Senior Reporter

March Trailer Orders Decline 36%

This story appears in the May 2 print edition of Transport Topics.

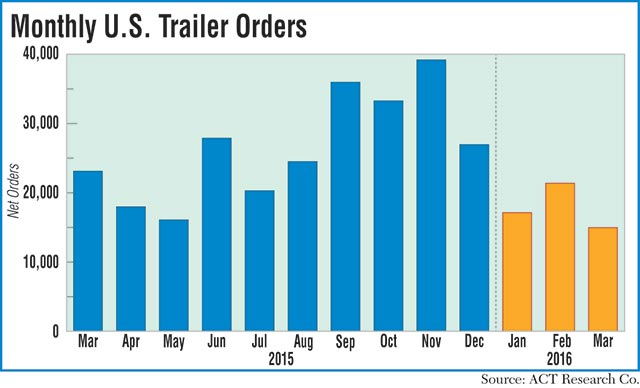

U.S. trailer orders in March fell sharply year-over-year to the lowest point since July 2013, but earlier orders remain in place, analysts said.

ACT Research Co. put March orders at 14,981, down 36% year-over-year. Orders were off 30% month-over-month from 21,412 in February.

While new orders declined, orders already placed “remain solid,” Frank Maly, director of commercial vehicle transportation analysis at ACT Research Co., told Transport Topics. “It’s two sides of the coin.”

Maly said there had been so much order activity months earlier by large fleets that there was less pressure to place orders now. “Everybody has already taken their position,” he said. “The industry backlog is out about seven months and refrigerated trailers and dry vans about a month or so longer. We are still on the high side.”

Also in March, the dump trailer was the only category that grew backlog, he added.

“Maybe, finally, we are starting to see highway repair and infrastructure projects have some impact,” Maly said.

The research firm FTR pegged the order volume at 13,800, down 39% year-over-year as all but dump trailers showed weakness, while backlogs remained solid.

“The long, strong run of the trailer market finally appears to be moderating. Backlogs are still robust, so production should be steady for the next several months,” Don Ake, FTR vice president of commercial vehicles, said in a statement.

Ake told TT the dry van and refrigerated trailer manufacturers were “booked solid but not overly solid. They have orders in there, and they are running.”

Orders have totaled 291,000 over the past 12 months, and backlogs are down only 6% year-over-year, according to FTR.

Ake said dry van orders were “weak” compared with recent months because most fleets already have placed orders for 2016, beginning as far back as August 2015.

“The big question now is how solid the backlog will be if the economy remains stagnant. How many get canceled when it’s time to build them?” he said.

And once cancellations start, he said, they spread across the industry. “Fleets talk. You have all this communication in the industry. They go into lockstep,” Ake said.

Trailer makers said they remained confident in the market’s strength.

One trailer maker said the industry is simply returning to a “normal” volume of orders.

“The use of ‘normal’ in the trailer- ordering world is hard to define because of the volatility of the market by its nature. We are unfortunately used to the swings up and down,” David Giesen, vice president of sales at Stoughton Trailers, told TT.

He added: “Our backlog remains record-strong.”

Glenn Harney, chief sales officer at Hyundai Translead, said he expected the “moderation” in the first-quarter orders.

“April has spiked up again, and activity remains brisk,” Harney said. “A slowdown could certainly be starting, but it is too early for us to call. I believe replacements for vans taken out of the pool are still catching up.”

Charles Willmott, chief sales officer at Strick Group, said he expects 2016 to be equal to or slightly ahead of the 2015 near-peak demand.

The pace of new orders slowed a bit in the first quarter, he said, “due to the usual winter doldrums and weather, along with the fact that many factories were already full or near full for the year.”

April also has shown a “marked increase in both requests for quote and new orders over the first quarter,” he said. “We expect that to continue through the third quarter, at least.”

“The market will turn; it always does,” Willmott said, “but 2016 doesn’t look like the year.”

Larry Roland, director of marketing at Utility Trailer Manufacturing Co., said orders were still strong, “but we are in the latter innings of the game cycle.”

Backlog at Utility also remains strong in dry and refrigerated vans, he said.