Is Tesla’s Elon Musk Wrong About Lidar Technology?

Elon Musk has called lidar a crutch.

The Tesla CEO believes he can build self-driving and semi-autonomous cars without relying on the technology, which uses lasers to help the cars map and navigate their surroundings.

Instead, Tesla has looked to cameras and radar — without lidar — to do much of the work needed for its Autopilot driver assistance system.

Elon Musk (Susana Gonzalez/Bloomberg News)

But other automakers and tech companies rushing to develop autonomous cars — Waymo, Ford and General Motors, for instance — are betting on lidar.

In a posting on Medium last year, Kyle Vogt, CEO of GM’s Cruise Automation, wrote, “Lidar sensors contribute to the redundancy and overlapping capabilities needed to build a car that operates without a driver, even in the most challenging environments.”

RELATED: Tesla’s new semi already has some rivals

Many industry watchers believe lidar is an essential part of developing safe self-driving systems. Lidar, also known as light detection and ranging, typically is seen as a device spinning atop an autonomous vehicle.

“I think you absolutely need all three types [cameras, lidar and radar] because each one has strengths and weaknesses,” said Sam Abuelsamid, an analyst with Navigant Research. Abuelsamid pointed to a camera’s ability, for instance, to recognize objects but its difficulty in seeing in certain dark and light conditions. Lidar, on the other hand, bounces lasers off an object to create an image, potentially avoiding the lighting issue even as rain and snow could limit its effectiveness.

In our debut episode of RoadSigns, we ask: What does the move toward autonomy mean for the truck driver? Hear a snippet from Fred Andersky of Bendix, above, and get the full program by going to RoadSigns.TTNews.com.

Because of those strengths and weaknesses, each technology offers a level of redundancy, which Abuelsamid and others believe is needed.

“Tesla’s trying to do it on the cheap,” Abuelsamid said. “They’re trying to take the cheap approach and focus on software. The problem with software is it’s only as good as the data you can feed it.”

Tesla’s approach on lidar has raised questions in light of some recent crashes involving cars in Autopilot mode, although it’s not clear that lidar would have made a difference.

RELATED: Autonomous coast-to-coast Tesla trip past deadline, still coming

Tesla declined to comment on the subject.

David Liniado, Cox Automotive’s vice president for new growth and development, has experience with Tesla’s Autopilot because he drives a Model X.

“I think it’s the safest cruise control that there is, their Autopilot, and I think it’s a game changer,” Liniado said.

Cost, he said, is likely what motivated Musk’s comments on lidar.

With prices estimated as high as $75,000 per vehicle in recent years, it’s not difficult to see why. But those in the industry say prices will come down dramatically.

Mitch Hourtienne, director of business development for lidar startup Cepton, predicted at a lidar conference this month in Ypsilanti, Mich., that the company eventually could get its price below $200.

Velodyne, the most established player in the lidar space, announced previously that it was cutting the costs on some of its sensors to about $4,000, and Ouster, whose CEO and co-founder, Angus Pacala, also was at the conference, says it has a lidar unit available for $3,500.

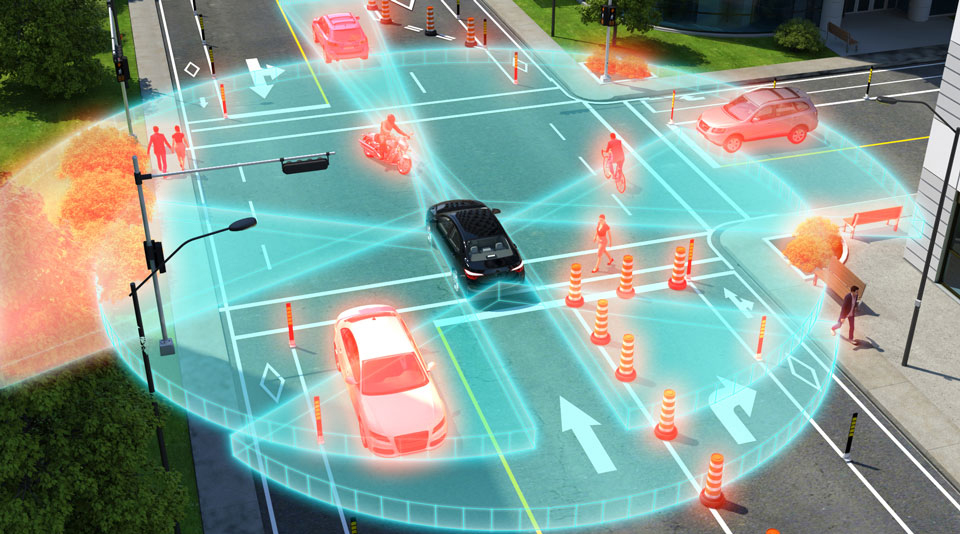

Leddertech

Lower prices are important because consumers will not necessarily be willing to pay extra for lidar, Hourtienne said, noting that carmakers must sell consumers on the technology’s benefits regarding safety. GM’s Vogt, in the Medium post, said the company’s acquisition of Strobe, a lidar startup, would help it reduce the cost of lidar on its self-driving cars by 99%.

At the conference, representatives of Velodyne, Ouster and other companies such as Blackmore, Innoviz and TetraVue joined Hourtienne in discussing their approaches to the technology and how they were working to make lidar units small enough not to be noticeable as well as reduce the cost of the units.

During his talk, Hourtienne showed a display with a white vehicle moving on a street, an example of how lidar can map an area. He could point to images of a bicyclist and pedestrian moving, as well as a dark bubble immediately around the vehicle, showing where the lidar was not focused.

That display was one of several a Free Press reporter saw during the conference, including during driving demonstrations on public roads around the hotel where the conference was being held. The displays showed computer-generated images of objects in a range of colors that were easy enough to decipher.

Aditya Srinivasan, Innoviz general manager for North America, used a ball to demonstrate in the simplest of terms how lidar works, dropping the ball to the ground to show how the device would send light, or lasers, out to bounce against objects and measure the time of flight in order to create an image map.

Srinivasan, who said his company would be providing lidar units for various BMW vehicles in coming years, said in an autonomous vehicle, “the machine must perceive its environment much better than you or I can.”

It’s important to have a perceptive machine because of the risk inherent in creating robots that can travel on the roads at high speeds, he said.

Liniado of Cox Automotive, whose company has invested in Ouster, said lidar has the ability to boost autonomous vehicle development because of what it can do, and if prices do drop, it could begin to make economic sense in certain circumstances.

“As a centerpiece of data collection for mapping, it brings a level of data extraction … we’ve never seen before because it can literally map a crack in the road,” Liniado said.

One of the main issues going forward for lidar and other aspects of autonomous vehicle development could be a lack of standards for the technology. Abuelsamid noted that more potential problems are likely to emerge as additional autonomous and semi-autonomous vehicles begin testing on public roads.

Based on the Trump administration’s aversion to regulations, the onus of such an effort likely would fall to the auto industry and the states, Abuelsamid said, declaring that states should require testing before releasing the vehicles onto the roads.

When asked if additional crashes are likely to happen before action is taken, Abuelsamid said that “unfortunately that’s probably what it will take.”

Distributed by Tribune Content Agency, LLC