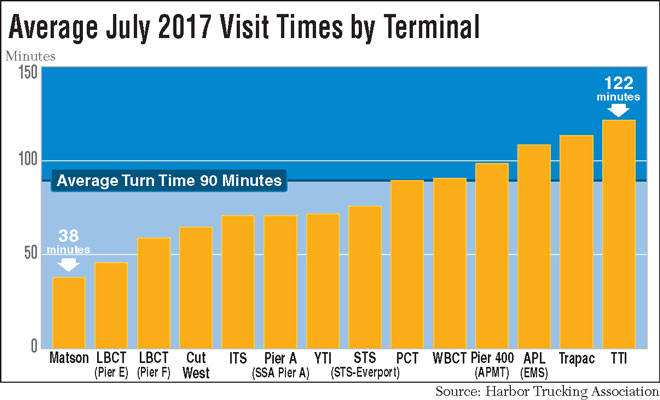

At the Port of Los Angeles, TraPac had the longest turn time at 114 minutes.

In Long Beach, Total Terminals International was the longest at 122 minutes, marking the sixth time this year the terminal had the worst performance. TTI received a massive influx of cargo through the new 2M Alliance — Mediterranean Shipping Co. and The Maersk Group.

Eagle Marine Services’ terminal in Los Angeles deteriorated to 109 minutes in July compared with 62 minutes a year ago, the result of additional cargo from bigger CMA CGM containerships, LaBar said.

“TTI and Eagle Marine are the two I get the most complaints about from my members. Eagle Marine’s night turn time is almost 140 minutes on average,” he said. “As far as TTI, it’s just at overcapacity at this point, in my opinion. They’ve opened gates on Sundays to handle all the volume.”

Port of Long Beach (Tim Rue/Bloomberg News)

The Matson and Middle Harbor terminals continue to be the quickest in Long Beach at 38 and 46 minutes, respectively. In Los Angeles, it was California United Terminals at 65 minutes. However, the results are due to Hyundai Merchant Marine’s agreement to move cargo from California United Terminals in Los Angeles to Total Terminals International in Long Beach. As a result, California United Terminals will be closing its doors Aug. 31, citing the “extremely competitive environment.”

Nevertheless, the Port of Los Angeles set a monthly record in July with 796,804 industry-standard 20-foot-equivalent units (TEUs), up 16% year-over-year. Loaded container imports increased 13% to 417,090, and loaded exports rose 17% to 154,925.

“The market is stronger than it’s been in recent years, and I’d like to say we’re capitalizing on it because of the great efforts we’ve made collectively on supply chain optimization. Ease of doing business and predictability are both very important to logistics decision makers,” Port of Los Angeles Executive Director Eugene Seroka told Transport Topics.

For example, he cited the success of an ongoing pilot program with GE Transportation to digitize maritime shipping data and sharing it with cargo owners and third-party logistics.

Through July, total cargo volumes are 5,279,352 TEUs, up 9.5% from this time last year when the Port of Los Angeles set an all-time record for the Western Hemisphere.

The Port of Long Beach also set a record for the best month ever in its history with 720,312 TEUs in July, 13% higher than one year ago. Year-over-year cargo traffic has increased for five consecutive months in Long Beach and in six of the first seven months of 2017.

Loaded imports jumped 16% to 378,820, also setting an all-time record, although exports slipped 12% to 126,098.

“These numbers are great for Long Beach and good news for the economy,” Port of Long Beach Executive Director Mario Cordero said.

So far this year, Long Beach dockworkers have processed 4,171,720 TEUs, a 6.4% increase from the first seven months last year. The percentage may surge further in the second half because volume plummeted after Hanjin Shipping Co. filed for bankruptcy protection Aug. 31, 2016, triggering major disruptions throughout the supply chain.

Todd Fowler, industry analyst with KeyBanc Capital Markets, said the data suggest retailers are swiftly restocking warehouses and economic conditions are generally good right now.

“Big box retailers are primary importers, as well as top customers of truckload and intermodal providers,” he wrote in an investors note “As such, we view import activity as ultimately correlated with road and rail freight activity.”