Knight, Swift Plan Merger

This story appears in the April 17 print edition of Transport Topics.

A merger of Knight Transportation Inc. and Swift Transportation Co., two of the nation’s largest trucking companies, is expected to trigger a historic move to consolidate the truckload freight sector, industry analysts said last week.

The blockbuster stock deal, valued at $6 billion, was approved by the board of directors of both companies and announced April 10.

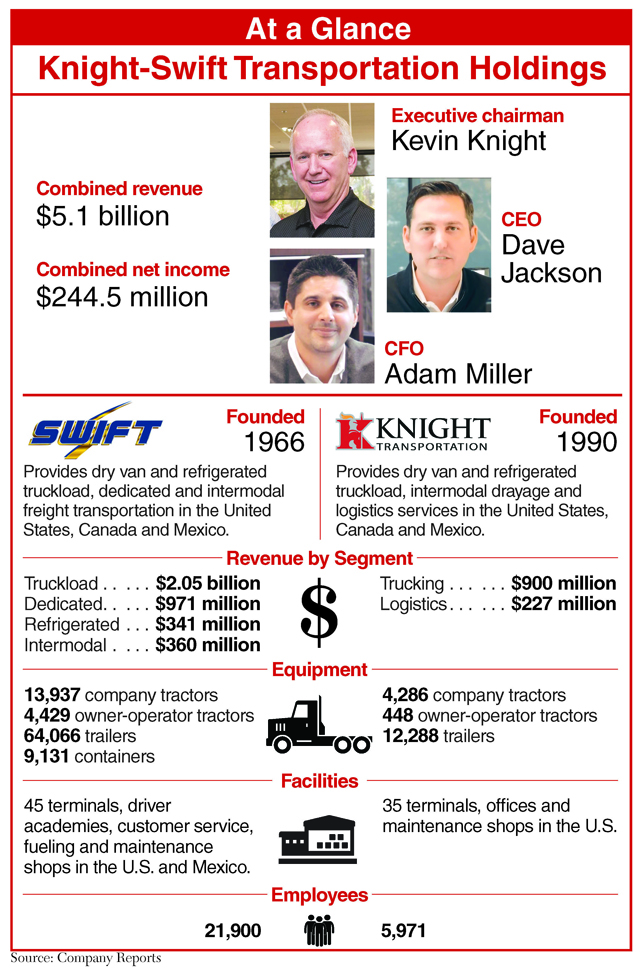

The deal would combine ownership of the two Phoenix-based companies under Knight-Swift Transportation Holdings Inc., with top executives from Knight assuming control of the business — although Swift shareholders will own 54% of the stock in the new enterprise and Knight shareholders will own the balance. The stock will continue to be publicly traded on the New York Stock Exchange under the ticker KNX.

Kevin Knight, executive chairman of Knight Transportation, who will serve in the same capacity at Knight-Swift, stressed that he will keep the trucking operations of Swift and Knight separate while taking advantage of economies of scale in purchasing things such as insurance and technology.

VIDEO: Will deal catch antitrust regulators' interest?

TRUCKLOAD RANKINGS: Swift No. 1 on 2015 list

“This is a monumental day, bigger than any other that I can think of in the history of our company,” Knight said in a video statement produced for employees after the announcement. “We have an opportunity to … work together to make sure Swift is the best it can be and Knight can be the best it can be.”

Knight also pointed out the common history with Swift with his brother Keith and cousins Randy and Gary Knight having worked for Swift until they started their company in 1990 and the Knight family sharing roots in Plain City, Utah, with Swift founder and former CEO Jerry Moyes.

“Our family and Jerry are very close,” Knight said in the video. “There is an enormous amount of trust between our families.”

Moyes, who will own about 24% of the stock in the merged company, will serve as a senior adviser to the Knight executive team, while Swift CEO Richard Stocking and Chief Financial Officer Ginnie Henkels are expected leave the company after the close of the transaction.

Over the years, Swift has made many acquisitions of its own, most notably M.S. Carriers in 2000 and Central Refrigerated Service in 2014. The company first went public in 1990 and was taken private by Moyes in 2007. Swift re-emerged as a public company in 2010.

With combined revenue of $5.1 billion, Knight-Swift would solidify its position as the largest truckload carrier in the country and will operate a combined fleet of 23,000 tractors, 77,000 trailers and 28,000 employees. Swift ranks No. 6 on the 2016 Transport Topics Top 100 list of the largest for-hire carriers in the United States and Canada. Knight ranks No. 29 in the for-hire TT100.

Reaction to the deal from the investment community was quick and almost all positive, with nearly all the analysts tracking the companies saying they expect Knight executives to boost profits at Swift over time. Knight’s operating ratio, which compares expenses with revenue, was 84.9% in 2016 and is among the best in the industry. That compares with an operating ratio of 94% at Swift.

Moreover, industry analysts said the time is right for more consolidation in the truckload business.

“I would be surprised if we didn’t see a couple of more deals in the next few months,” said John Larkin, managing director of Stifel, Nicolaus & Co. “This would be the time to do it, before the economy really takes off, before supply and demand tightens.”

Industry consultant Satish Jindel went further, citing the recent public stock offering by another big truckload carrier, Schneider, and predicted mergers and acquisitions “at a pace never witnessed before in the truckload and intermodal industry.”

Compared with other segments of the transportation industry, Jindel said the largest truckload carriers represent a tiny fraction of the truckload market, which he pegged at $208 billion, and that creating larger companies will enable firms to use drivers and equipment more efficiently. That will boost profits that are vital for reinvestment in the business, Jindel argued.

Knight officials said they expect the transaction to boost earnings in the second half of 2017 by about $15 million and to save $250 million in expenses over the next two years.

“When the two companies began discussions, we had four goals in mind,” Kevin Knight said in a statement announcing the merger. “Create a company with the best strategic position in our industry, identify significant realizable synergies that would create value for both sets of stockholders, create a business that over the long term will operate at Knight’s historical margins and financial returns and agree on a leadership and corporate governance framework that will benefit all stakeholders. I am confident we have achieved those goals.”

Swift’s Stocking said he was proud of what Swift has accomplished and encouraged employees to “work together to continue building the Swift brand.”

Staff Reporter Roger W. Gilroy contributed to this article.