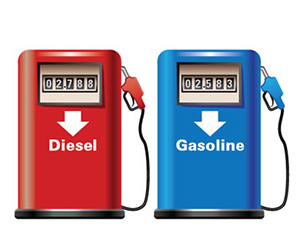

Diesel Dips 0.3 Cent to $2.788 a Gallon

The price of diesel remained virtually unchanged last week, and gasoline prices drifted downward as fuel supplies continue to recover from disruptions caused by flooding in Texas from Hurricane Harvey as well as Hurricane Irma-related evacuations in Florida.

The U.S. average retail diesel price fell 0.3 cent a gallon to $2.788, the Department of Energy reported Sept. 25.

Trucking’s main fuel was 40.6 cents a gallon higher than a year ago, DOE’s Energy Information Administration said.

US avg #diesel price on 9/25 Down 0.3¢ to $2.788/gal over last week. See data https://t.co/SUFqUPUMoH #Radio spots https://t.co/8ZfPK2X8eM pic.twitter.com/BehYBs9r7t

— EIA (@EIAgov) September 26, 2017

The 0.3-cent dip follows a decline of 1.6 cents the prior week, which was diesel’s first drop since Aug. 21.

Diesel prices fell across the country, except in the Central Atlantic and Rocky Mountain regions, where it increased by 0.6 cents and 0.19 cents, respectively. The average price of diesel fuel was unchanged in the West Coast region at $3.103 a gallon.

Diesel’s lowest price was along the Gulf Coast, down 1.5 cents to $2.624. It was highest in California, rising 0.1 cent to $3.180.

For companies such as Mission Petroleum Carriers, recovery from the storms can’t come soon enough. The Houston-based company hauls gasoline and diesel and crude oil throughout Texas and surrounding states. It still is feeling the effects of the refinery shutdowns when Hurricane Harvey came ashore Aug. 25 and stalled for several days, depositing more than 50 inches of rain in the Houston area.

“It’s better, but it’s not the same,” said Larry Marshall, a fleet manager for Mission Petroleum Carriers. He said drivers are dealing with heavy traffic and extended wait times at refineries in the area.

Mission Petroleum Carriers ranks No. 16 on the Transport Topics list of top for-hire carriers in the tank/bulk sector and operates a fleet of 404 tractors and 463 trailers.

Heavy damage from flooding also could delay construction of petrochemical projects along the U.S. Gulf Coast, according to a report written by Heather Doyle for London-based Petrochemical Update.

The American Chemistry Council estimates that 310 projects are under construction or planned with $185 billion in potential capital investment throughout North America in 2017. The surge in development is attributed to the plentiful supply and low price of natural gas in the United States and Canada.

“Almost all of the construction sites are flooded and muddy,” said Tony Salemme, vice president of craft labor at Industrial Info Resources, a consulting firm in Sugar Land, Texas, and is tracking $30 billion in project activity in hard-hit Harris County, Texas.

A report issued by IHS Markit shows that 15 of 20 refineries affected by Hurricane Harvey were at or near normal operating rates as of Sept. 19 and that U.S. crude oil production was increasing.

Crude oil stocks also appear to be growing as more domestic and imported oil enters the market, the company observed.

West Texas Intermediate crude futures on the New York Mercantile Exchange closed at $52.03 on Sept. 27 compared with $50.69 per barrel Sept. 20.

Despite higher production and inventories, crude oil prices have risen more than 10% over the past month as both the Organization of Petroleum Exporting Countries and the International Energy Agency sweetened their worldwide demand forecasts, Bloomberg News reported.

Concerns over excessive supplies from the United States also are easing as American exploration firms reduced the number of rigs searching for crude last week to the lowest level since June, according to Bloomberg.

“The implication here is that, with drilling activity in the United States moderating, it’s going to be very likely that we will not get the robust increases that many had expected from U.S. shale,” Bart Melek, head of global commodity strategy at TD Securities in Toronto, told Bloomberg. “Certainly, this whole idea that OPEC is communicating that we are rebalancing quicker than expected” has helped underpin the rally, he said.