Senior Reporter

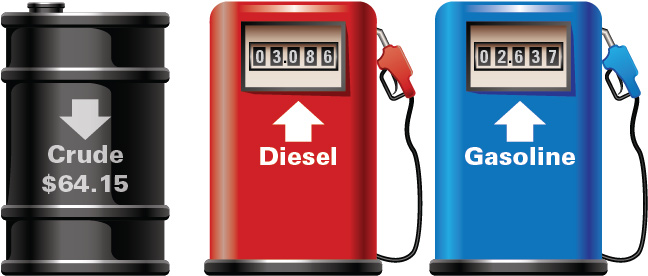

Diesel Rises 1.6¢ to $3.086 a Gallon

The U.S. average retail price of diesel rose 1.6 cents to $3.086 as oil slipped and continued to slide below $64 a barrel. It marked the fourth consecutive week of average diesel prices above $3.

The rise in diesel follows an increase of 4.5 cents the prior week. Trucking’s main fuel is 52.8 cents more expensive than a year ago, the Department of Energy reported after its survey of fueling stations.

The average price of diesel increased in every region of the country, rising the most in New England and California, where it rose 2.8 cents, according to the Energy Information Administration.

The national average price for regular gasoline increased 3 cents to $2.637 a gallon, EIA said. The price is 34.4 cents higher than it was a year ago.

Electrification of commercial vehicles could eventually put a large dent in demand for petroleum-based fuels, Elon Musk said during an earnings call with analysts Jan. 31.

Musk

Musk, co-founder and CEO of Tesla Inc., announced two models of a Class 8 electric truck in November.

“I think, 100,000 units a year [for Tesla’s Class 8] is a reasonable expectation. Maybe more, but that’s the right — roughly the right number, I think,” he said, adding, “I think we might be able to exceed the specs that we unveiled last year too, which is pretty exciting.”

The Tesla Semi, which is powered by a battery pack and four independent electric motors on the drive axles, will offer a range of 300 or 500 miles on a single charge depending on the model, according to the company.

Production of the Tesla Semi is slated to begin in 2019.

Meanwhile, in the latest available data from December, nearly half the price of a gallon of diesel (49%) stemmed from the price of oil, EIA said.

West Texas Intermediate, the U.S. benchmark, topped $66 a barrel this year for the first time since 2014, extending a rally driven by the extension of production caps by the Organization of Petroleum Exporting Countries and allied producers.

By Feb. 8, crude had slipped to below $62 a barrel, and to a one-month low as surging U.S. supply and technical indicators signal the potential for further declines, according to Bloomberg News.

While crude’s strong start to the year also was helped by dwindling American inventories and a weakening dollar, analysts have been cautioning about the potential for a surge in U.S. shale output, Bloomberg reported.

EIA estimated U.S. crude oil production averaged 10.2 million barrels a day in January, up 100,000 barrels a day from December 2017.

“There is more supply coming to this market, and we are entering the period of the refineries’ maintenance,” John Kilduff, founding partner at Again Capital, told Bloomberg.

“We are going to see a hit to demand globally that is lowering global prices today,” he said.

WTI for March delivery dropped $1.30, or 2%, to $64.15 a barrel on the New York Mercantile Exchange. The decline adds to a 0.5% loss from Feb. 2.

U.S. drillers last week added six oil rigs to raise the number of machines drilling for crude to 765, the highest since Aug. 11, Baker Hughes Inc. data showed Feb. 2.

That may lead to a further increase in U.S. crude production, which breached 10 million barrels a day in November to the highest level in more than four decades, analysts said.

Baker Hughes ranks No. 15 on the Transport Topics Top 100 list of the largest private carriers in North America.

Looking ahead, Musk said the competitive long-term strength of Tesla is not going to be the company’s trucks or cars.

“It’s going to be the factory. We’re going to productize the factory. And really, this is a lesson that is kind of obvious in history because the Model T wasn’t the product, it was River Rouge [the world’s largest integrated automobile production facility when completed in 1927]. The Model T was a very simple car. Anybody could have made that car, but not anyone could make River Rouge, and that’s really what will be Tesla’s long-term competitive advantage.

“We’ll have a great product. So a great design, great engineering the products itself in the vehicles and autonomy and all that sort of stuff. But the factory is going to be the product that has the long-term sustained competitive advantage, in my opinion,” he said.