Senior Reporter

Diesel Falls 2.2¢ to $2.421 as Crude Rises

This story appears in the Nov. 28 print edition of Transport Topics.

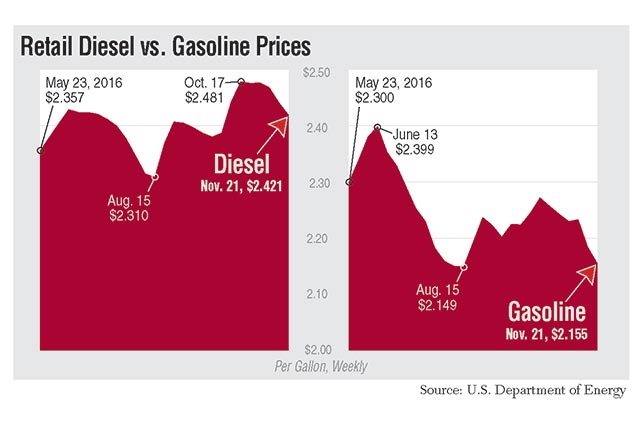

The U.S. average retail price of diesel fell 2.2 cents a gallon to $2.421, the Department of Energy said Nov. 21, as crude oil prices crept higher.

The national diesel price is 2.4 cents less than it was a year ago, when it was $2.445. Fuel has declined in four of the past five weeks since reaching a year-to-date high Oct. 17. The cumulative value of the decline over that period is 6 cents a gallon.

Average diesel prices were lower in all DOE regions.

DOE’s Energy Information Administration also said the regular gasoline average price dropped 2.9 cents a gallon to $2.155, or 6.1 cents higher than a year ago. Gasoline has declined in five of the past six weeks for a total of 11.7 cents a gallon.

The average price of gasoline was down in all DOE regions, except the Midwest, where it rose by 2 cents.

In 2015, trucks burned 54.3 billion gallons of fuel for business purposes — 38.8 billion gallons of diesel and 15.5 billion gallons of gasoline, according to American Trucking Associations statistics.

Diesel prices are likely to trend higher because there has been a rally in oil prices, and those costs have yet to pass through into the fuel market, said Denton Cinquegrana, chief oil analyst for the Oil Price Information Service.

Driving the rise in crude is the assumption that “OPEC is going to get something done, that there might even be some teeth in this agreement when they officially announce it Nov. 30,” Cinquegrana said.

OPEC has been working to limit the group’s production to improve oil prices but with little to show for it, so far, he said.

“This time around, their credibility is on the line,” Cinquegrana said, adding a freeze or a seasonal cut was possible.

Even with low diesel prices, fuel-saving strategies still make sense, Dale Newkirk, founder and vice president of operations at Troublefree Transportation, told Transport Topics.

“We always need to be conscious that what goes down always will come back up,” he said.

A key means of managing fuel costs for his Butler, Missouri- based truckload carrier, he said, is SmartTruck’s system of aerodynamic components that attach to the trailers and improve air flow, lessening aerodynamic drag.

“The good thing about this system is it requires no driver interaction,” Newkirk said, and it generates an 8-10% improvement in average fuel mileage, which saves about 1,000 gallons of fuel per truck annually. His fleet consists of eight tractors and 15 trailers.

Newkirk noted the system makes a noticeable difference in winter.

“It is very common that your taillights will get covered in snow in literally a matter of an hour or so,” Newkirk said. “That’s because of the vacuum created at the rear of the trailer, that swirling that happens. But I can drive all day long with this system and my taillights will be clear. That tells me that vacuum has been done away with,” and air is flowing more freely past the trailer.

He also specifies wide-base tires and limits the top speed of his trucks to 67 mph.

As for fuel purchasing, he uses a discount card from the National Association of Small Trucking Cos.

“I am getting about double the amount off that anybody else offers me,” Newkirk said.

NASTC said it represents the buying power of more than 60,000 trucks at 5,000 trucking companies.

Before Thanksgiving, EIA said winter has begun with residential heating oil and propane prices at levels similar to prices last winter, which on average were the lowest in a decade.

Inventories of both fuels are near or above five-year highs for this time of year, the agency said.

Heating oil is a distillate fuel, as is ultra-low-sulfur diesel, and high demand for it during cold weather can drive up diesel prices.

Crude oil futures on the New York Mercantile Exchange closed Nov. 21 at $47.49 per barrel, compared with the $45 range the week before.

OPEC is seeking to trim output for the first time in eight years, a plan that has been complicated by Iran’s commitment to boosting its production and Iraq’s request for an exemption to help fund its war with Islamic militants, Bloomberg News said.