Senior Reporter

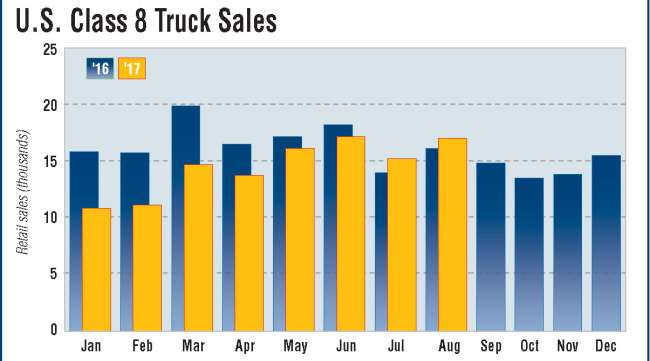

Class 8 Sales Top 17,000, Second-Highest Month in 2017

U.S. retail sales of Class 8 trucks rose to the second-highest total of the year, eclipsing 17,000, as they begin to mimic the earlier strengthening of orders and production, and small- and medium-size fleets increasingly see new trucks as crucial to driver retention, experts said.

Sales were 17,166, up 5.6% compared with 16,262 a year earlier, WardsAuto.com reported. Year to date, volumes were 116,814, down 13.2% compared with 134,505 in the eight-month period in 2016.

One analyst said sales should continue to improve this year even as inventory increased in August.

“We saw orders take off, then build [rates] got traction and now sales are also starting to pick up,” ACT Research Co. Vice President Steve Tam told Transport Topics. “They haven’t picked up to the degree or magnitude that orders or production have, and so we have seen an increase in inventory to 2.4 months, so a little elevated, but not of concern.”

Driving the sales improvements is “all that optimism that we saw expressed late last year and early this year is really starting to come to closure as sales start to increase,” Tam said.

Freightliner, a unit of Daimler Trucks North America, remained the market leader with a 34.1% share but saw sales slip 4.6% to 5,848 trucks.

International saw the largest gain, 39.9% to 2,751 compared with 1,967 a year earlier, good for a 16% share. It credited the rise in orders to its latest Class 8 models and new A26 12.4-liter engine.

International is a unit of Navistar International Corp., whose fiscal year ends Oct. 31.

International’s Class 8 market share of about 9% year-to-date “is a function of its 3% share in the 13L market and its 16% share in the 15L market,” Stifel, Nicolaus & Co. analyst Michael Baudendistel wrote in an investor note in September.

“Even small improvements in the company’s share of the 13L market may help the company’s Class 8 share inflect from the current lows,” Baudendistel said in the note.

Also, Mack Trucks on Sept 13 introduced Anthem, its new Class 8 on-highway truck, citing expectations for increased sales of Mack products here and abroad “of much more than 10% all over the globe,” Volvo Group CEO Martin Lundstedt said at an event in Allentown, Pa.

Volvo Group is Mack’s Gothenburg, Sweden-based parent company.

Mack saw sales rise 6.2% in August to 1,372, good for an 8% share.

Volvo Trucks North America posted a 10.8% decline in sales, 183 trucks to 1,513 and an 8.8% share.

“We expect the longhaul market to strengthen, with the bulk of demand for a 70-inch sleeper cab like our new VNL 760 model. A resurgence in regional haul will also continue driving Class 8 sales,” said Magnus Koeck, vice president, marketing and brand management, at VTNA.

Peterbilt Motors Co. saw sales increase 22.2% to 2,761, good for a 16.1% share.

“We’re encouraged by the strong retail sales in August and remain optimistic about the future,” Peterbilt General Manager Kyle Quinn said. “The Class 8 market remains incredibly competitive … [and] is still recovering from the record-setting 2015 and the subsequent slowdown in 2016.”

Kenworth Truck Co. slipped 3.5% to 2,427 trucks, earning it a 14.1% share.

Peterbilt and Kenworth are brands of Paccar Inc.

Western Star, DTNA’s niche brand, posted a gain of 22.5% on sales of 473 trucks, or 87 more than a year earlier.

A multibrand dealer said vocational sales remained strong, too.

“We are seeing in our markets that vocational is actually on the rise, regional haul is steady and sleepers are probably having marginal growth year-over-year,” Robert Gomez, executive vice president of sales, Worldwide Equipment Inc. told Transport Topics.

The Prestonsburg, Ky., company represents multiple brands including Mack, Volvo, Kenworth and International. Worldwide Equipment operates in six states and has 16 full-service dealerships and 15 leasing locations, among other facilities.

In addition, medium-size fleets, with 50 to 300 trucks “are getting wiser” and about 90% of those fleets are doing what they can to retain drivers, he said. Often, that means offering them reward-based choices in makes, models, interiors and even paint job of trucks.

“It’s reality. Some drivers would prefer certain things, and that is actually making some fleets somewhat diverse,” Gomez said.

Also, “Some of our counterparts down South are looking [after the recent hurricanes] for vocational equipment to keep with demands of vehicles to sell,” he said, “so we have tried to help them out and dealer-trade in efforts to help.”