Senior Reporter

Equipment Suppliers Post Quarterly Gains

This story appears in the Feb. 13 print edition of Transport Topics.

Equipment manufacturers and diversified suppliers reported mostly stronger fourth-quarter results.

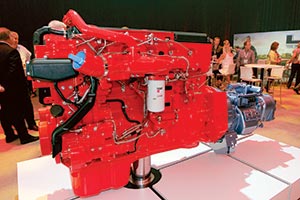

Independent engine maker Cummins Inc. reported net income for the period ended Dec. 31 jumped to $378 million, or $2.25 per share, compared with $161 million, or 92 cents, a year earlier. That reflects $361 million less in loss contingency, impairment and restructuring charges compared with a year earlier.

Revenue was $4.5 billion, down 6% from the same quarter in 2015, largely reflecting lower commercial truck production in North America and weak global demand for industrial engines and power generation equipment, the Columbus, Indiana-based manufacturer said Feb. 9.

It shipped 18,500 heavy-duty engines in the quarter, down from 24,300 a year earlier, the company said. Medium-duty shipments were 58,000, down 1,700 engines from a year earlier.

“Despite weak conditions in a number of our largest markets, Cummins delivered fourth-quarter results that were a little better than expected due to our strong market share in on-highway markets in North America and the benefits of our cost- reduction work,” CEO Tom Linebarger said.

The Environmental Protection Agency also has certified Cummins’ full range of heavy- and medium-duty diesel engines as meeting the 2017 greenhouse-gas emissions standard, the company said.

Year-to-date, net income was $1.39 billion, or $8.23, compared with $1.4 billion, or $7.84, in 2015. Revenue was $17.5 billion, 8% lower than in 2015, Cummins said.

Allison Transmission Holdings Inc., the largest global provider of commercial-duty fully automatic transmissions, reported net income of $61 million, or 36 cents per diluted share, compared with $13 million, or 8 cents, for the 2015 period.

Allison Chairman and CEO Lawrence Dewey related the net income increase to “stronger than anticipated demand conditions in North America off-highway service parts and global on-highway products.”

Sales dipped 2% to $469 million, compared with $478 million in the same period in 2015.

One analyst said Indianapolis-based Allison was poised for prolonged growth.

“Given revenue tailwinds across the business, we expect a multiyear growth cycle to emerge for the first time as a public company,” Robert W. Baird & Co. analyst David Leiker wrote in a note.

Year-to-date, net income was $215 million, or $1.27, compared with $182 million, or $1.03, on sales of $1.84 billion, down from $1.98 billion a year earlier.

Meanwhile, components supplier Dana Inc. saw fourth-quarter net income surge as a result of a tax benefit as revenue rose 5% compared with the 2015 period.

Net income was $489 million, or $3.34 per share, compared with a net loss of $79 million, or 54 cents, in the fourth quarter of 2015.

The 2016 results included a $490 million tax benefit compared with a tax expense of $92 million in the same period of 2015, Dana said.

Sales totaled $1.45 billion, compared with $1.38 billion in same period of 2015. Benefits from the stronger global light-vehicle market were partially offset by weaker demand in the commercial-vehicle and off-highway markets, the Maumee, Ohio-based company said Feb. 9.

Net income for the full year was $653 million, or $4.38, compared with $180 million, or $1 per share, in 2015.

Sales were $5.8 billion, $234 million lower than 2015, primarily due to unfavorable currency translation, Dana said.

In addition, electronics supplier Delphi Automotive, a United Kingdom-based company, reported its net income, according to U.S. generally accepted accounting principles, for the period ended Dec. 31 rose to $281 million, or $1.03 per diluted share, compared with $199 million, or 70 cents, in the 2015 period.

“Our strong organic growth and bookings demonstrate that our portfolio of market-relevant advanced technologies is meeting changing industry needs,” Delphi CEO Kevin Clark said.

Sales reached $4.3 billion, up 11% from a year earlier, said Delphi, whose U.S. operation (its largest) is based in Troy, Michigan.

For the full year, net income slipped to $1.15 billion, or $4.21, compared with $1.18 billion, or $4.14. Revenue climbed 8% to $16.7 billion, the company said.