Senior Reporter

Class 8 Sales Up 37% in April

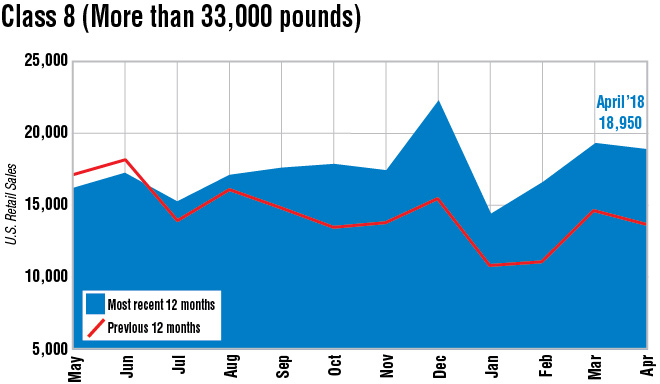

U.S. retail sales of Class 8 trucks in April climbed 37% to nearly 19,000 units as all truck makers posted double-digit gains, WardsAuto.com reported. One key supplier said parts are flowing in from around the globe to meet the demand — which is expected to build this year.

Sales in the month were 18,950 compared with 13,836 a year earlier.

The latest volume was the highest for that month since April 2015, when sales reached 20,509, according to Ward’s.

Sales year-to-date climbed 36.8% to 69,479 compared with the 2017 period.

“Production is actually lagging demand, right now,” ACT Research Co. Vice President Steve Tam said. “We are up on a percentage basis but are still not seeing on an absolute basis the level of sales that everyone seems to be expecting.”

The order-to-sales cycle typically is at least four to six months, he said, and “can be as long as 12 months or more. They are forgetting that.”

At the same time, the order boards are strong and cancellation activity remains in the mundane category, Tam said.

One supplier executive said the trucking industry in 2018 is approaching what would be peak capacity over the past 15 years, in terms of quarterly numbers.

“So we all become jugglers,” John Nelligan, vice president of global truck sales and service for Meritor Inc., told Transport Topics. “And I think the global supply chain has changed in the last year. We are all bringing things from around the world. We are all getting through it and doing our very level best to make sure the customers get their trucks, whether the OEM or end user.”

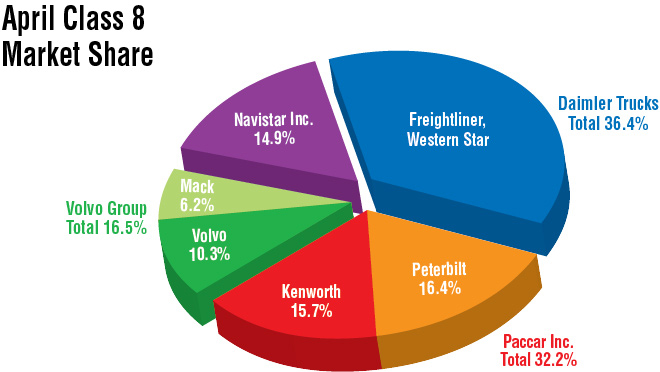

Meanwhile, Freightliner, a unit of Daimler Trucks North America, sold a leading 6,400 trucks, up 28.9% year-over-year. The gains came amid strong demand for its new Cascadia, its Detroit engines and Detroit Assurance suite of safety systems, a company executive said.

Freightliner’s April market share slipped compared with a year earlier, to 33.8% from 35.9%.

“With the strong demand and the corresponding increases in production levels, the entire industry is faced with supply constraints and pressure on delivery timing. We are working with our supply base and our customers and dealers to manage the situation appropriately,” said Richard Howard, DTNA senior vice president of sales.

DTNA’s Western Star brand had a jump in sales of 16% to 501 trucks, earning a 2.6% share.

International, a unit of Navistar Inc., saw its sales skyrocket 84.1% to 2,826, good for a 14.9% share.

Sales to leasing companies and truckload carriers prompted the gains, said Jeff Sass, Navistar Inc. senior vice president of North America truck sales.

“We have increased our build rates and anticipate our production share will show growth over the next few months as well, and we are striving toward recapturing the market share we had in the past,” he said.

In 2006, International notched a market share of 19.1% through April, according to Ward’s.

Volvo Trucks North America posted strong sales in April, too. Compared with the 2017 period, sales jumped 58.5% to 1,943, good for a 10.3% share. It had an 8.9% share a year earlier.

“As fleets purchase new equipment, premium comfort and productivity features remain a high priority, particularly among carriers actively focused on attracting and retaining professional drivers needed for the market’s torrid pace to continue throughout 2018,” said Magnus Koeck, VTNA vice president of marketing.

VTNA is a unit of Volvo Group.

At Mack Trucks North America, also a Volvo Group brand, sales rose 11.4% to 1,182, earning it a 6.2% share — down from 7.7% a year earlier.

“We expected retails to be a bit slow through Q1 as we started production of the new Mack Anthem product and implemented a significant production ramp to meet the demand, so we were prepared for the decrease,” said Jonathan Randall, senior vice president of sales for MTNA. “The good news is that we have a strong backlog of orders that we believe will help us regain market position in the upcoming months in the U.S.”

Peterbilt Motors Co. posted a 16.4% share on sales of 3,115, up 36.3% from a year earlier.

Kenworth Truck Co. had sales of 2,983, good for a 15.7% share. Volume was up 28.4% from the 2017 period.

Peterbilt and Kenworth are brands of Paccar Inc. The two truck makers either declined to comment or did not respond to a request for comment.

April’s jobs report serves as a warning to carriers that they may find adding capacity tougher in the months ahead, an outcome that could help maintain fleets’ profit margins but limit revenue opportunities, according to Avery Vise, vice president of trucking research at FTR.

Employers overall added workers in April, dropping the unemployment rate to 3.9%, the lowest since December 2000.