Senior Reporter

Diesel Gains 4.6¢ to $2.586, Highest Price Since Aug. 2015

This story appears in the Jan. 9 print edition of Transport Topics.

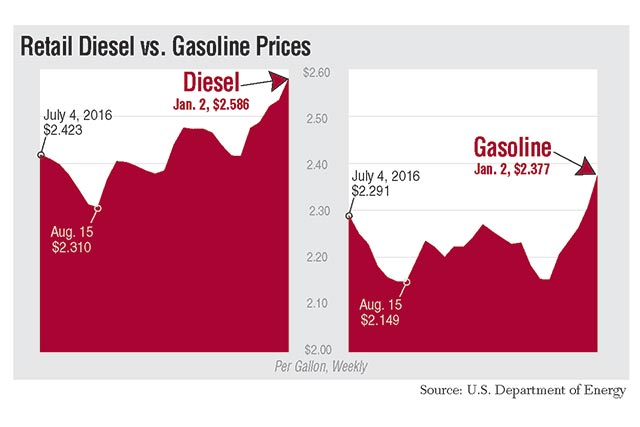

The U.S. average retail price of diesel climbed 4.6 cents to $2.586 a gallon, according to the Department of Energy on Jan. 3, pushing diesel to a nearly 17-month high amid volatile crude oil prices.

The latest increase marked diesel’s highest average price since Aug. 17, 2015, when it was $2.615 a gallon.

Trucking’s primary fuel also costs 37.5 cents more a gallon than it was a year ago, when the price was $2.211, DOE said Jan. 3 in a report covering the period ending Jan. 2.

All regions posted a higher weekly average diesel price, and all were above year-ago prices, DOE said.

The U.S. average price for regular gasoline also rose 6.8 cents to $2.377 a gallon, 34.9 cents higher than a year ago, according to the department’s Energy Information Administration.

It was gasoline’s highest point since June 13, when it was $2.399 a gallon.

The average weekly gasoline price rose in all regions, and year-over-year prices were higher everywhere but on the West Coast, where they averaged a decline of 1.2 cents.

Experts, however, bucked the tide of rising prices for oil and fuels, saying they would likely fall this year.

“In a nutshell, I think that rally in oil prices, which has helped to push up the price of diesel fuel at the pumps, has probably just about run its course,” Jeffery Born, a professor of finance at Northeastern University in Boston, told Transport Topics.

“I see prices of diesel and gasoline coming down during the year ahead,” Born said.

West Texas Intermediate crude futures on the New York Mercantile Exchange eased somewhat to close at $53.26 per barrel on Jan. 4 compared with $53.77 on Dec. 29.

EIA’s Annual Energy Outlook 2017, released Jan. 5, said fuel-efficiency and greenhouse-gas regulations set to take full effect in 2027 will lead fuel economy to increase by 38% in new medium- and heavy-duty vehicles from 2016 to 2032.

Then fuel economy levels off, “but stock fuel economy continues to increase through 2040 as less fuel-efficient vehicles retire,” according to the agency.

EIA said, however, that vehicle miles traveled by medium- and heavy-duty trucks would increase to about 375 billion by 2040 compared with about 275 billion in 2016.

The outlook report made projections for U.S. energy markets through 2050 and said diesel will remain the dominant fuel for trucks despite increasing use of alternative fuels.

EIA also intends to continue to monitor the development of autonomous vehicle technologies and their implications for on-road fuel economy and total travel demand, leading to commercial delivery vehicles that can operate without human control, the outlook noted.

“I’m not sure if [autonomous] means more or less fuel use. I think the academics and researchers are still working on that,” EIA Administrator Adam Sieminski said in presenting the outlook.

Meanwhile, OPEC and 11 other nations agreed to cut production beginning Jan. 1 in an effort to reduce a glut of global inventories.

Oil climbed to an 18-month high in New York on Jan. 3, when it touched $55.24 as output cuts by Kuwait and Oman signaled OPEC and its partners are delivering on their agreement to stabilize the market, Bloomberg News reported.

But later that day, oil fell from the highest level since July 2015 as the dollar strengthened while doubts persisted about the ability of OPEC and its partners to balance the market, Bloomberg reported.

Oil is a commodity priced globally in U.S. dollars.

“Too much faith has been put in OPEC and the other countries that have promised cuts,” John Kilduff, a partner at Again Capital, a New York-based hedge fund that focuses on energy, told Bloomberg. “They have been increasing output the last few months, so the cuts will be like New Year’s crash diet, and we know how those end.”

EIA attributes 44% of the cost of a gallon of diesel to the cost of a barrel of oil; for gasoline, oil was 49% of the cost.

At the same time, Born called natural gas a “domestic hammer” that acts to keep oil prices in check because many industrial businesses can substitute natural gas for oil.

Prices for natural gas have risen lately, and producers are considering increasing their production, he said.

“That will hold down natural-gas prices, which will help keep oil prices from going significantly higher in my opinion,” he added.