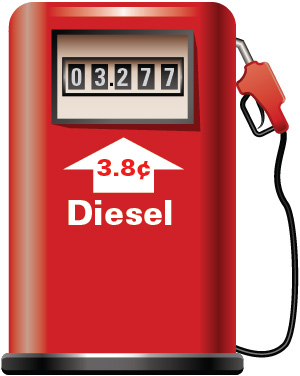

Diesel Rises for 9th Straight Week, Up 3.8¢ to $3.277

The U.S. average retail price of diesel fuel rose 3.8 cents last week to $3.277 a gallon, making it the ninth straight week that the price of trucking’s main fuel has gone up, according to the weekly report from the U.S. Department of Energy’s Energy Information Administration on May 21.

Diesel now costs 73.8 cents per gallon more than it did one year ago.

Once again, the average price rose in all regions nationwide, with California the most expensive place to buy the fuel at $3.973 a gallon, up 4.4 cents for the week. Diesel prices in California have climbed $1.061 per gallon in the past year, the most for any region. The West Coast region without California saw its price rise 2.1 cents for the week to $3.503, an increase of 77.8 cents in the past year.

Diesel prices in the Midwest and the Gulf Coast regions each rose 4.3 cents a gallon in the past week. The Midwest price is $3.218 a gallon, up 75 cents for the year. The Gulf Coast remains the least expensive region at $3.055 a gallon, up 67 cents in the past year, EIA reported.

“It’s going up 3 cents to 6 cents every week. It’s getting crazy,” said Jim Becker, president of Glendale Heights, Ill.-based Becker Logistics. “It’s driving costs up. It’s going to cause inflation in the next six months.”

Traders on the Nymex sent the price of West Texas Intermediate crude oil futures 1.19 cents higher to $72.47 in after-hours trading May 21.

Carriers that have long emphasized fuel efficiencies may be ahead of the curve in managing the rising costs.

UPS Inc. said that its Orion software is designed to ensure its drivers take the most efficient routes. It reports that, companywide, drivers are on the road approximately 100 million miles less annually than prior to the implementation of the software and saving about 10 million gallons of fuel every year.

UPS ranks No. 1 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

Carrier A. Duie Pyle uses fuel surcharges to reduce its exposure to the price increases, but it also has taken steps to cut diesel use.

“Sixty percent of our trucks have been built within the last 3½ years and therefore have the best technology to minimize exhaust emissions and improve fuel economy,” said Frank Granieri, chief operating officer of the West Chester, Pa.-based less-than-truckload firm.

Last year, Pyle began an employee engagement program in which facilities compete monthly to lower their carbon footprint by implementing more sustainable driving practices such as progressive shifting, avoiding rapid acceleration and using cruise control, Granieri said.

“Recently, the company saved 101,230 gallons of fuel during a period of three months [and] saved over 2.2 million pounds in CO2 emissions,” Granieri said.

Meanwhile, the price of a gallon of regular gasoline was up 5 cents to $2.92, which is 52.4 cents more than a year ago, according to EIA.

Despite the rise, nearly 37 million motorists were expected to hit the roads Memorial Day weekend, according to the American Automobile Association.

Pundits are pointing to several reasons for the fuel cost increase. A strong economy means strong demand for energy, the members of the Organization of Petroleum Exporting Countries have adhered to their 2016 voluntary daily production cut, geopolitical risk is higher with the United States dropping out of the Iran nuclear accord, there’s been a decline in large-scale projects such as production in the North Sea, and U.S. producers aren’t rushing to cash in on the recent rise by pumping out fuel.

The price rise occurs as EIA announced the United States remained the world’s top producer of petroleum and natural gas hydrocarbons in 2017, topping the next two nations, Russia and Saudi Arabia. The United States produces the equivalent of 30 million barrels per day of oil, about evenly split between natural gas and petroleum.

In 2017, U.S. petroleum products increased by nearly 750,000 barrels a day as crude oil prices rose about 21% to $65 to barrel. EIA forecasts U.S. petroleum production will rise to 17.6 million barrels a day in 2018, up from 15.6 million in 2017.