Senior Reporter

Schneider Passes Halfway Mark in Conversion to AMTs

Schneider, one of the largest truckload carriers in North America, announced it has converted more than half of its heavy-duty trucks to automated manual transmissions and expects to complete the process in 2019.

Schneider ranks No. 6 on the Transport Topics Top 100 list of the largest for-hire carriers in North America. It operates about 10,300 tractors.

AMTs already dominate in Europe and are spreading in Asia, too, experts said.

“We have been testing various versions of automated transmission tractors since 2007, so we had a lot of experience behind us when we made the decision in 2015 to start transforming the fleet,” said Rob Reich, Schneider’s vice president of equipment, maintenance and driver recruiting.

We're more than halfway to an all automated transmission fleet and are receiving great reviews from drivers! https://t.co/uwiShh1fvP — Schneider (@schneiderjobs) August 22, 2017

AMTs are easier for drivers to operate, more energy-efficient and require less maintenance — compared with manual transmissions — and will “open the door even wider” for those considering a career in U.S. truck driving, according to Schneider.

AMTs can provide fleets an average improvement in fuel economy in the range of 1-3%, according to the North American Council for Freight Efficiency, and can cost $3,000 to $5,000 more than similar vehicles with manual transmissions. Green Bay, Wis.-based Schneider declined to provide additional details on the specific AMTs it is buying or the trucks using them. However, Schneider had 964 of its own used trucks for sale online in late August — 98% of which were Freightliner models. Freightliner is a brand of Daimler Trucks North America.

Also, in June, Daimler Trucks — parent of DTNA— announced it extended its long-term supply agreement with Wabco for new heavy-duty automated manual transmission control technology to support production in Europe, North America, Japan and South America of its series production. DTNA’s engine-making subsidiary, Detroit, offers an AMT known as the DT12.

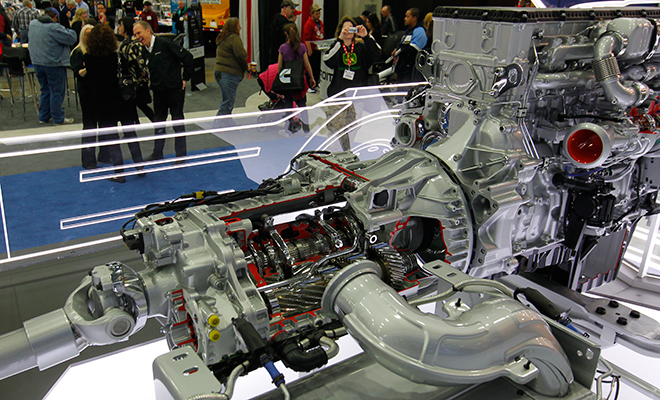

Cutaway of Detroit DT12 (John Sommers II for Transport Topics)

Wabco said it was first to market in 1986 with automated manual transmission control technology for commercial vehicles and has sold 3.5 million AMT systems.

Other companies making AMTs include Volvo Trucks North America and Mack Trucks, each a brand of Volvo Group, as well the recently announced automated transmission joint venture between Eaton Corp. and engine maker Cummins Inc.

Also, component manufacturer Knorr-Bremse AG said AMT transmissions are in 80% of heavy-duty trucks sold in Europe, and Asia is a growing market.

“The growth rates in Asia for automated clutch and gear shift systems in commercial vehicles are enormous,” said Peter Laier, member of the executive board of Knorr-Bremse responsible for the commercial vehicle systems division. “In Europe, four out of five heavy-duty trucks are sold with an automated transmission, whereas in China, this trend is just beginning.”

The potential of the Chinese commercial vehicle market is huge, given that it is two to three times the size of its European counterpart, according to Knorr-Bremse.